Ford Motor Stock Analysis and Outlook for 2024: Earnings per Share More Than Double Forecasts

Get the latest Ford Motor Company stock forecast for 2024. Read technical and fundamental analysis of F. View a live chart of Ford Motor stock. The post Ford Motor Stock Analysis and Outlook for 2024: Earnings per Share More Than Double Forecasts appeared first at R Blog - RoboForex.

Ford Motor Company (NYSE: F) was expected to achieve a revenue of 43 billion USD based on the Q4 2023 results. However, the outcome exceeded expectations by 7%. Furthermore, the US automaker announced regular and special dividend payouts and shared an optimistic outlook for 2024. Consequently, its stock surged.

On 12 February 2024, we examined the auto giant’s financial performance, conducted a technical analysis of its stock, and explored expert forecasts for its prospects in 2024.

About Ford Motor Company

Ford Motor Company is an American company that designs, manufactures, and sells passenger and commercial vehicles, including electric and hybrid vehicles, under the Ford and Lincoln brands. Henry Ford founded it in 1903 in Detroit, Michigan.

Additionally, the company provides financial, infrastructure, and other services to its customers. The majority of its revenue comes from vehicle sales, especially pickups and trucks. According to the report, in 2023, 1.08 million units were sold, which is 13.2% more than the 2022 statistics. It also generates income from its subsidiaries and joint ventures in China, Europe, and other regions.

In 2023, the company sold 1.99 million vehicles, which is 7.1% more than the total in 2022. The most popular models were the Ford Explorer, the F-Series with the F-150 electric version, and the Transit, including the E-Transit electric version.

About Ford Blue, Ford Model E, and Ford Pro

On 26 May 2021, Ford Motor Company unveiled Ford+, the company’s development plan for the electric and hybrid vehicle era, which introduced new distinct auto units. On the same day, it launched Ford Pro, a service unit that provides a wide range of services to commercial vehicle owners.

Ford Pro components:

- Ford Pro Software – a suite of digital tools operating based on real-time vehicle data, enhancing efficiency and reducing fuel consumption

- Ford Pro Charging – electric vehicle charging solutions encompassing public charging stations, home and office chargers, and charging management and optimisation software

- Ford Pro Service – vehicle maintenance and repair services, including service centres, sales of spare parts and accessories, as well as warranty and insurance services

- Ford Pro FinSimple – financial solutions for vehicle purchase and lease, including lending, special offers and discounts

According to Ford Motor Company’s 2023 report, Ford Pro revenue reached 58.1 billion USD, marking a 19% growth compared to 2022 statistics.

The next stage involved establishing the businesses for Ford Blue and Ford Model E. The former specialises in developing and manufacturing internal combustion engine cars, while the latter focuses on producing electric vehicles, software development, and communication tools. Ford Blue and Ford Model E revenues for 2023 amounted to 101.9 billion USD and 5.9 billion USD, respectively, reflecting an 8% and 12% increase compared to 2022 results.

Analysing the financial performance of Ford Motor Company

On 6 February 2024, Ford Motor Company released the Q4 and full-year 2023 report, showing that financial performance has exceeded expectations.

Q4 2023 results compared to Q4 2022 statistics:

- Revenue: +4.55%, up to 46 billion USD, forecasted at 43 billion USD

- Net loss: 0.53 million USD compared to a previous profit of 1.3 billion USD

- Adjusted loss per share: 0.13 USD versus the previous EPS of 0.32 USD, with a forecast of 0.12 USD

- Operating cash flow: +111%, reaching 2.49 billion USD

Full-year 2023 results compared to 2022 statistics:

- Revenue: +11.47%, reaching 176.19 billion USD

- Net profit: 4.35 billion USD compared to a previous net loss of 1.98 billion USD

- Adjusted EPS: 1.08 USD versus a previous net loss of 0.49 USD

- Operating cash flow: +117.7%, reaching 14.9 billion USD

The factory workers’ strike in Q4 negatively impacted the financial statistics, which cost the company 1.7 billion USD. We will provide more details below.

