$1.75B in Bitcoin Sent to ‘Accumulation Addresses’ in Just 24 Hours. What does this Mean?

TL;DR Investors moved more than $1.7 billion to “accumulation” wallets during the recent Bitcoin price drop below $63,000. This record-breaking movement resulted in the transfer of a total of 27,700 BTC in a single day to these wallets. Analysts suggest that this behavior may be related to anticipation of the upcoming BTC halving scheduled for ... Read more

TL;DR

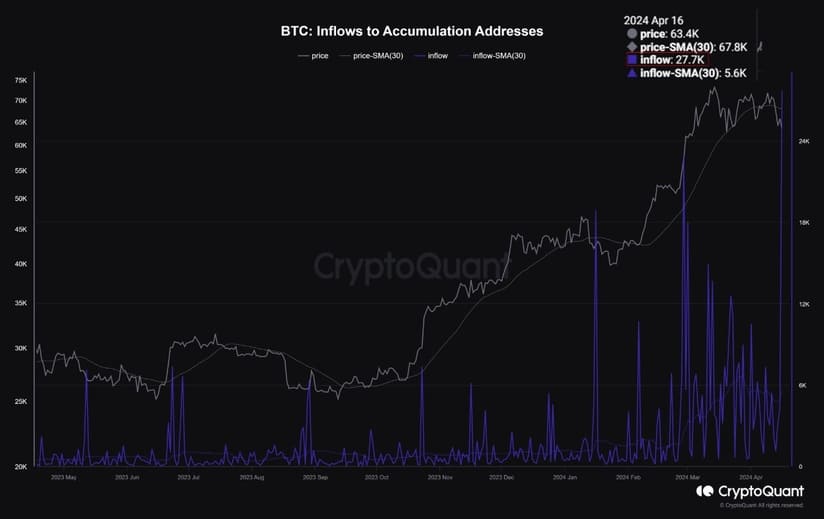

- Investors moved more than $1.7 billion to “accumulation” wallets during the recent Bitcoin price drop below $63,000.

- This record-breaking movement resulted in the transfer of a total of 27,700 BTC in a single day to these wallets.

- Analysts suggest that this behavior may be related to anticipation of the upcoming BTC halving scheduled for April 20.

In recent days, the Bitcoin market has experienced considerable volatility, prompting hodlers to take actions that have caught the attention of the community. Investors moved more than $1.7 billion to “accumulation” wallets during the recent Bitcoin price drop below $63,000.

The movement set a record and translated into the transfer of a total of 27,700 BTC in a single day. These addresses, known as “accumulation” wallets, are those that show no history of previous withdrawals and hold a balance of more than 10 BTC. They are considered indicators of investors’ long-term confidence in the potential of Bitcoin.

The massive flow to these wallets suggests that institutional and large-scale investors are betting on the leading cryptocurrency despite the recent market volatility. Confidence denoted by the decision to accumulate Bitcoin rather than selling it amid price declines.

BTC managed to rebound in the last session. Its current price is just over $65,000 after a growth of 4.1%. However, it remains 12% below its ATH of $73,750, reached just over a month ago.

Just One Day Until Bitcoin’s Halving

Analysts believe that this “accumulation” behavior may be linked to anticipation of the upcoming halving, scheduled for April 20. The reduction in block mining rewards has historically been associated with an increase in the price of the cryptocurrency in the past.

In this regard, experts like trader Rekt Capital suggest that the current behavior of Bitcoin’s price resembles previous halving cycles, indicating that the market may be entering a “re-accumulation” phase. Rekt Capital also predicts that BTC could enter a “re-accumulation” phase after the halving, which historically has lasted just over a year.

The market closely monitors how these trends develop and what impact they will have on the price and future adoption of the leading cryptocurrency. The halving is just around the corner and will be the topic of discussion; we will be attentive to all the news.