Ethereum (ETH) Up 10% as Buyers Eye $1.7k

Ethereum is firm, adding 10 percent in the last trading week. As it is, buyers are setting sights at $1.7k but first need to break $1.35k

The Ethereum price is pumping at spot rates, adding 10 percent in the last trading week. From the formation in the daily chart, ETH looks likely to break above $1.35k. It will be especially so if buyers add to their recent gains.

Based on this preview, the odds of ETH surging to new multi-week highs remain high, relieving the crypto markets. Amid this development is the general resilience of traders and the rising participation levels, a net positive.

Though the crypto market is recovering across the board, the spike in trading volumes, especially in ETH, is notable. With traders hopeful and watching, there is sufficient evidence pointing to possible price swings to new levels in the days ahead.

Shanghai Upgrade in Ethereum

There are myriads of factors traders are looking at, helping solidify asset prices, including ETH. After last year’s deep losses, the crypto market may bounce, relieving pressure and buoying prices. This will inevitably pump ETH, as is the case at spot rates. However, traders also look at fundamental events, especially with the Shanghai Upgrade.

Following the shift to proof-of-stake, locked ETH remains inaccessible. Shanghai will unlock those coins, a reassurance for Ethereum believers, quelling rumors. Traders expect more ETH in circulation, some of which may be locked up, fortifying the second-largest blockchain platform. Although rewards may dip, stakers will rest assured that their coins are safe and can be pulled out anytime.

Ethereum Price Analysis

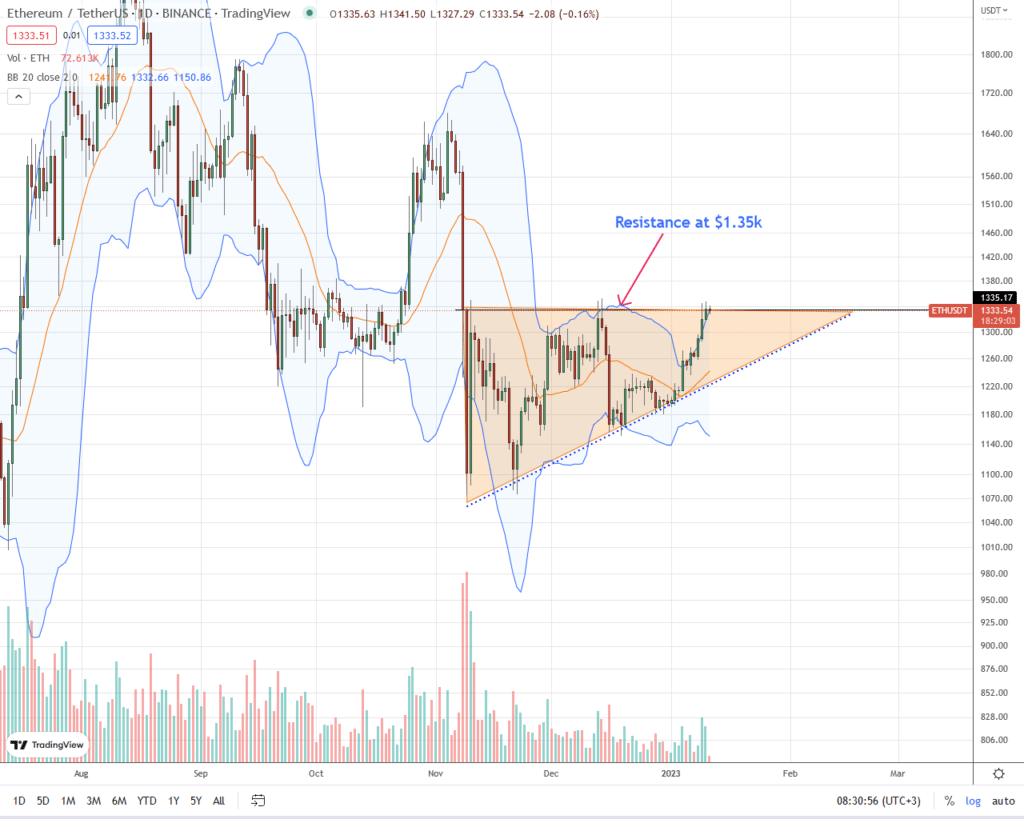

In the daily chart, Ethereum has a strong liquidation line at $1.35k.

Despite recent gains, buyers have yet to break above this level. Still, ETH has been firm, printing higher highs inside a wedge. For context, the coin is up 26 percent from November lows as prices defy gravity.

The immediate support line, of which buyers must maintain prices above, is at $1.27k, or around December 16 highs. Losses of the December 16 bearish engulfing bar were reversed at the back of expanding trading volumes. If ETH closes above $1.35k today, it will reverse the losses of November 9, 2022. It is positive from an effort versus result perspective, especially if the bullish breakout is with rising trading volumes.

The surge in activity pumped momentum, as evidenced in the daily chart. ETH bars are riding the upper BB, an indicator of strength. Therefore, risk-averse traders can load the dips at spot rates as long as prices are above $1.27k, targeting November 2022 highs at around $1.7k.

Technical charts courtesy of Trading View Disclaimer: Opinions expressed are not investment advice. Do your research.