The day after the report’s release, Ford Motor Company’s stock added 6.05% at the close of the trading session, rising to 12.80 USD.

Vehicle sales statistics by segment

On 4 January 2024, Ford Motor Company presented vehicle sales statistics for the last quarter and the full year 2023.

Q4 2023 sales versus Q4 2022:

- Electric vehicles: +27.5%, reaching 25,937 units

- Hybrid vehicles: +55.5%, reaching 37,229 units

- ICE vehicles: −3.4%, reaching 424,674 units

2023 sales versus 2022 statistics:

- Electric vehicles: +17.9%, reaching 72,608 units

- Hybrid vehicles: +25.3%, reaching 133,743 units

- ICE vehicles: +5.5%, reaching 1,789,561 units

Ford Motor Company financial forecast for 2024

- Adjusted EBIT: 10-12 billion USD

- EBIT Ford Pro: 8-9 billion USD

- EBIT Ford Blue: 7-7.5 billion USD

- EBIT Ford Model E: from −5 to −5.5 billion USD

- Dividends: Regular dividends of 0.15 USD per share and supplemental dividends of 0.18 USD per share are payable on 1 March 2024.

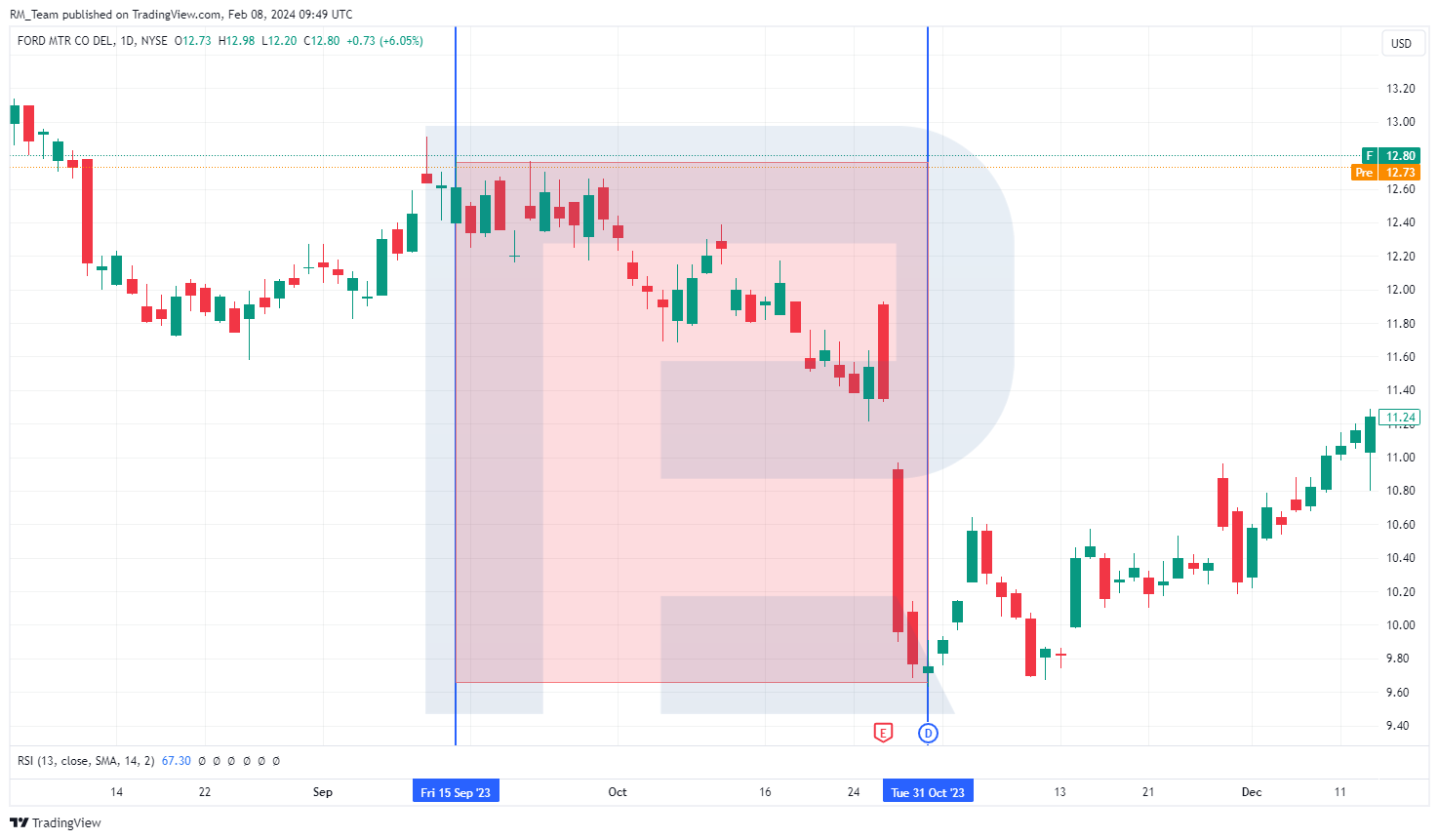

Impact of the industrial action on Ford Motor Company's stock

The most recent strike, as of the preparation of this material, involving the UAW (United Auto Workers), signifies a major conflict between the trade union representing automotive industry workers striving for better working conditions and the three automotive giants, namely, Ford Motor Company, General Motors Company (NYSE: GM), and Stellantis NV (NYSE: STLA). The strike lasted from 15 September to 31 October 2023, resulting in a compromise between the parties.

According to Ford Motor Company’s management, the strike cost the manufacturer 1.7 billion USD. Additionally, workers’ new contracts till 2028 will increase production costs by 900 USD per vehicle. The company plans to increase labour productivity and reduce production costs to offset these losses. The automaker’s stock fell 23.7% during the strike, from 12.70 to 9.70 USD.

Ford Motor Company stock analysis for 2024

Since 19 September 2022, Ford Motor Company shares have traded between 11.20 and 14.60 USD per unit. Amid the UAW strike, the quotes broke below its lower boundary, reaching a low of 9.63 USD. After the parties to the conflict reached an agreement, the stock prices retraced to the trading range and hovered at 12.68 USD at the time of writing.

