How Bitcoin Mining Is Adapting To The Energy Transition

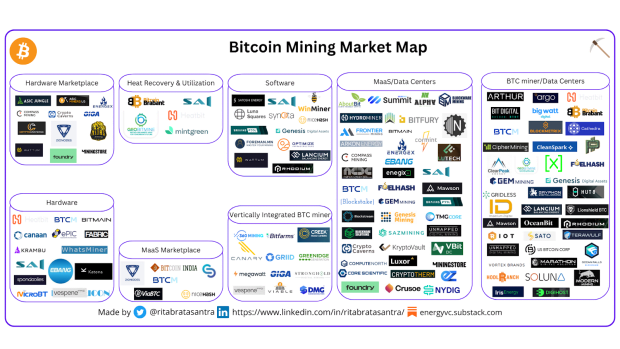

Researching more than 100 bitcoin mining companies, it’s clear that this industry is poised to advance energy consumption more than any other.

Researching more than 100 bitcoin mining companies, it’s clear that this industry is poised to advance energy consumption more than any other.

This is an opinion editorial by Ritabrata Santra, an engineer focused on energy tech.

I bought my first bitcoin in 2016. I was a college sophomore and it was my second year living in the U.S. As I was acclimating myself to the new way of life I found myself living, I came across an article on Bitcoin.

I had saved up some money from my on-campus jobs. As someone who saw the devaluation of my parent’s hard-earned money, the value proposition of Bitcoin was immediately clear to me and I made the second-biggest mistake of my life: I bought a bitcoin off of Coinbase (for $1,500) instead of mining and cold storing (HODL’ing) it! If you are wondering what my biggest mistake is: Two months later, I got an internship in Germany, so I sold the bitcoin to buy myself a ticket to Berlin, and six months later, one bitcoin was worth around $16,000!

The Energy Trilemma And Bitcoin

One of the many things that stood out in my new way of life in the U.S. is the reliable access to electricity. Growing up in India, I witnessed how a lack of energy impacted health, knowledge and opportunity.

Today, developed economies consume as much energy as 12 times the average in some of the developing economies. There are over 900 million people who do not have access to electricity but we flare enough gas every year to power entire sub-saharan Africa. In other words, we burn enough gas (emitting carbon dioxide, or CO2) to provide energy for millions of people without creating any economic value, as we do not have the necessary technology to profitably transport the energy where it is most needed.

I believe that the energy trilemma, the need to balance energy reliability, affordability and sustainability, is one of the great challenges of our lifetime — we need to eradicate energy poverty and meet the additional demand of energy from emerging economies, while actively decarbonizing to reach carbon neutrality.

Bitcoin mining serves as a medium for capturing the wasted economic potential of excess energy resources, accelerates otherwise expensive but innovative renewable development, and therefore sits at the center of solving the energy trilemma.

Trend One: When Harry Met (Stranded) Sally

Innovative monetization of stranded or excess energy resources will create positive economic opportunities and drive bitcoin mining’s growth.

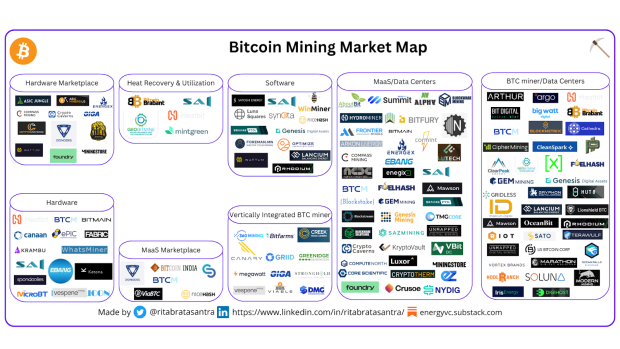

Every energy producer, regardless of the carbon intensity of the energy they produce, has to deal with surplus energy which cannot be monetized. As hydrocarbon production increases, reservoir pressure drops and producers inadvertently end up producing gas which is often costly to transport and therefore they do not have a choice but to burn/flare it. In fact, according to a recent article, the amount of gas flared globally is equivalent to Europe's total natural gas import from Russia before the sanctions imposed over its invasion of Ukraine.

According to the IEA, we need to curb the gas flaring by over 90% to meet its net zero target by 2030, as shown in the figure below. Similarly, renewable generators would often have to curtail their energy production to match the demand from the grid, and in the absence of a battery, that often means wasting the energy.

Many energy producers lacking capabilities in bitcoin mining are partnering up with bitcoin miners to efficiently monetize such otherwise wasted or stranded energy in the absence of transmission infrastructure. Oil giant ExxonMobil has already started a pilot project with Crusoe Energy to mine bitcoin. Similarly, renewable giant Nextera and bitcoin miner Marathon run a joint facility in King Mountain, Texas.

Perhaps the only thing better than a joint venture is a vertically-integrated mining company.

To minimize some of these uncertainties with the energy price and availability, we are observing bitcoin mining companies who own the energy production source, i.e., they produce and use their own energy by cutting out the middlemen. Examples range from companies owning natural gas (such as 360 mining and Canary Mining), to hydropower (Bitfarms), to solar energy (Viable Mining) assets and many others.

