Bitcoin Exchanges Report Massive Outflow of Over $2 Billion. What Does This Mean?

TL;DR A withdrawal of over $2 billion in Bitcoin from exchanges was recorded on March 1, approaching a historical record in the cryptocurrency. Glassnode data shows a notable decrease in the total BTC stored in major exchanges, reaching the lowest level since March 2018. BTC has reached $65,000. Analysts suggest a possible bullish momentum in ... Read more

TL;DR

- A withdrawal of over $2 billion in Bitcoin from exchanges was recorded on March 1, approaching a historical record in the cryptocurrency.

- Glassnode data shows a notable decrease in the total BTC stored in major exchanges, reaching the lowest level since March 2018.

- BTC has reached $65,000. Analysts suggest a possible bullish momentum in the market.

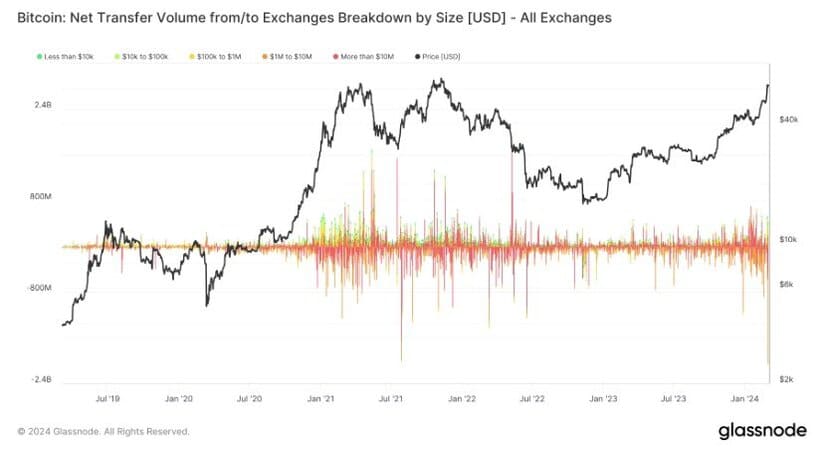

The cryptocurrency market has witnessed a significant movement in recent days, with Bitcoin withdrawals from exchanges reaching levels close to a record. According to recent reports, over $2 billion in BTC was withdrawn from exchanges on March 1, marking one of the largest fund outflows in the cryptocurrency’s history.

This phenomenon challenges previous records, including those observed in 2021, when critical withdrawals also signaled a market shift. Specifically, daily withdrawals towards the end of June 2021 were some of the highest recorded to date.

Glassnode data shows that the total Bitcoin stored in major exchanges has decreased significantly, reaching its lowest point since March 2018. This suggests a possible preference for offline storage or private wallets.

Regarding the affected platforms, it is highlighted that both Binance and Coinbase experienced significant fund outflows, with Binance seeing around $400 million in withdrawals. Interestingly, withdrawals from Binance do not seem to be related to interest in BTC ETF, suggesting different motivations for investors.

Withdrawals from Binance are further highlighted by the magnitude of the transactions. There were multiple withdrawals of over $50 million, with many others of over $10 million, according to reports. This concentration of large volume withdrawals indicates that certain investors may be moving large amounts of BTC out of exchanges for strategic or security reasons.

Bitcoin Continues to Rise and Analysts Predict Continuation of Bullish Trend

Despite these massive withdrawals, the price of Bitcoin has experienced an increase in the past hours. At the time of writing this article, BTC is trading around $65,000, an increase of 4.34% in the last 24 hours. This price increase, along with consolidation above $62,000, has led to 99% of BTC addresses being profitable.

Market analysts suggest that these movements may indicate a bullish market phase driven by fear of missing out (FOMO), which could lead to a continued increase in the price of Bitcoin in the coming months. However, as always in the cryptocurrency market, volatility and uncertainty are constant factors to consider.