Dollar softens ahead of Fed Chair Powell’s speech

Stocks earning driven rally supports risk assets USD softer against majority of trading partners Jobless Claims drop to lowest levels since January It’s dawning on Wall Street that despite a giant ‘wall of worry’, the Fed is probably going to have to resume raising rates. Fed fund futures are now leaning towards one more rate […]

- Stocks earning driven rally supports risk assets

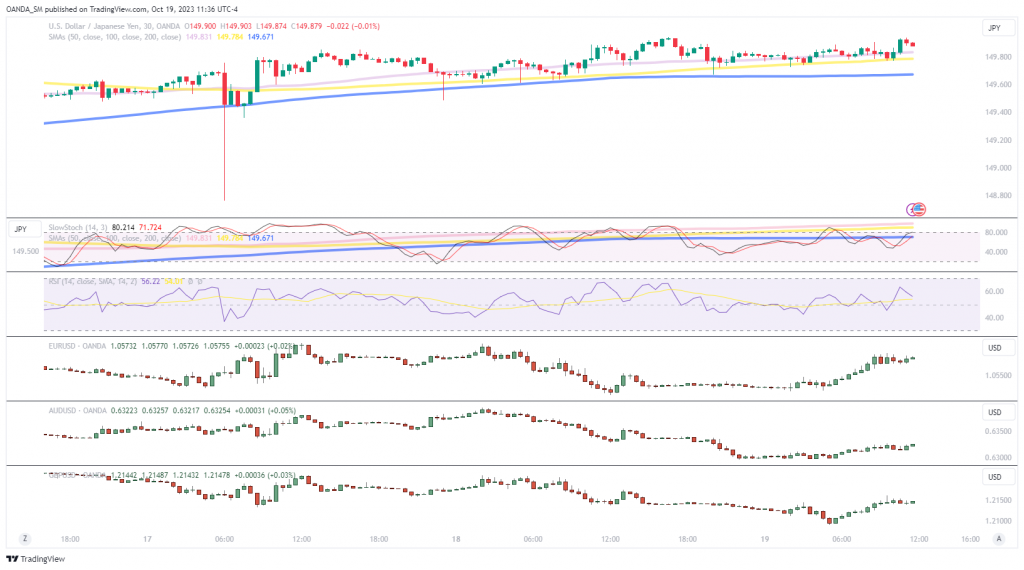

- USD softer against majority of trading partners

- Jobless Claims drop to lowest levels since January

It’s dawning on Wall Street that despite a giant ‘wall of worry’, the Fed is probably going to have to resume raising rates. Fed fund futures are now leaning towards one more rate hike by the January FOMC decision. After another low jobless claims report, it is clear that the US economy remains resilient and is unlikely in a position to bring inflation to the Fed’s target. US stocks were boosted on mostly strong earnings but there isn’t a lot of momentum here given Treasury yields refuse to stop rising.

Fed Chair Powell’s speech will probably provide clarity if ‘higher for longer’ includes a 10-year yield above 5.00%. Fed officials have mostly signaled that the November 1st policy meeting will likely be a hold. If Powell acknowledges that the bond market is doing some of their work and that they will likely keep rates steady next month, that could provide some relief for the multi-decade highs we are seeing with Treasury yields. If Powell does not provide any hints that the policy is most likely restrictive enough, it could get very ugly. If Treasury yields surge above 5%, this could send stocks back to monthly lows.

The key for the dollar will be if yields keep on going higher post Powell.

US Data

Last week’s initial filings for unemployment unexpectedly dropped, supporting the case that the market won’t be seeing a sharp slowdown in Q4. Weekly jobless claims printed at 198,000, well below the 210,000 consensus estimate and 211,000 prior reading. Continuing claims edged higher to 1.734 million, which was higher than the 1.706 million forecast. Labor strikes from the automakers aren’t really impacting the data.

The Philly Fed business outlook showed general activity remained stuck in negative territory. The survey showed almost 1/3 of firms are still reporting increases in input prices, while 6% saw decreases. Given the weakening outlook for 2024, it is no surprise firms are expecting lower CAPEX next year.

Existing home sales just fell to the lowest levels in 13 years. With low inventories and mortgage rates now above 8%, it should not come as a surprise that sales are declining.

Earnings

Tesla

Tesla had an uninspiring earnings report. The street was used to Tesla always delivering on earnings day. The third quarter saw softer than expected EPS, revenue, margins, and free cash flow. This was the first EPS and revenue miss since 2019, which goes to show you how careful they are in providing guidance. Musk remains upbeat on AI and the progress with full self-driving cars, but everyone focused on his downplaying expectations for the Cybertruck. He highlighted enormous challenges exist in bringing production up and that it will take time to get it cash-flow positive. Cybertruck deliveries will start on November 30th.

Tesla shares are plunging, posting the worst drop since July 2020.

Netflix

Netflix crushed it this quarter. Netflix posted robust subscriber additions and revenue steadily grew, while the competition struggled with pricing and content. 2024 margins are expected between 22-24%, which would be better than the 20% they see for this year. Netflix remains the streaming king and it seems no one is close to it. Netflix shares surged over 18%, which is the largest gain seen since January 2021.