China’s Stimulus Casts Doubts on Copper and Aussie Dollar Performance

Discover how China's stimulus measures affect AUD and copper prices, and their impact on the global recovery.

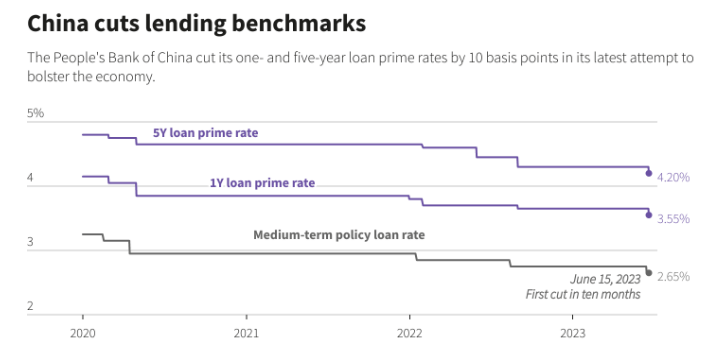

China’s stimulus measures fall short, hindering economic recovery and casting doubts on copper and the Australian dollar (AUD). The recent 10 basis points cut in benchmark lending rates by the People’s Bank of China (PBoC) raises concerns about the efficacy of their economic stimulus. This comprehensive article examines the repercussions of China’s underwhelming stimulus on the AUD and copper, analyzing the intricate interplay between these markets and their potential ramifications for the broader global recovery.

China’s stimulus disappoints, exerting downward pressure on AUD and copper prices, raising concerns for the global recovery.

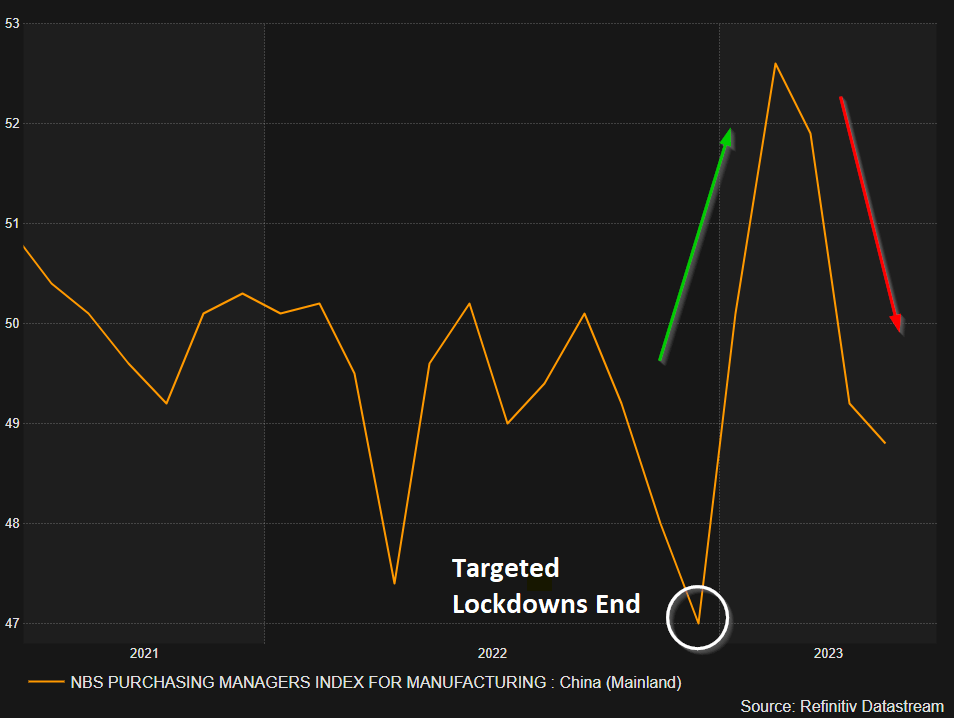

The PBoC’s decision to cut the 1-year and 5-year loan prime rates came shortly after a rate cut for the medium-term policy loan rate. While these adjustments were intended to stimulate economic recovery, they have been met with skepticism by both the markets and analysts. Chinese assets, including the Heng Seng, Chinese SSE Composite Index, and the Chinese Yuan, have weakened significantly since the announcement. Fundamental data also paints a grim picture, with the manufacturing industry entering a contraction phase as depicted by a drop below the 50 level.

Market observers anticipate the possibility of further rate cuts, with some suggesting a cumulative reduction of 25 basis points by the year-end. The PBoC also has the option to lower the reserve ratio requirement, providing banks with more capital flexibility to boost credit growth and spending. However, the effectiveness of these measures remains uncertain, leaving Chinese assets vulnerable to additional risks.

