EURJPY Price Action and Technical Analysis Overview

Talking Points: FOMC January 31st, 2024, Meeting Minutes. Technical Analysis EUR/JPY 8-Hour chart Commitment of Traders Report – EUR/JPY OANDA’s Position Ratio Indicator FOMC January 31st, 2024, Meeting Minutes This Wednesday, markets await the FOMC minutes for their latest meeting on January 31st, 2024; it is not expected that there will be any significant surprises […]

Talking Points:

- FOMC January 31st, 2024, Meeting Minutes.

- Technical Analysis EUR/JPY 8-Hour chart

- Commitment of Traders Report – EUR/JPY

- OANDA’s Position Ratio Indicator

FOMC January 31st, 2024, Meeting Minutes

This Wednesday, markets await the FOMC minutes for their latest meeting on January 31st, 2024; it is not expected that there will be any significant surprises in the minutes; however, traders will be searching within the text for indications regarding the Fed’s economic projections and what was the Fed’s view on inflation on the meeting day. An overall view of the surprising January Consumer Price Index – US CPI, Producer Price Index – US PPI and US Retail Sales combined, as well as other economic indicators, suggests that inflation rose slightly and economic activity contracted in January; this led traders to continue pushing their expectations for the FED’s first interest rate cut to take place in June/July 2024, rather than in May. On Friday of last week, FED’s Bostic said, “There is no rush to cut Interest rates with the US Labor market and economy still strong and cautioned it’s not clear, yet, that inflation is heading sustainably to the central bank’s 2% target, the evidence from data, our surveys, and our outreach says that victory is not clearly in hand and leaves me not yet comfortable that inflation is inexorably declining to our 2% objective”.

Markets anxiously await the Fed’s preferred inflation indicator, “Personal Consumption Expenditure PCE,” due on February 29th, 2024, for more clarity on how the interest rate path will be. The numbers can impact most currency pairs, so we will review the technical analysis for EURJPY.

Technical Analysis Overview – 8–Hour Chart

- Price has been trading in an intermediate uptrend since early December 2023 (Green line), forming higher highs along the way; the intermediate uptrend is part of two longer-term uptrends, which began in 2011 and 2020; both can be seen on more extended time frames.

- The uptrend is currently finding resistance at its weekly R1 and monthly R1 standard calculations within the range of 161.87 – 162.21; a break above the resistance level may lead price action to the next resistance at 162.74; however, if the resistance level was to hold, price action might retest the intermediate trendline.

- Price action broke and closed above EMA9, SMA9, SMA21, and its weekly pivot point.

- A negative divergence can be identified between Price action and the MACD indicator on the weekly close, as price action makes higher highs while MACD makes lower highs. (Blue circles), MACD line remains tangled with its signal line.