A retracement of the stock prices to the range may indicate a high probability of further growth towards its upper boundary at 14.60 USD. The formation of an inverse Head and Shoulders pattern on the chart could serve as an additional signal confirming a potential stock rise.

If Ford Motor Company’s shares surpass the resistance level of 14.60 USD, they will likely climb to the next resistance level of 16.50 USD.

Technical analysis of Ford Motor Company*

Expert forecasts for Ford stock for 2024

- According to Barchart, five out of 17 analysts rated Ford Motor Company stock as Strong Buy, two as Moderate Buy, seven as Hold, and three as Strong Sell, with an average price target of 13.52 USD

- Based on the information from MarketBeat, four out of 14 experts assigned a Buy rating to the shares, nine gave a Hold recommendation, and one designated a Sell rating, with an average price target of 13.66 USD

- As TipRanks reports, six out of 15 specialists designated a Buy rating for the automaker’s stock, six rated it as Hold, and three gave a Sell rating, with an average price target of 13.74 USD

- According to Stock Analysis, two out of 13 analysts rated the shares as Strong Buy, three as Buy, six as Hold, one as Sell, and one as Strong Sell, with the average 12-month stock price forecast of 13.78 USD

Conclusion

CEO of Ford Motor Company, Jim Farley, notes that the US government’s infrastructure expenses, as per Joe Biden’s plan, positively impact the company’s earnings as demand for Ford trucks is growing. In addition, in 2024, the company plans to manufacture electric vehicles according to demand. It will be poised to ramp up its production if the consumer focus shifts from hybrid vehicles to electric ones.

The Ford Model E business is projected to see a higher loss this year, but an increase in hybrid vehicle sales can offset this loss. It is worth noting that sales of this type of transport rose by more than 25% in 2023. Additionally, the special dividend payout can make the auto giant’s stock more appealing to investors while positively affecting its value.