Source: dailyFX

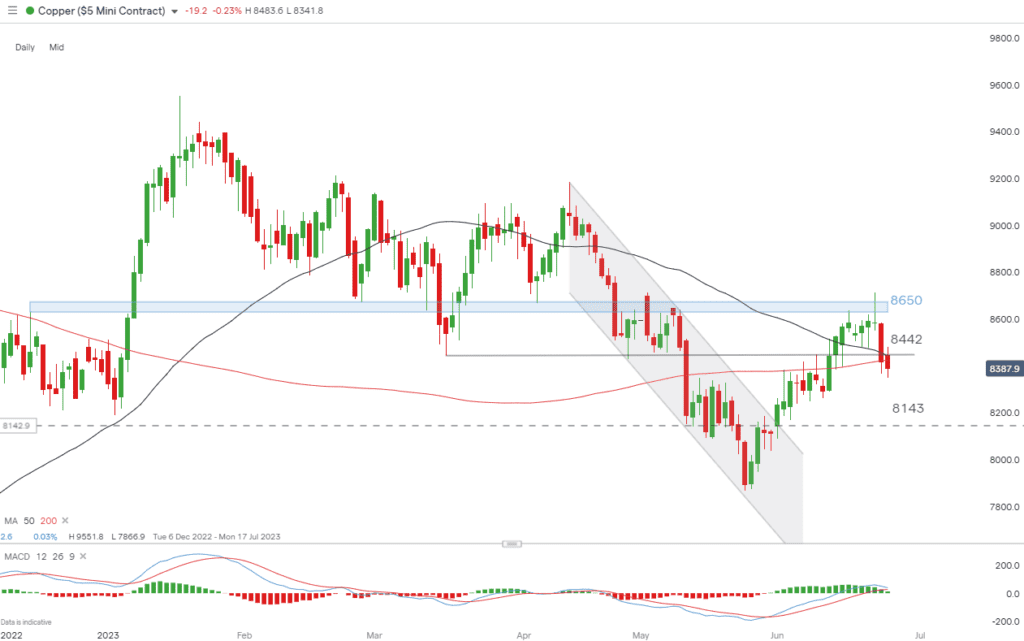

Copper, often regarded as a leading indicator of economic health, has seen a significant reversal in recent times. Despite struggling to break above the resistance zone around 8650, the metal displayed a bearish turn with selling pressure intensifying. It closed below the March swing low of 8842 and tested the crucial 200-day moving average, suggesting a potential downward move towards the next level of support at 8143. Traders should keep a close eye on the MACD index, which hovers near a bearish crossover, indicating further potential downside in the coming trading sessions.

Source dailyFX

Click here to check the Live Copper Trading Rate

The Australian dollar, closely tied to China through the “core-perimeter model” of trade, has also felt the impact of China’s economic slowdown. As Chinese demand for Australian and New Zealand exports wanes, the AUD faces a broad sell-off. The cooling of the Australian economy, driven by reduced Chinese demand, could lead to decreased inflation and a halt in the rate-hiking cycle. Consequently, the AUD is expected to weaken further, aligning with the current trend.

Source: dailyFX

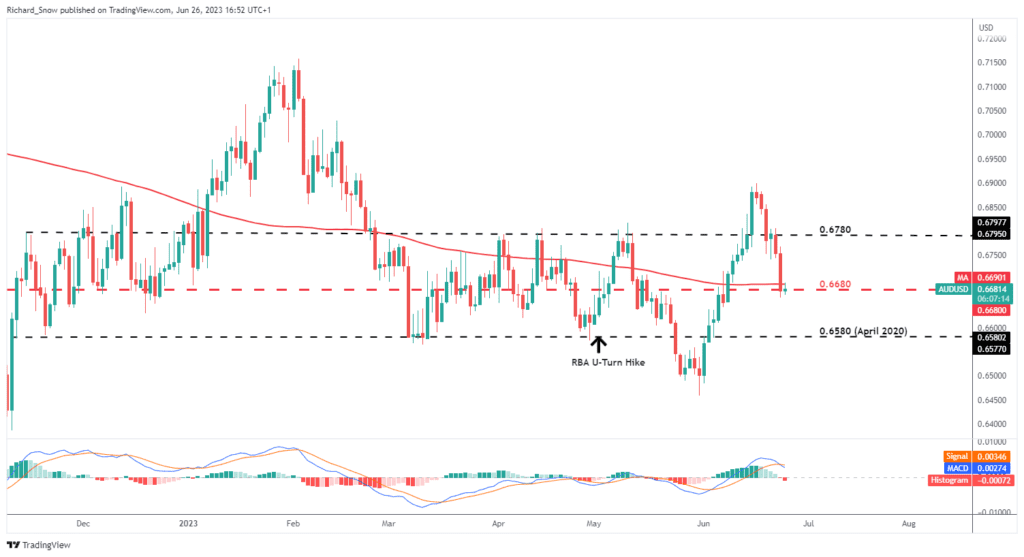

AUD/USD, the currency pair that represents the Australian dollar against the US dollar, has faced significant downward pressure. It breached the 200-day simple moving average and is now testing the long-term level of 0.6680. This level conveniently falls within the broader range of 0.6580 to 0.6780, which has witnessed the majority of price action over the past four months. Worsening Chinese data or a decision by the Reserve Bank of Australia (RBA) to pause interest rate hikes could propel the bearish momentum, with a focus on the support level at 0.6580. Meanwhile, the resistance level remains at 0.6780, but a close below 0.6680 would render it less relevant.

Click here to check live AUD/USD Rate

The broader picture in commodities markets reveals a steady downtrend, albeit with energy prices accounting for a significant portion of the decline. During economic booms, commodities tend to rise in value, while they typically decline in periods of economic hardship. As the global recovery faces challenges, the downward pressure on commodity prices is notable.

Conclusion

China’s lackluster stimulus measures have sent ripples through the copper and Aussie dollar markets, casting doubts on the effectiveness of the country’s economic recovery. Copper’s warning signals and the weakening AUD reflect the interconnectedness between China’s economic performance and global market dynamics. Traders and investors need to closely monitor these developments, as they can provide valuable insights into the broader global recovery and offer trading opportunities. However, it is crucial to remain cautious and adapt strategies to navigate the uncertainties arising from China’s economic slowdown and its impact on key commodities and currencies.

Click here to read our latest article on GBP/USD Price Forecast