2022 second-worst 12 months ever for Bitcoin worth – Arcane

Arcane Analysis’s 2022 year-end report cited that 2022 was the second-worst-performing 12 months for Bitcoin…

Arcane Analysis’s 2022 year-end report cited that 2022 was the second-worst-performing 12 months for Bitcoin (BTC), because the main crypto noticed a 65% lower all year long, solely crushed by the 73% sink recorded in 2018.

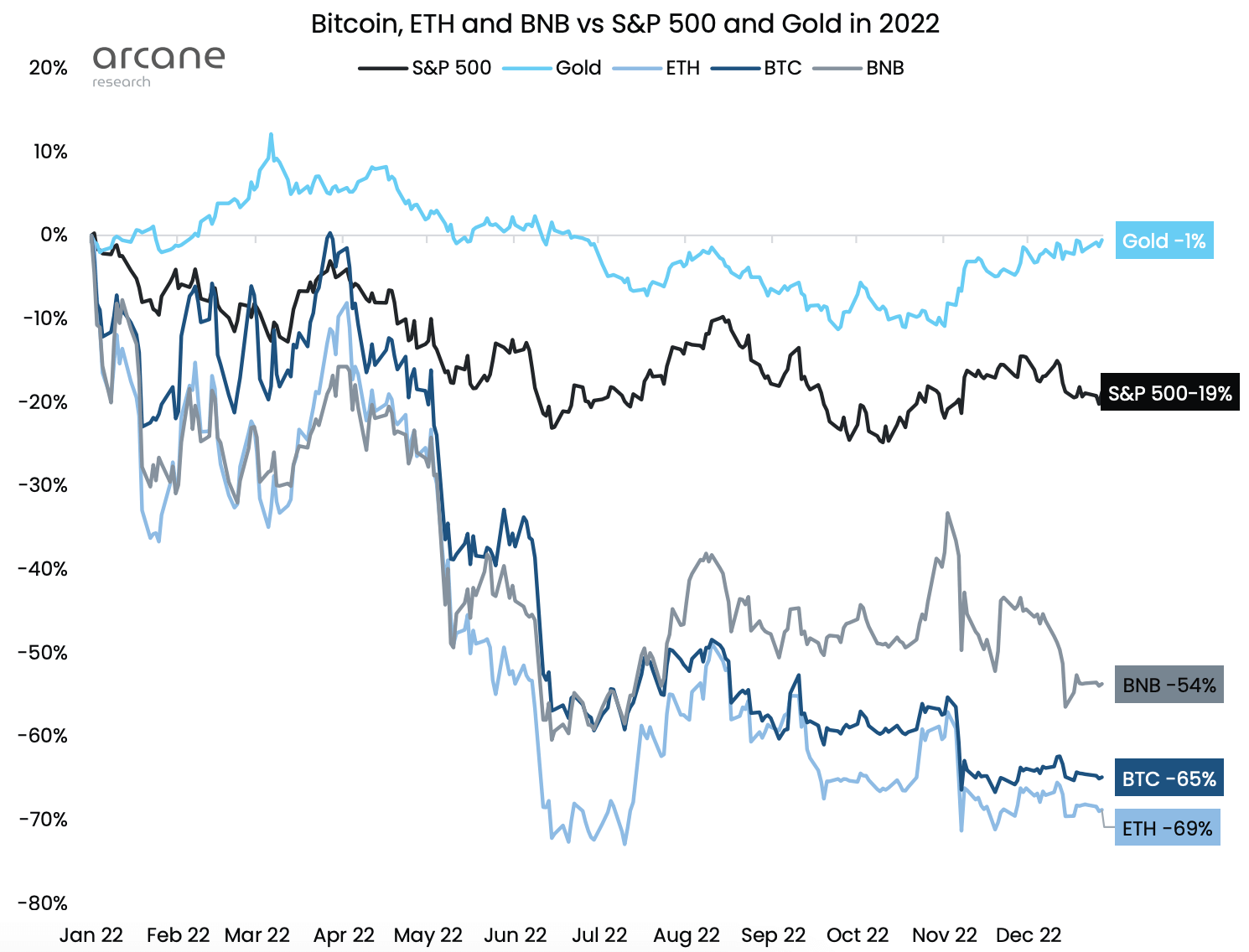

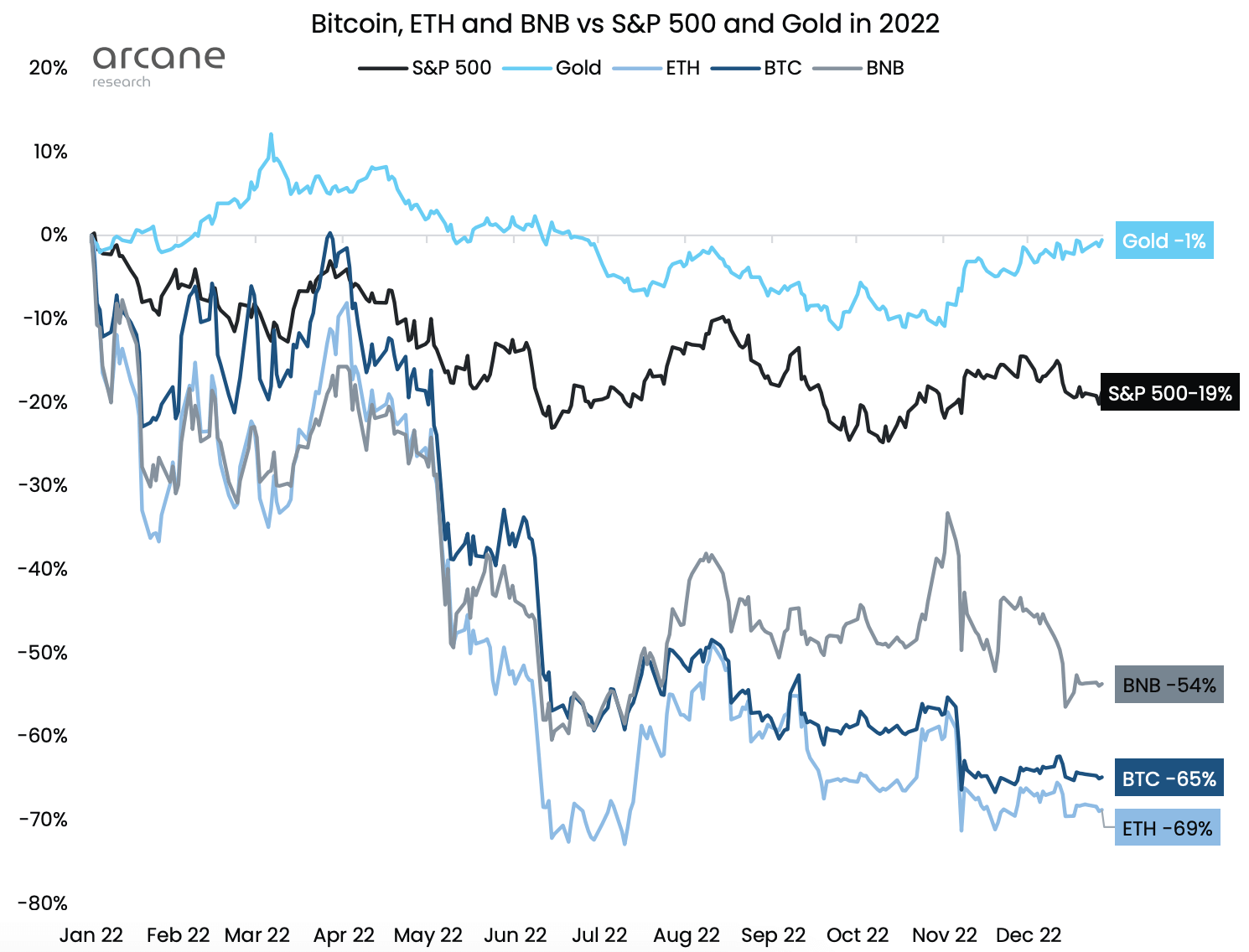

BTC’s efficiency was the second-worst of the 12 months in comparison with Binance Coin (BNB), Ethereum (ETH), S&P 500, and Gold. ETH recorded probably the most vital lower by falling 69%. Gold was probably the most resilient, recording solely a 1% fall.

