How Coinbase Plans to Bring One Billion Users to Web3

Inside COIN's new Layer 2 solution (called Base). The post How Coinbase Plans to Bring One Billion Users to Web3 appeared first on Bitcoin Market Journal.

Since its inception in 2012, Coinbase has had the goal of being the crypto platform that’s most trusted and the easiest to use.

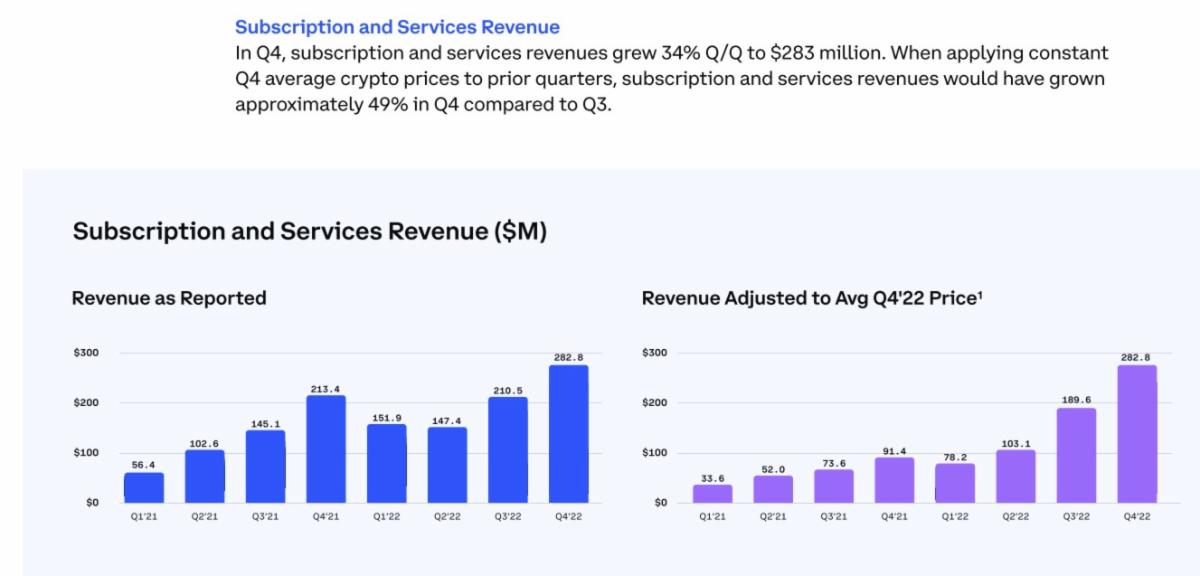

It has certainly accomplished this in terms of its crypto exchange service and, more recently, its subscription business (which is growing at a 34% rate; see our CEX Sector Report for more details).

Now, the company is making its move into the developer space, and the implications are nothing less than epic.

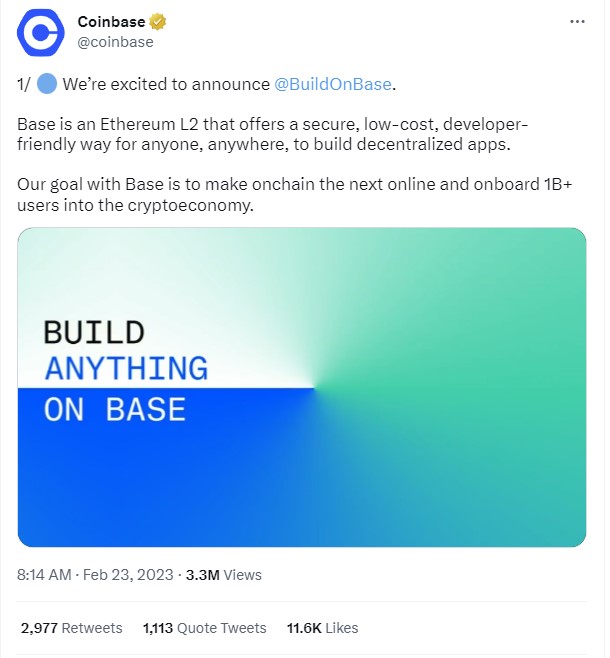

On February 23, Coinbase announced the launch of a new testnet called Base, which is an Ethereum Layer-2 network powered by Optimism and developed using the OP Stack. This will allow Base to be decentralized, permissionless, and open to anyone looking to create decentralized apps that can reach the full set of Coinbase products, tools, and users.