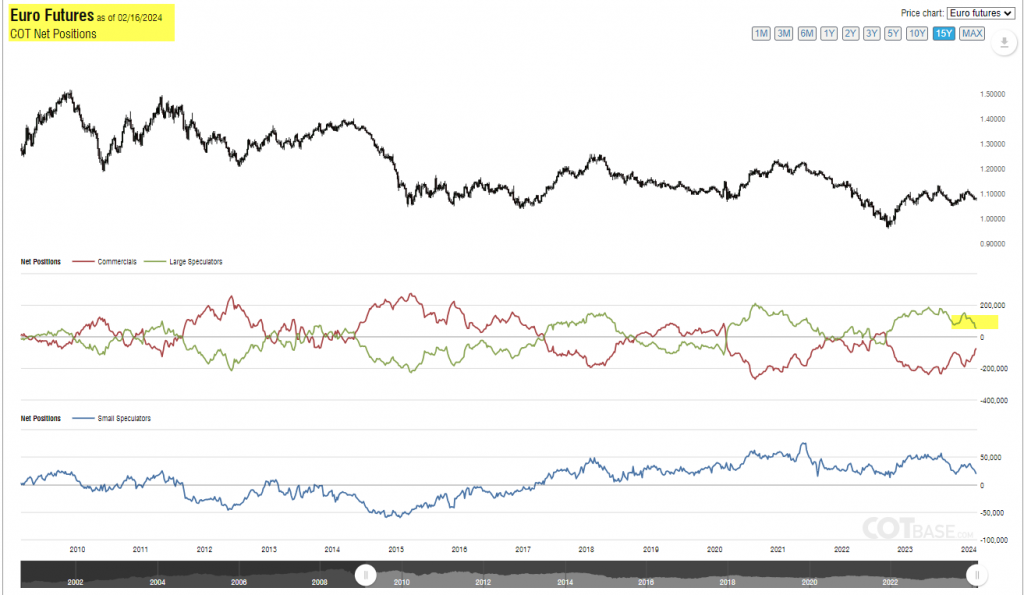

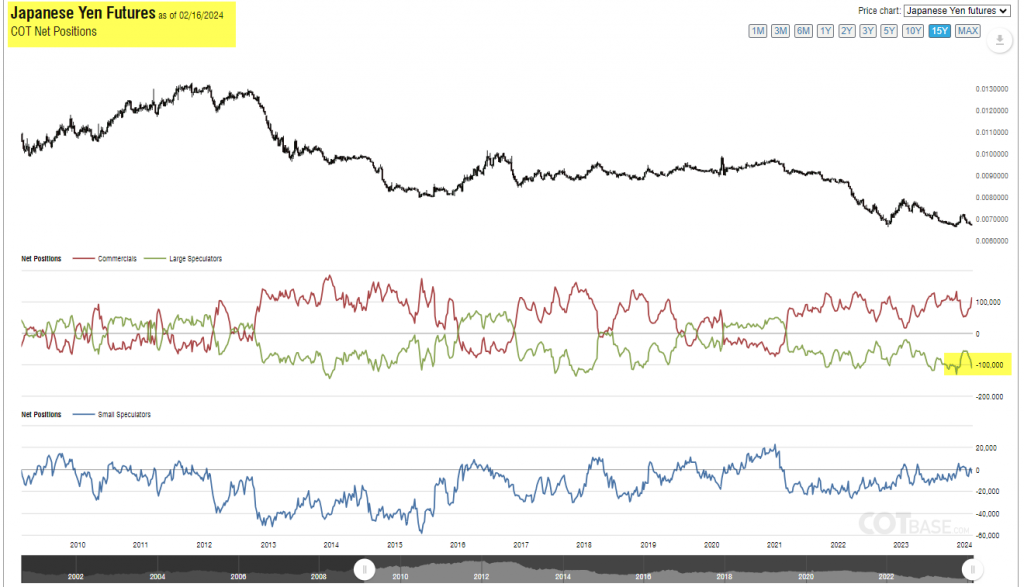

COT Report Analysis

- Upon comparing the Positioning for the Euro to JPY on the most recent commitment of the trader’s report, we can see that large speculators’ Euro net positioning continues to move down towards the short from its extreme long positions. On the other hand, the same group’s positioning on JPY is very close to the extreme short level, suggesting a potential change in sentiment.

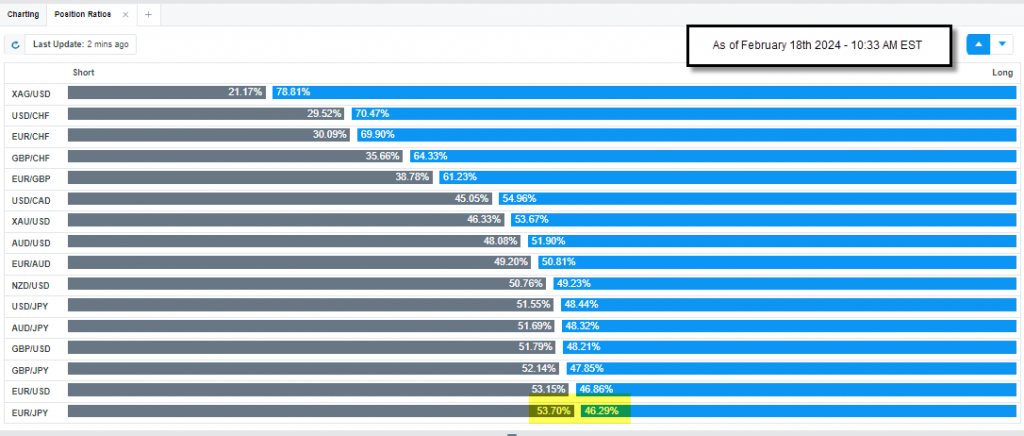

OANDA’s Position Ratio

- The Orderbook indicator reflects that retail traders continued to add to their long positions as of early February 2024; the long ratio changed from 40.43% to the current 46.29%, which may suggest that a change in sentiment can be approaching.