Binance

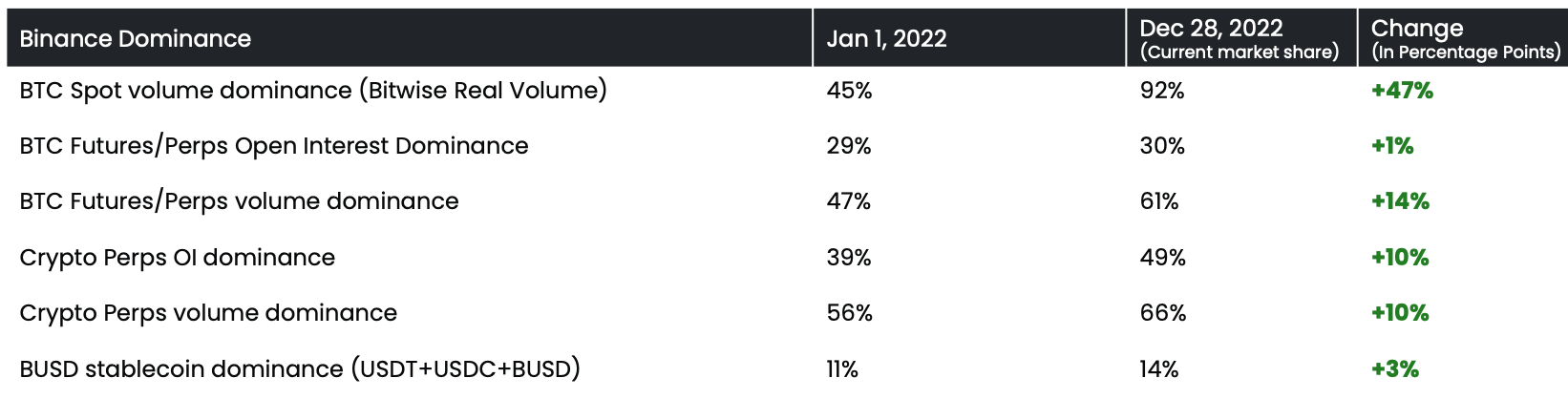

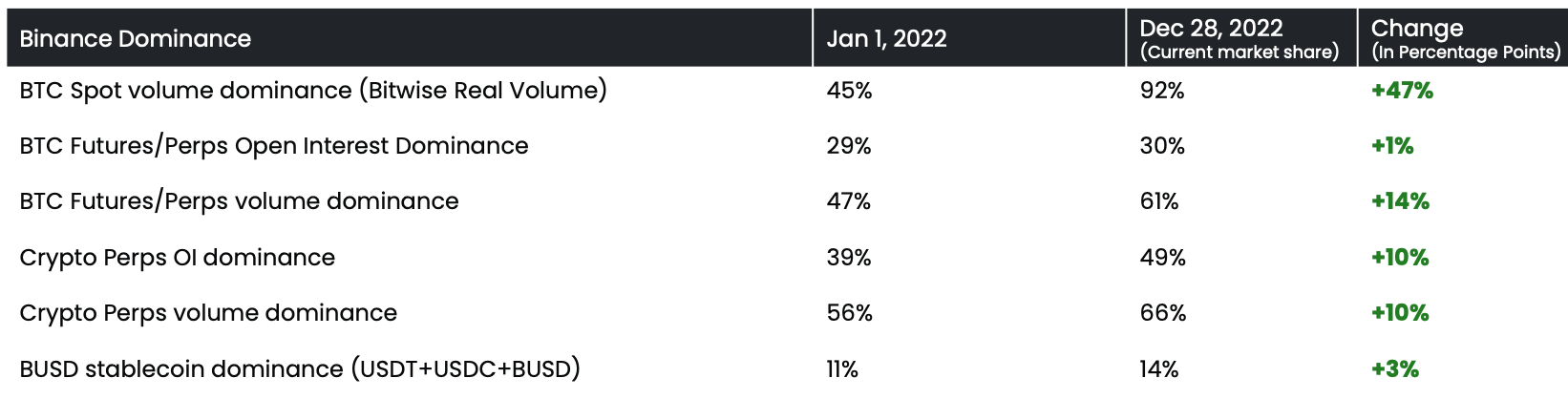

Crypto trade Binance’s progress was one other spotlight of 2022. Binance’s dominance in BTC spot quantity grew by 47% all year long, growing to 92% on the present market share from the 45% recorded on the primary day of the 12 months.

Binance was accountable for 66% of the crypto perp quantity and 61% of the BTC derivatives quantity because the 12 months concludes. The trade recorded a ten% improve in each areas, in comparison with 49% and 56% in the beginning of the 12 months.

The report predicted Binance’s dominance within the spot market will decline, and the BUSD dominance will improve.

