Crude Oil Prices Target Best Month Since October as Retail Traders Turn Bearish

Crude oil prices surge towards their strongest month, but retail traders' shift raises caution and potential reversals.

Amidst a significant surge driven by robust market demand and supply constraints, crude oil prices target their best month since October, indicative of the prevailing bullish sentiment. Nonetheless, recent shifts in retail trader sentiment have prompted caution regarding a potential reversal in the upward trend of oil prices. Technical analysis highlights that the growing volume of downside bets from retail traders could act as a contrarian indicator, signaling a prospective downturn in crude oil prices.

Over the past few weeks, WTI crude oil prices have displayed an impressive upward trajectory, gaining momentum with each passing day. On Tuesday alone, the commodity rallied by 2.2 percent, contributing to an extended period of gains since the end of the previous week. This surge in prices has resulted in the highest closing levels witnessed since early May. Notably, crude oil prices have already risen by approximately 6.2% in July, signaling the potential for the strongest four-week performance since October, when WTI experienced a notable 8.4% gain.

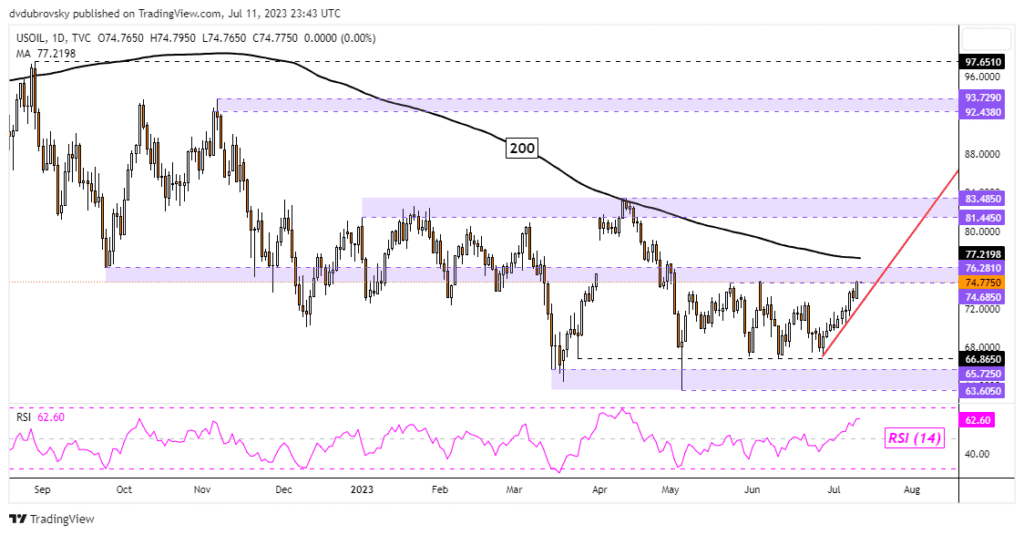

To gain further insight into the market dynamics, it is crucial to examine the price charts and identify key levels of support and resistance. Currently, the commodity hovers on the edge of the 74.68 – 76.28 inflection zone, which has historically acted as a significant resistance level. Should prices face rejection at this critical level, it could trigger a downward move, leading to a potential retracement towards the near-term rising trendline from June 28th. Moreover, a breakout beneath this trendline would expose additional support at 66.86, followed by the crucial 63.60 – 65.72 zone, which holds the potential to be a major turning point for oil prices.

Source: dailyFx

However, if crude oil manages to overcome the resistance at 76.28, it may encounter another substantial hurdle in the form of the long-term 200-day Simple Moving Average (SMA). This SMA level is widely regarded as a robust resistance point, capable of maintaining the broader downside focus. Nevertheless, should oil prices sustain an extended upward movement, they could pave the way for revisiting the 81.44 – 83.48 resistance zone, which previously played a significant role in April.

