CNBC’s Jim Cramer calls Binance “means too sketchy”

Advert CNBC host Jim Cramer mentioned Binance is “means too sketchy” for him to make…

CNBC host Jim Cramer mentioned Binance is “means too sketchy” for him to make use of the platform.

The remark got here following a CNBC look by former Commodities Futures Buying and selling Fee (CFTC) Chair Tim Massad, by which Cramer had the chance to listen to Massad converse in regards to the trade.

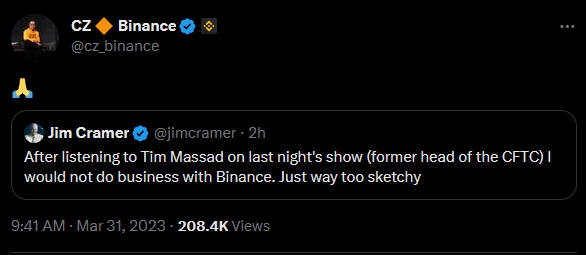

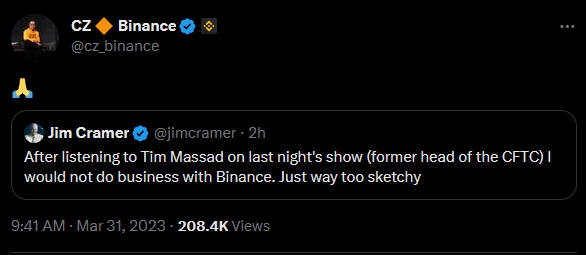

“After listening to Tim Massad on final evening’s present (former head of the CFTC) I might not do enterprise with Binance. Simply means too sketchy.”

Massad served as CFTC Chair between 2014 and 2017 and now works as a Analysis Fellow at Georgetown regulation college, specializing in monetary regulation and fintech.

Inverse Cramer

Cramer’s submit was met with a number of replies making gentle of his phrases.

Crypto Rand mentioned that’s the sign to go lengthy on the BNB token. Equally, Carl From The Moon mentioned he now feels assured sufficient to deposit funds again on the trade.

“Excellent, now I’m able to deposit again to #Binance

Thanks Jim, greatest affirmation I may have gotten.”

Binance CEO Changpeng Zhao (CZ) joined in by merely tweeting the “pray” emoji, presumably to thank Cramer for contributing to the pro-crypto trigger.

Cramer has a long-running popularity for making incorrect calls. A 2013 CBS Information article cited a number of examples of his “poor capability to name inventory sells.”

Jokingly, the creator floated the concept of launching a hedge fund known as Remarc (Cramer spelled backward) to commerce his reverse calls.

Ten years later, the Inverse Cramer ETF was launched in March – managing to beat the S&P500 in its first week.

CFTC goes after Binance

On March 27, the CFTC filed authorized motion in opposition to Binance over allegations of breaking commodities guidelines — thus working an unlawful trade.

The 74-page criticism detailed a number of expenses, together with serving to U.S. residents bypass blocks to accessing the platform, working an opaque company construction with no bodily location headquarters, and failing to stop and detect cash laundering and terrorism financing.

CZ mentioned the corporate doesn’t agree with the costs — which he put all the way down to “ an incomplete recitation of info.”