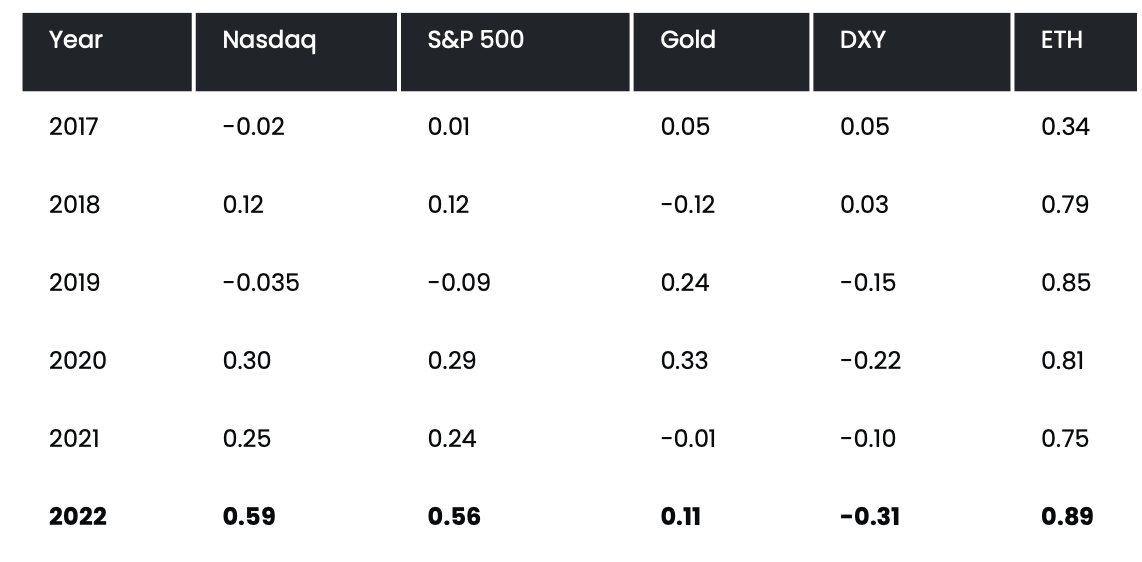

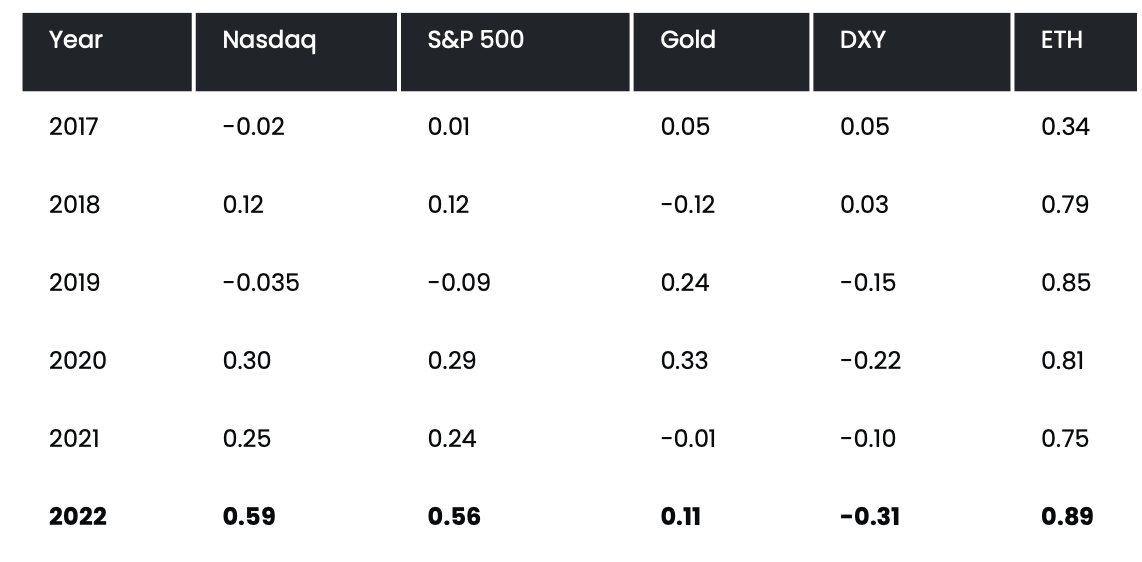

BTC and equities correlation

BTC’s correlation with different equities has additionally been considerably excessive in 2022. The report appeared into BTC’s annual correlation with Nasdaq, S&P 500, Gold, DXY, and ETH since 2017.

The info confirmed that BTC’s correlation with ETH has been robust since 2017. Nevertheless, 2022 was the primary 12 months BTC demonstrated such a robust correlation with different equities.

BTC’s correlation with Nasdaq was sturdy all year long at 0.59, intently adopted by S&P 500 at 0.56. Nevertheless, the report expects BTC’s correlation with different belongings to say no within the following years because the buying and selling exercise in crypto declines.

Stablecoins

Stablecoins’ market cap relative to BTC additionally grew exponentially in 2022, growing to 41% from 15% in the beginning of the 12 months.

The report claimed that the rising stablecoin dominance has a self-evident clarification. It said:

“Cryptocurrency valuations have deteriorated this 12 months, and stablecoins are secure.”

The mixed market cap of stablecoins represented 28% of BTC’s and ETH’s mixed market cap and 17% of the overall crypto market cap. This proportion was 10% and 6% in the beginning of the 12 months.