Bitcoin (BTC) Craters as Trend Shifts Bearish, Selloff Linked To Silvergate

Bitcoin is down at spot rates and may post even more losses in the near term as the trend shifts to bearish.

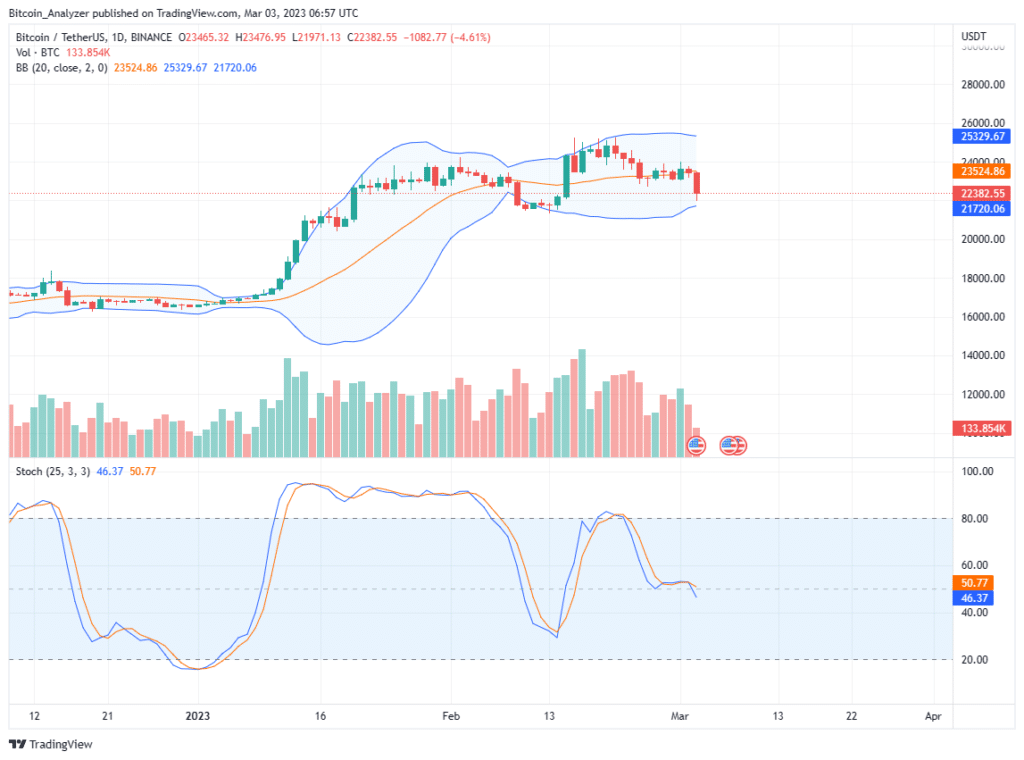

Bitcoin price fell by over $1k earlier today, tanking below the consolidation zone.

With prices down and bears appearing to have the upper hand, the BTC cool-off may continue in the sessions ahead.

In the immediate term, sellers are in charge even though bulls may lead the charge from a top-down preview. It is courtesy of the sharp gain of prices from mid-December 2022 that saw BTC expand to retest $25k in February.

As it is, traders may look to short on every attempt towards $23k as they set their eyes on $21.5k, or lower in the days ahead.

Silvergate’s fallout

There are many contributing factors to the recent retracement. There are links between today’s selloff with Silvergate’s fallout.

Per reports, hours after Coinbase ended their contract with the crypto-friendly bank, Silvergate, people aware of what’s happening said they are assessing their viability. Their liquidity concerns, analysts say, may spread to the markets, impacting price action.

However, the cool-off was expected after a welcomed expansion in the better part of Q1 2023.

Whether BTC will inch lower, breaking below February lows, is yet to be seen. Nonetheless, the short-term trajectory is set despite supportive fundamentals.

For instance, on-chain data shows that long-term holders now hold a big chunk of BTC. It is estimated that over 15 million coins have been shifted to the so-called “diamond hands.”

#Bitcoin Old Supply Last active has just surpassed 15 million coins. A higher-high each cycle.

— James V. Straten (@jimmyvs24) February 27, 2023

That is 78% of the circulating supply in long-term holder hands. pic.twitter.com/LxyR0wzArX

Bitcoin Price Analysis

Despite general market optimism and the long-term uptrend structure remaining intact, the short-term favor sellers.

Therefore, since the breakout bar is wide-ranging and mirrors the losses of February 24, sellers may unload on every attempt higher.

Resistance lies at $22.8k, while support, the immediate bear target, is around February lows at $21.5k.

Even so, it should be noticed that BTC prices are technically bullish within a bull flag. Moreover, the retracement from February highs is with relatively low trading volumes, a net positive for optimistic traders.

The current bearish preview will be canceled should there be gains above $24.1k and, ideally, $25k, with expanding volumes.

Technical charts courtesy of Trading View. Disclaimer: Opinions expressed are not investment advice. Do your research.If you found this article interesting, here you can find more Bitcoin news.