The move is epic as it combines one of the largest global crypto exchanges with the largest smart contract blockchain. The reach will be huge. In the words of Coinbase:

“Our goal with Base is to make onchain the next online, and onboard 1B+ users into the cryptoeconomy.”

Considering Coinbase currently has 110 million registered users, a leap to 1 billion has to be considered epic.

Let’s look at how Base works, why they created it, and the implications for Coinbase (COIN) investors.

The Goal of Base and Why Coinbase Chose Optimism

Base was created with a goal of bringing many more users into the crypto ecosystem. It’s meant to be the home of all future on-chain products created for Coinbase.

By choosing Ethereum and Optimism, Coinbase has ensured it will remain a decentralized, permissionless, and open ecosystem that anyone can use to build dApps and solutions.

Coinbase says this will foster ease of use and make the transition to Web3 easier, and that’s true. It will also benefit Coinbase as it brings in the collective experience of millions of developers who can create an ecosystem around Coinbase.

Coinbase could have created its own blockchain as Binance did with Binance Smart Chain. Instead, the company partnered with Optimism and used Ethereum as the Layer 1, meaning it can leverage the existing Ethereum developer base.

Collaboration and decentralization gives Coinbase far greater reach and trust in developing this Layer-2 solution. This should ensure the long-term adoption and growth of Base. In the words of Coinbase,

“We believe this decentralized effort will create the foundation for a much more vibrant developer ecosystem than what would be possible by a single chain alone.”

What’s not been publicized is Coinbase has been working with OP Labs (the first core dev for the OP Stack) and the core Ethereum development team since May of last year.

That collaboration has accelerated work on Ethereum’s EIP 4844, which will decrease fees for Layer 2 networks by 10-100x. It also takes the network one step closer to full sharding (another 10-100x cost reduction), and ensures the new data storage requirements are manageable for stakers.

During the collaboration with OP Labs, the two companies found common ground. Using the OP Stack, they could deliver massive benefits to users, developers, and the broader crypto ecosystem by providing interoperability and composability between the two companies.

The vision they share is a mesh of rollups that will eventually form a Superchain which jointly scales Ethereum. Such a Superchain is expected to be far more beneficial to the crypto ecosystem than a single chain could ever be.

The Benefits of Base

There are several ways in which Base will benefit not only Coinbase, but also Ethereum and the overall developer and user communities.

1. The choice of Ethereum as the blockchain rather than building a new blockchain for Base is a huge vote of confidence in Ethereum and its ecosystem. This sets a massive precedent that others firms like banks and fintech companies will likely follow. Ethereum could become the de facto Layer-1 solution used globally for all Layer-2 activities.

2. Despite Coinbase being centralized, Base is the best decentralized way for the company to launch a chain. There’s no token; it’s all open source. A huge win for the crypto maximalists, as Base is more DeFi and less CeFi.

3. Base is a trustless money system built on transparent, open, DeFi protocols. This could help appease regulators by showing how code can be used to protect retail investors in the space.

4. With Coinbase having 110 million verified users, the success of Base could see an explosion in DeFi and crypto native users in the coming years.

5. Coinbase now has an incentive to help develop Ethereum’s infrastructure. This brings massive resources to Ethereum development. It will also supercharge Layer 2 development, accelerating innovation in the space.

6. The fact that Coinbase was able to get this through its legal and compliance teams in the U.S., where regulators seem to be constantly battling any innovation in the crypto space, indicates confidence that Base will not be shut down by the S.E.C. Even if it tries, few companies are as well prepared to battle regulators in the U.S. as Coinbase.

Not Without Problems

While the initial hype surrounding Base was overwhelmingly positive, the project has already run into problems. Just hours after Base was announced, social media saw a flood of user complaints about the functionality of the network.

Those first hours saw the majority of transactions reverted (i.e., reversed), and with the Base bridge being unverified, no one was able to figure out why this might be happening.

“The bridge contracts bump up gas usage under load, which wallets weren’t properly estimating,” Coinbase software engineer Roberto Bayardo explained on Twitter some hours after the launch. “Hardcoded a higher gas limit.”

It seems Coinbase wallets were inaccurately estimating the amount of Ethereum fees (gas) needed to complete a transaction. This meant users weren’t allowing enough gas for their transactions, and Base was reverting the transactions rather than processing them.

Speculation is that Coinbase didn’t anticipate the huge flood of users coming to try out the new Base bridge.

Given the history of Coinbase, which has halted transactions due to overcapacity multiple times in the past, this probably shouldn’t be too surprising. You’d think they’d be used to these growing pains by now.