Crude Oil Prices Target Potential Reversal as Retail Traders Ramp Up Downside Bets, Indicates Technical Analysis

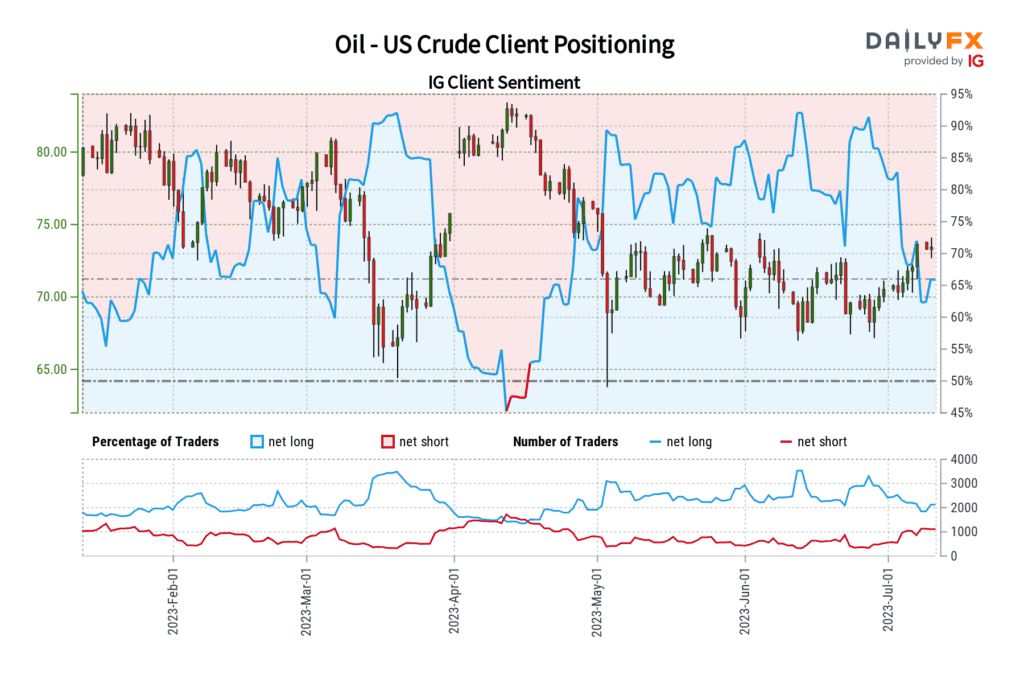

Examining retail trader sentiment provides further insight into the potential direction of crude oil prices. According to the latest data from the IG Client Sentiment (IGCS) gauge, approximately 59% of retail traders are currently net-long on crude oil. Contrary to conventional wisdom, IGCS tends to function as a contrarian indicator, suggesting that prevailing bullish sentiment among retail traders could be a precursor to a future decline in prices.

Click here to check the Live Crude Oil WTI Price Chart

Remarkably, retail traders have recently increased their downside exposure, with a rise of 14.56% compared to the previous day and a significant 54.41% increase compared to the previous week. These shifts in sentiment imply that despite the overall positioning favoring the upside, the price trend may soon reverse higher. Retail traders’ behavior, as indicated by the IGCS, often serves as a useful gauge for potential market reversals. The increase in downside bets by retail traders suggests growing uncertainty and caution among this group, both of which have historically preceded reversals in oil prices. This highlights the contrarian nature of retail trader positioning and emphasizes the importance of monitoring their sentiment.

While the current surge in crude oil prices has been impressive, it is essential for investors and market participants to exercise caution. Technical analysis and the retail trader sentiment outlook both indicate the possibility of a reversal in the market. As retail traders turn more bearish, it serves as a warning sign for a potential decline in oil prices.

Given these dynamics, it is crucial for investors and market participants to closely monitor the price levels and key resistance zones mentioned earlier. A rejection at the inflection zone and a subsequent downward move would indicate the potential for a short-term correction in oil prices. On the other hand, a sustained breakthrough and a move beyond the resistance levels would suggest further upside momentum, reinforcing the bullish sentiment. By remaining vigilant and responsive to market indicators, investors can navigate the volatile crude oil market more effectively.

Conclusion

In conclusion, crude oil prices are on track for their best month since October. However, the increasing bearishness among retail traders and the contrarian nature of their positioning raise concerns about a possible reversal in the market. Technical analysis suggests potential downside risks, urging caution among investors and highlighting the importance of closely monitoring price levels and market sentiment in the coming weeks.

Click here to read our latest article on The Optimistic Euro Outlook