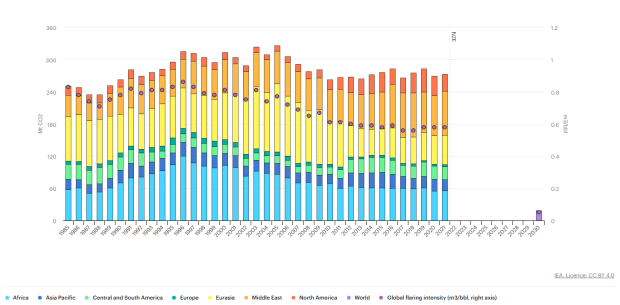

While there are previous instances of bitcoin accelerating otherwise expensive firm renewable energy (such as OTEC) development in the U.S., we are more likely to see similar instances in countries with favorable bitcoin mining policies. For example, El Salvador, which currently produces over 50% of its electricity from renewable energy, has huge geothermal energy potential as shown in the picture below. Currently, there is a huge push from the El Salvador government to develop these geothermal resources for sustainable bitcoin mining.

Trend Two: Software Is Eating The (Mining) World

The specialized optimization software category could be an attractive investment for investors hesitant about capital-intensive digital infrastructure companies.

Bitcoin mining is a highly-efficient capital allocation mechanism and as close as it gets to the invisible hand of the free market. In the past year, several bitcoin mining companies such as Core Scientific, Celsius, Compute North and Butterfly labs declared bankruptcy, while a couple others like Argo Blockchain and Iris Energy were on the verge. The price of energy and being able to efficiently capitalize on the energy demand of the grid have a huge effect on the operational profit margin of a bitcoin mining company; this problem creates a need for energy optimization and efficient usage.

I have created a separate category in my market map for companies which solves these optimization problems for bitcoin miners. Additionally, some mining as a service (MaaS) companies like Lancium offer a bundled software solution to manage computing/mining operations as well optimize energy usage.

But building the infrastructure for bitcoin mining is a major investment and involves risk due to the volatility of the price of bitcoin and the cost of energy needed. To de-risk these investments (to a certain extent) by diversifying their offerings, many MaaS companies are building data centers for low-latency computing. With the astronomical rise of cloud computing, the demand for latency-agnostic computing has significantly increased in the past decade and is projected to increase by 10% year over year until 2030.

MaaS companies are well positioned to build data centers as this resonates with their existing capabilities of building efficient computing infrastructure solutions, thereby significantly increasing their total addressable market.

Trend Three: Swiss Army Knife Of Decarbonization

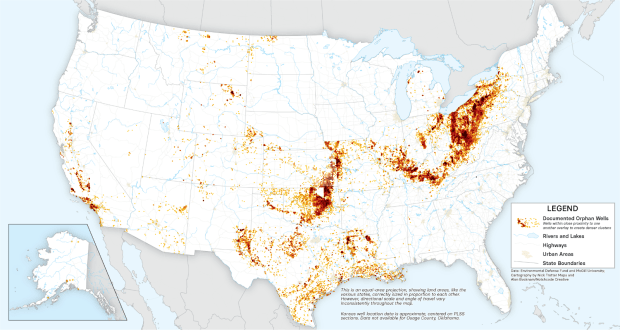

Just like a Swiss Army knife, bitcoin mining incentivizes energy-efficient decarbonization in many ways. Repurposing coal refuses and sustainably combusting them, utilizing natural resources to preserve key wildlife habitats, capturing methane from landfills and using that energy to mine bitcoin creates positive economic value for the society. In fact, there are over 120,000 orphaned wells in the U.S. alone which emit methane equivalent to producing seven million to 20 million metric tons of CO2 per year and threaten lives in surrounding communities.

Assuming an average cost of $100,000 to plug such a well and that only 10% of such wells would be suitable for repurposing using bitcoin mining, that’s a $1.2 billion market!

Bitcoin mining uses electrical energy and is therefore as clean as the source of the electricity. However, as we integrate more intermittent renewables to the grid, the need to balance the grid increases, which could be addressed by a flexible load like bitcoin mining and data centers in certain locations.

The electrical energy used in bitcoin mining is converted to heat. Just like the energy producers trying to monetize their excess energy with bitcoin mining, bitcoin miners can monetize the wasted heat by capturing and repurposing it. Here’s a great example of how bitcoin mining can incentivize waste heat recovery.

In creating my market map, I have seen companies repurposing heat from bitcoin for agricultural purposes such as greenhouse chambers to grow tulips, distill whiskey or for heating homes. In addition to a resilient revenue model, efficient users of wasted energy and heat will be the winners.

Conclusion

Due to the decentralized nature and the low barrier to entry, creative destruction is built into bitcoin mining by design. Bitcoin miners who constantly innovate to improve operational and energy efficiency will thrive in this industry.

This is a guest post by Ritabrata Santra. Opinions expressed are entirely their own and do not necessarily reflect those of BTC Inc or Bitcoin Magazine.