Given the information provided in the text, it can be assumed that the optimistic forecast of Ford Motor Company management may prove true, provided that the US economy continues to grow in 2024. In this case, the stock will likely have the chance to reach the levels projected by experts.

FAQ

At the time of writing, the stock price of Ford Motor Company stands at 12.68 USD, with a 52-week high of 15.42 USD and a low of 9.63 USD.

To purchase Ford Motor Company stock, you can follow these general steps:

1. Open a trading account. Choose a brokerage account that suits your trading needs. For example, RoboForex offers accounts of several types for various platforms.

2. Make a deposit. For example, for RoboForex, the minimum first deposit starts from 10 USD, depending on your account type.

3. Choose Ford Motor Company stock.

Determine the investment amount, keeping your budget and investment strategy in mind.

4. Close the trade. Log in to your trading platform, select Ford Motor Company stock, and place a buy order.

5. Monitor your investment. Keep track of your stock positions, analyse performance, and adjust as needed.

The dividend yield of Ford Motor Company shares is 4.73% at the time of writing. However, a special dividend of 0.18 USD per share payable on 1 March 2024 should be added to the yield.

Ford Motor Company delivered positive results at the year-end 2023 amid intense competition and the big UAW strike, surpassing the 2022 figures. Annual revenue rose by 12% to 176.2 billion USD. Net profit reached 4.4 billion USD; a year ago, the company posted a loss of nearly 2 billion USD. The shares gained 10% over 2023, climbing from 11 to 12 USD.

Multiple Internet resources provide Ford Motor Company stock analysis and forecasts, such as Blog Roboforex, Yahoo Finance, MarketBeat, WallStreetZen, and StockScan.

Investing in Ford Motor shares involves the following risks:

1. Cyclical business operations. The company’s sales and earnings largely depend on the economic cycle. When the economy is weak or unstable, consumers may postpone or cut their auto spending, potentially impairing the auto maker’s earnings and profit

2. Disadvantages of value stocks. Ford Motor Company shares are considered value stock, trading at a low price relative to their earnings, assets, and growth potential. While value securities may bring in appealing profits in the long term, they may also encounter challenges such as low investor interest, negative market sentiments, or slow growth

3. Debt burden. The company has a high debt level of 129.29 billion USD as of 31 December 2023. The debt-to-equity ratio is 3.02, considerably higher than 1. The debt increases the automaker’s interest expenses and limits its financial flexibility and ability to invest in growth opportunities. The company may also face problems with refinancing its debt or fulfilling its obligations in case of a business decline or a credit rating downgrade

Ford Motor Company news sources:

1. The primary source is the company’s official website

2. Yahoo Finance news aggregator offers complete, valuable, and up-to-date information on the company, including the latest news, analysts' ratings, forecasts, price targets, data on financial earnings reports, dividends, and many more

3. News resources such as The Motley Fool, MarketWatch, CNBC, etc.

As mentioned above, financial earnings reports and complete important information on Ford Motor Company are published on its official website under the Report & Fillings Section.

It is worth noting that Ford Motor Company provided an optimistic annual outlook and raised dividend payouts. Additionally, the automaker focuses on production optimisation and a more balanced approach to electric vehicle production, studying demand in this segment to launch the most sought-after models. All these factors should be considered when assessing the automaker’s stock prospects. According to the above reputable sources, 2024 price targets for the company’s shares range from 13.52 USD to 13.78 USD.

* – The charts presented in this article are sourced from the TradingView platform, widely recognized for its comprehensive suite of tools tailored for financial market analysis. Serving as both a user-friendly and sophisticated online market data charting service, TradingView empowers users to conduct technical analysis, delve into financial data, and engage with fellow traders and investors. Moreover, it furnishes valuable guidance on adeptly comprehending how to read forex economic calendar, while also offering insights into diverse other financial assets.

The post Ford Motor Stock Analysis and Outlook for 2024: Earnings per Share More Than Double Forecasts appeared first at R Blog - RoboForex.