Former BitMEX CEO Arthur Hayes Remains Bullish on Bitcoin (BTC)

Coinspeaker Former BitMEX CEO Arthur Hayes Remains Bullish on Bitcoin (BTC) Bitcoin's strong bounce back despite the SEC lawsuits has made analysts optimist about the beginning of the next bull run. Former BitMEX CEO Arthur Hayes Remains Bullish on Bitcoin (BTC)

Coinspeaker

Former BitMEX CEO Arthur Hayes Remains Bullish on Bitcoin (BTC)

After facing strong selling pressure earlier this week, the world’s largest cryptocurrency Bitcoin (BTC) has given a strong bounceback today moving closer to $27,000. As of press time, BTC is trading 3.2% up at a price of $26,603 and a market cap of $515 billion. The recent bounce back has created optimism among Bitcoin enthusiasts with analysts turning bullish on the crypto once again. Former BitMEX CEO Arthur Hayes recently tweeted that it’s time to join the next bull run for Bitcoin.

“The wall of worry is being climbed, come with me on the $BTC bull market bus. We are still on struggle street, but the moon ain’t far away,” wrote he.

Earlier this week, Bitcoin (BTC) and the broader crypto market came under major selling pressure following the SEC lawsuit on crypto exchange Binance. Soon after, crypto exchange Binance saw massive withdrawals on the platform, pushing the BTC price all the way under $26,000.

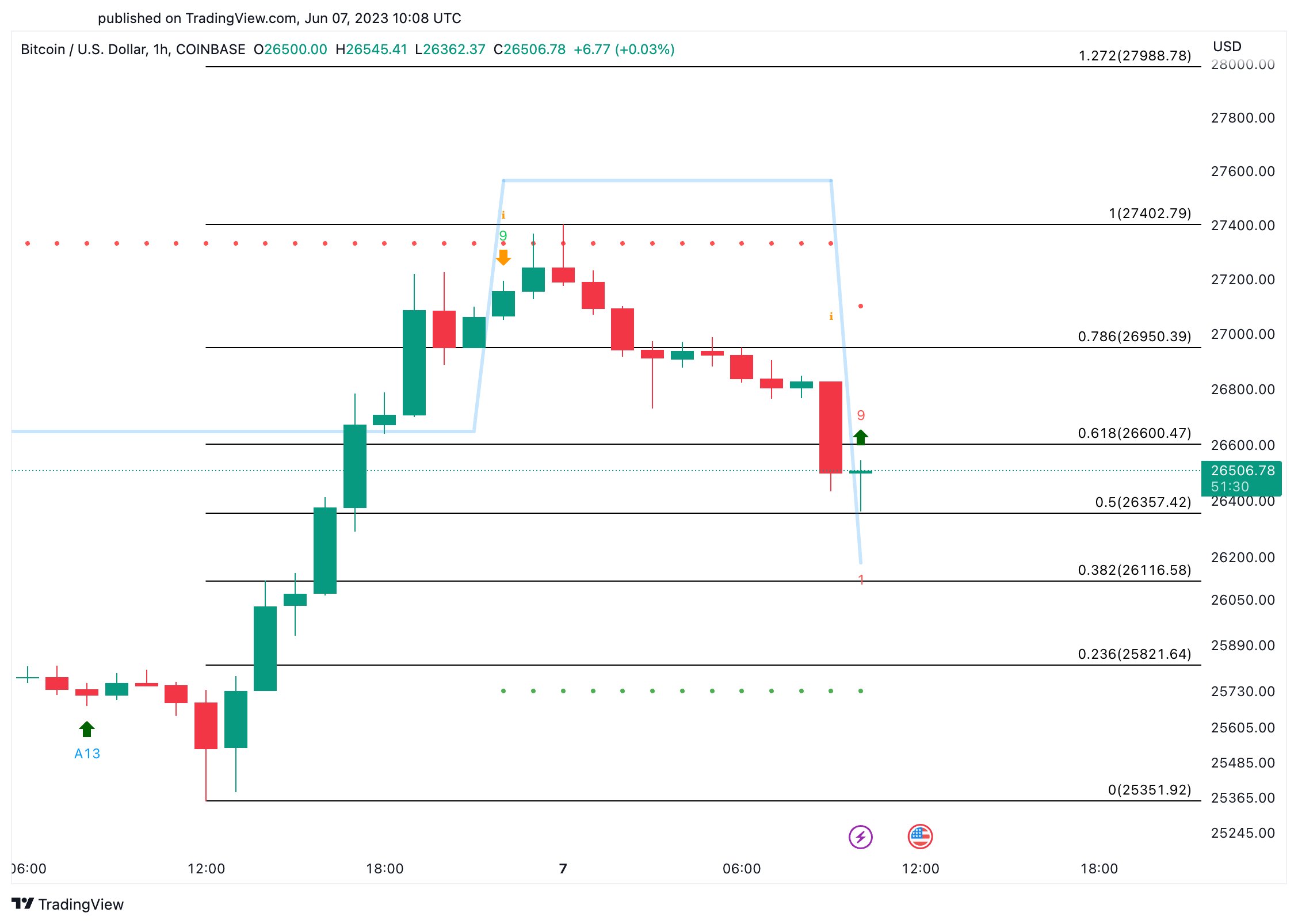

Today’s bounceback, however, brings interesting technical chart patterns into the picture. Popular crypto analyst Ali Martinez wrote:

“The TD Sequential presents a buy signal on the hourly chart, which could see $BTC rebound to $27,000 – $27,300. Still, #BTC must avoid an hourly close below $26,360 because it could lead to a downswing to $25,800.”

- Photo: TradingView

Similarly, popular analyst Michael Van de Poppe noted:

“Great move of #Bitcoin, but you’d preferably want to see it hold above $26,100 to avoid a cascade. If $26,100 is lost, that’s the trigger that we’ll be losing the 200-Week MA on the Total Market Cap of #Crypto too.”

Traders Liquidate Shorts, But the Dips

The recent surge in the Bitcoin price and crypto market shows that investors are willing to look past the SEC’s regulatory actions on Binance and Coinbase. Amid the V-shaped recovery in the Bitcoin price, traders had to liquidate many short positions. On-chain data provider Santiment reports that”traders had many #liquidated #shorts today after showing some over-eagerness to bet against markets. The largest shorts in 3 months acted as rocket fuel as $BTC jumped back above $27k. We saw a similar price bounce when traders shorted on March 10th.

On the other hand, the investor’s interest in buying the dip shot up as the crypto prices corrected heavily. As the US SEC picks up the battle with the top two crypto trading platforms, it will be interesting to see what lies ahead.

The lawsuits’ outcomes have the potential to establish a crucial precedent for cryptocurrencies. If the courts side with the SEC and classify numerous digital assets as securities, it could lead to a substantial transformation in cryptocurrency regulation, potentially granting the SEC authority over them.

nextFormer BitMEX CEO Arthur Hayes Remains Bullish on Bitcoin (BTC)