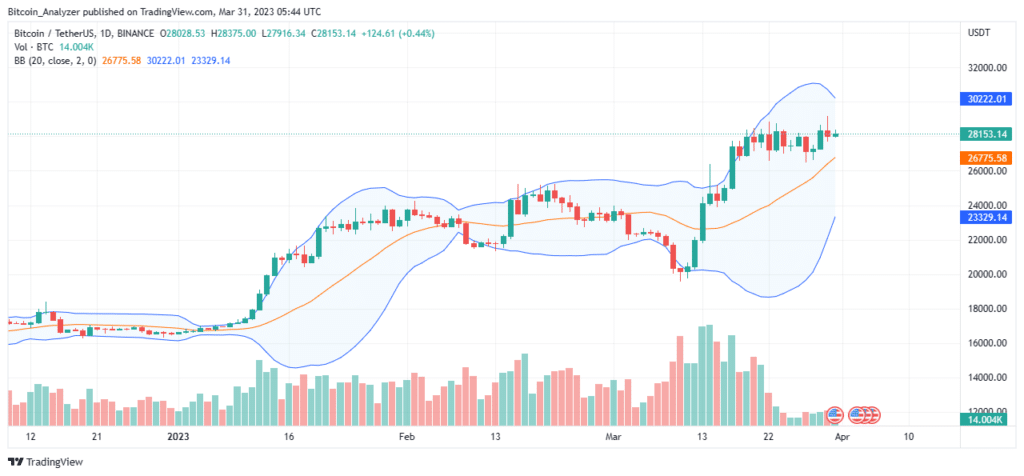

Bitcoin (BTC) Recoils From $29k After 75% Surge in Q1 2023

Bitcoin prices retraced from $29k after a 75% surge in Q1 2023. The BTC uptrend remains even though prices remain inside a rising channel.

Bitcoin prices on March 30 were underwhelming, recoiling from $29k and crashing below $28k. Still, this doesn’t mean sellers have everything under control.

From the daily chart, Q1 2023 was bullish as the coin added 75%. This trend could continue should BTC crack above recent highs, soaring above $29.1k.

Prices are back within the rising channel, but the upside momentum is fizzling, unable to shore prices above immediate resistance levels.

However, as long as BTC is above $26.6k and the leg down is with comparatively light trading volumes, there could be more expansions in the days ahead.

Banking Crisis, Expiry of BTC Options

Prices remain steady at spot rates, primarily because of the atmosphere in the United States and European banking sectors.

There are worries of a contagion should a major German bank crack. The implosion of this bank might trigger a widespread crisis that could cast more doubt on the robustness of the global banking infrastructure.

— Paul Kikos

“If Deutsche Bank collapses we’ll know the crisis is reaching its next level.

Credit Suisse was unprofitable and the weakest in the pack, easy to pick off. Deutsche Bank is profitable, so if it fails we’ll know that profitability does not render banks immune.” pic.twitter.com/BhtZ1nmu69(@PKikos) March 26, 2023

Even so, Janet Yellen, the United States Treasury Department chairperson, thinks the United States banking industry is robust and is ready to intervene.

Bitcoin vs. the banking crisis pic.twitter.com/oaoNcseU8R

— TradingView (@tradingview) March 22, 2023

Unlike traditional financial structures, the nature of Bitcoin makes it a resilient alternative for users who wish to transact any day without a third party.

Today, $4 billion worth of Bitcoin Options expire. Whether this would impact prices is yet to be seen. Since mid-month, there have been expectations of further gains, meaning more traders have call options.

Bitcoin Price Analysis

There is an inverted bear bar representing yesterday’s price action. Technically, the uptrend remains as long as prices are inside the rising channel and within the bull bar of March 17.

As it is, buyers have a chance from an effort versus result perspective. However, this could change should there be a sell-off below $26.6k with expanding volumes. This move will likely cancel gains of March 17, confirming sellers of March 22, essentially marking $29k as local peaks. In that case, BTC may drop to retest February highs at around $25k.

On the flipside, traders should closely watch price action, aware that gains above $29k with expanding volumes will confirm buyers of March 17, setting the base for the leg up to $32k. Such a breakout could allow buyers to ride the uptrend, aligning with the dominant trend of Q1 2023.

Technical charts courtesy of Trading View.

Disclaimer: Opinions expressed are not investment advice. Do your research.

If you found this article interesting, here you can find more Bitcoin news.