Bitcoin ETFs Record Second-Highest Weekly Inflow Of $1.8 Billion, Luring BTC Price To Retest $69K

The post Bitcoin ETFs Record Second-Highest Weekly Inflow Of $1.8 Billion, Luring BTC Price To Retest $69K appeared first on Coinpedia Fintech News Last week, cryptocurrency investment products saw their second-largest weekly inflow, reaching $1.84 billion, indicating rising investor confidence and a bullish market sentiment. CoinShares reported that trading volume for these products also reached a record high of over $30 billion. As a result, BTC price made a massive jump today as it surged above a new …

The post Bitcoin ETFs Record Second-Highest Weekly Inflow Of $1.8 Billion, Luring BTC Price To Retest $69K appeared first on Coinpedia Fintech News

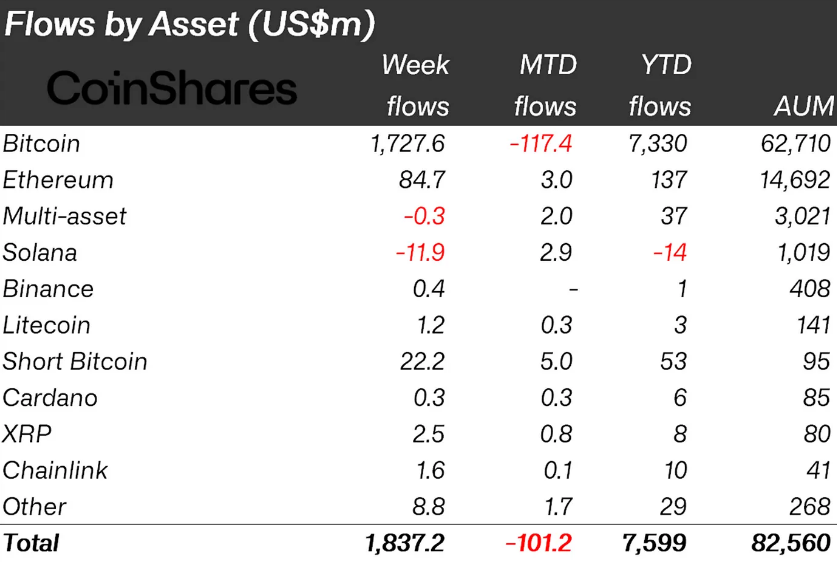

Last week, cryptocurrency investment products saw their second-largest weekly inflow, reaching $1.84 billion, indicating rising investor confidence and a bullish market sentiment. CoinShares reported that trading volume for these products also reached a record high of over $30 billion. As a result, BTC price made a massive jump today as it surged above a new yearly high of $65K.

Rising ETF Inflow Pushes Buyers’ Confidence

Today, Bitcoin’s surge past the $65,000 mark resulted in more than $60 million worth of short-position liquidations, driven by substantial investments in ETFs and increased interest from institutional investors the previous week. According to Coinshares, there were almost record-breaking weekly inflows into digital asset investment products, amounting to $1.84 billion. Furthermore, trading volumes soared above $30 billion, accounting for half of Bitcoin’s worldwide trading volume on major exchanges.

After recent increases in BTC price, the total value of assets under management (AUM) is now approaching the peak of $82.6 billion, just shy of the record $86 billion set in early November 2021. The United States continues to lead the market, with net inflows reaching $1.88 billion, though this was slightly offset by higher outflows from Grayscale’s Bitcoin ETF, totaling $1.46 billion.

New issuers in the market made up for these outflows, resulting in a net inflow of $3.2 billion over the last week. Investment patterns differed by region, with Switzerland seeing inflows of $20 million, while Sweden, Germany, and Canada faced outflows of $32 million, $35 million, and $23 million, respectively.

Bitcoin remained the primary beneficiary of these inflows, securing 94% of the total or $1.72 billion. Bitcoin is now nearing the $69,000 record as it holds momentum above $65,000.

Bitcoin ETFs Surpass Gold: New Normal

Last week, the peak trading volume exceeded $7.6 billion on Feb. 28, making Thursday and Friday the second and third highest trading days, respectively.

In just over seven weeks, BlackRock’s iShares Bitcoin Trust (IBIT) has reached over $10 billion in assets under management, a record that took the first U.S. gold-backed ETF, the SPDR Gold Shares (GLD), more than two years to accomplish after its 2004 launch.

Notably, BlackRock’s Bitcoin ETF reached this milestone on March 1, merely 39 trading days post-launch, surpassing significantly with GLD’s timeline.

Bloomberg’s ETF analyst, Eric Balchunas, noted in late February that Bitcoin ETFs are gaining an edge over gold as the preferred store of value, suggesting a strong possibility that Bitcoin ETFs could surpass gold ETFs in AUM in less than two years.

The reach of Bitcoin ETFs is currently expanding, with BlackRock’s iShares Bitcoin Trust ETF (IBIT) beginning to trade on Brazil’s B3 stock exchange, as announced by the company last week. Felipe Gonçalves, B3’s superintendent of interest and currency products, stated in a press release, “This launch offers investors a new way to access Bitcoin.”