Bitcoin maintains resilience in face of constant market uncertainty

Advert TLDR Bitcoin broke out of a possible bear market in accordance with realized value…

TLDR

- Bitcoin broke out of a possible bear market in accordance with realized value cohorts.

- Document-breaking BTC choices expired on Friday.

- On March 14, the U.S. authorities bought 9,861 BTC, and roughly 41,490 BTC stays.

- U.S. PCE information is available in barely decrease than anticipated

- E.U core inflation hits all-time excessive

- UK home costs endure the most important decline since 2009

- Deposit flight slows out U.S financial institution accounts

US

Financial institution panic slows

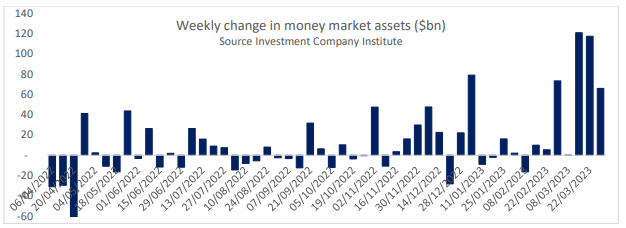

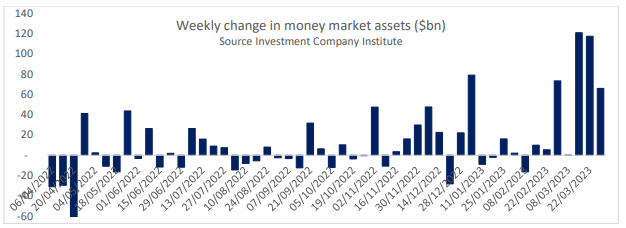

It’s been over two weeks because the collapse of Silicon Valley Financial institution, and we’ve seen the ripple results it has triggered on different regional banks. However we’ve but to see the complete extent of the fallout and potential contagion.

Up to now two weeks, depositors took out nearly $240 billion of deposits and moved them into treasuries/cash market funds to make sure a better yield. Nevertheless, this week deposit outflows had been decreased to $66 billion, which can sign panic is lowering.

PCE information lowers barely

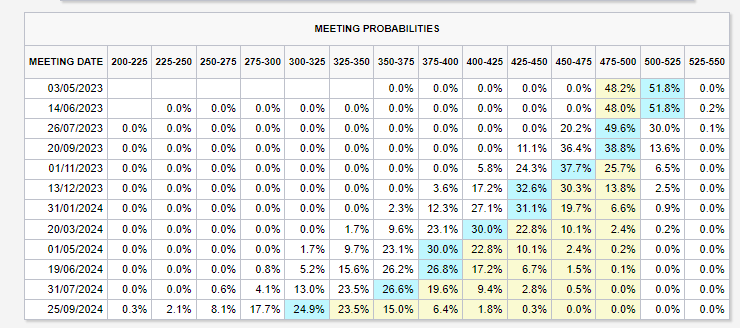

U.S. core PCE information got here in under expectations. Nevertheless, it’s nonetheless thought of scorching and probably too scorching for the Fed’s liking. The subsequent FOMC assembly isn’t till Could 3, and it’s a 50/50 cut up for a pause or a 25bps charge hike. Many macro indicators are nonetheless to return earlier than this assembly, together with; unemployment information and CPI.

EU

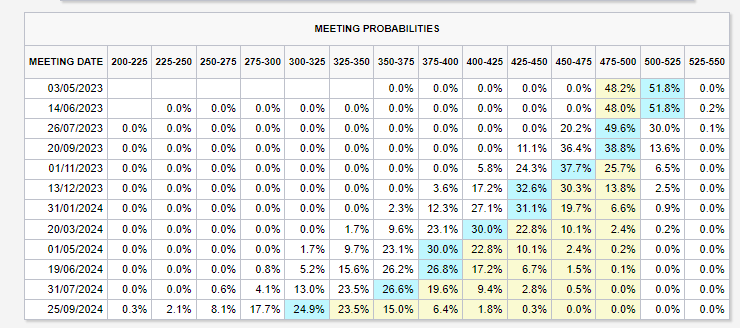

Sticky core inflation

CryptoSlate has mentioned this week that core inflation might be a lot more durable to deliver down than CPI/headline inflation. E.U core inflation hit an all-time excessive of 5.7%. On the identical time, headline inflation fell to six.9% under expectations. Declining headline CPI vs. sticky core CPI would be the narrative for the quick time period.

UK

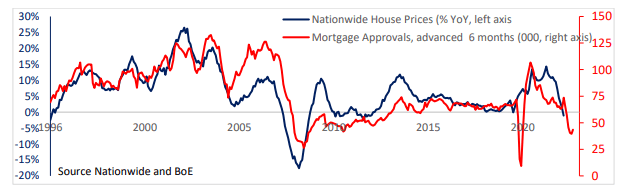

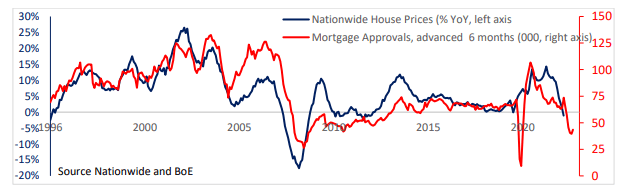

Housing is beginning to flip

UK home costs suffered the most important annual decline since 2009, with additional headwinds within the property market. Some causes embody; rising rates of interest, double-digit inflation, and additional tax implications for buy-to-let landlords with an growing old inhabitants.

Downward pressures have occurred for nearly a yr within the property sector, with a 14-year low within the RICS survey, pointing to extra bother forward.

Nevertheless, U.S. housing is beginning to stabilize, with the common charge on a 30-year mortgage coming down to six.45%. Nevertheless, the U.Ok. predominately on short-term charges, normally two or five-year mortgages. It’s best to anticipate to see a divergence between these two housing markets.

Bitcoin

Cussed Bitcoin and a few Q1 highlights

- Bitcoin hash charge continues to impress with a new-all time excessive.

- A report quantity of stablecoins leaving exchanges and being transformed into Bitcoin

- Self-custody has elevated because the collapse of SVB.

- ETH/BTC broke all the way down to new lows

- Choices contracts hit all-time highs, whereas futures contract makes new lows.

- Dwindling order books raises liquidity considerations.

- A flurry of liquidations as traders continued to get on the flawed aspect of Bitcoin

- The introduction of Ordinals has given Bitcoin a brand new lease on life

My Q1 ideas

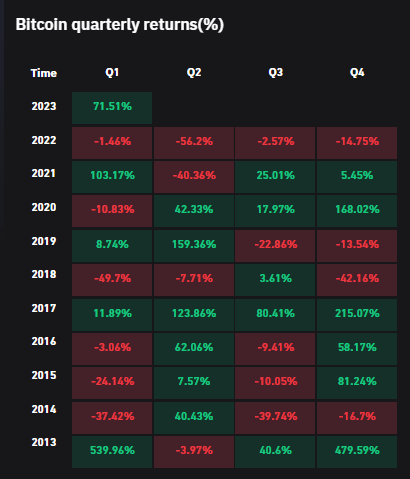

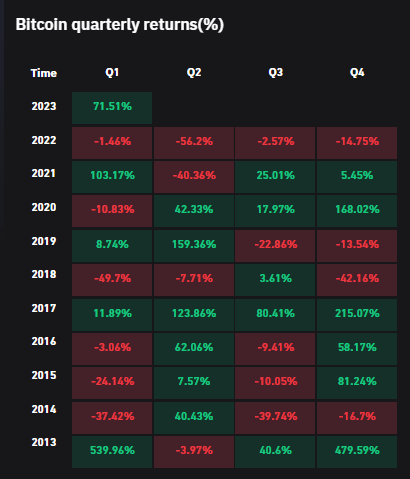

Bitcoin finishes off Q1 2023 up 70% with a value of over $28,000. That is amid an especially difficult surroundings of continuation of charge hikes, banking turmoil, and new liquidity applications being developed by the central banks.

The fed will hold charges elevated for so long as doable till one thing more than likely breaks whereas offering the market with as a lot liquidity as doable. As we’ve discovered, Bitcoin is probably the most liable to liquidity and stability sheet growth.

The basics of Bitcoin and the consumer have been examined to the max; we’ve seen report hash charge, 1GB mempool, the explosion of Ordinals, and a mini banking disaster. On-chain factors to an imminent bull market, and the macro surroundings’s volatility will solely worsen. Bitcoin will thrive off this surroundings in the long run as belief will proceed to interrupt down between authorities/central banks and other people.