Investor Opportunities in Base

One of the major commitments in building Base is it will remain open-sourced, decentralized, and permissionless, and that Base will not have its own native token, so how can we (as investors) benefit from Base?

Currently, there are three primary entities that could see a benefit from the launch of Base, though to be sure, any real gains likely won’t come until Base is launched on its mainnet. These three are:

- Ethereum (ETH)

- Optimism (OP)

- Coinbase (NASDAQ: COIN)

Ethereum

Ethereum is already the largest smart contract blockchain by far. With roughly 500,000 daily active addresses and a market cap just shy of $200 billion, it would take quite a shift for one project to heavily influence the price of ETH.

Yet, Base could be that project.

If Coinbase can meet its goal of one billion users, usage of Ethereum and ETH could grow 100-fold or more. That will take some time, but it’s worth baking into your forecast if you’re a long-term ETH hodler.

Optimism

The OP token saw a quick jump of 8% following the announcement of Base, taking it briefly above the $3 level. However, this proved to be too much resistance, and the price dropped back over the coming days.

Still, OP has seen a 230% gain in recent months, mostly on the back of bullishness surrounding the Ethereum Merge event.

Increased usage of Ethereum and Optimism, once Base hits mainnet, could be just the catalyst to see OP reach new all-time highs. At the very least, we expect a pump of the token when Base announces its mainnet date.

Long-term, the token may benefit from massive increased usage of Base if Coinbase can deliver on its promise of making on-chain the new online.

Coinbase

Like everything in crypto, Coinbase has seen its stock plunge during the crypto winter, with its price falling from an all-time high of $368.90 to its recent price of $64.15. That said, price has rallied by more than 10% in the wake of the Base announcement, promising better days to come if Base delivers on its promise.

Tom Dunleavy, a former senior analyst at Messari, put forth some interesting numbers in a Twitter explainer thread following the announcement of Base. He hypothesized that Coinbase could double its revenue and profits solely on the back of Base.

His hypothesis goes like this:

- Coinbase has 110 million verified users.

- Roughly 10% of these (let’s call it ten million) are active users, not just those who have an account for holding crypto assets.

- Assume 50% of them are interested in crypto-native applications. That gives Base a five million strong user base from day one.

- Users will need wallets. Assume that half the user base will choose Coinbase wallets simply for ease of use. That gives us 2.5 million Coinbase wallet users.

- All these users will need to swap assets. They could do this through Uniswap (which will likely be integrated with Base on day one), or they could use the native swap feature in the Coinbase wallet.

- According to data from Dune Analytics on MetaMask swaps, during a bear market, it does $200K-$500K a day in swap revenue across 4K-5K DAUS. During a bull market, it does $500K-$2M a day across 6K-7K DAUs.

- If only 1% of the total users do their swaps through the Coinbase wallet, we get 10x the DAUs of MetaMask. Assuming the same take as MetaMask we get $60-600 million per month in swap revenue, which is pure profit.

- Through Base and Coinbase wallet-native swaps, Coinbase could be adding roughly $0.7B (bear market) – $7B (bull market) annually to its bottom line in profit. Coinbase annual revenue was $3.15B in 2022 and $7.36B in 2021.

While Dunleavy’s numbers could be (ahem) optimistic (five million Base users and 2.5 million wallet users on Day one seems quite high), there’s still an opportunity for Coinbase to grow its revenues and earnings quite aggressively just from swaps, and as the user base grows over time, so will these numbers.

Also, as Base grows towards its goal of one billion users, it’s likely safe to assume the majority of these will favor convenience and ease of use, so they should favor the Coinbase wallet and native swaps. That means swap revenues could accelerate dramatically in the coming three-five year timeframe.

As an example, look at how services and subscription revenue at Coinbase grew in 2021 and 2022, even during a bear market.

A similar trajectory in Base swap fees would give Coinbase a pretty massive injection of easy revenues and profits.

Investor Takeaway

Coinbase is the largest U.S. crypto exchange, while Ethereum is the largest smart contract blockchain.

As they pair up to bring one billion users into the Web3 ecosystem, it’s probably fair to say this bears watching if you’re an investor.

If Coinbase can deliver on its promise to “make onchain the next online, and onboard 1B+ users into the cryptoeconomy,” this could easily be an “iPhone moment” for the crypto ecosystem.

Coinbase currently has a market cap of just over $15 billion, so imagine if it could grow to the size of Apple with a market cap in excess of $2 trillion.

Of course, ETH and OP stand to benefit massively from such adoption as well. Optimism has already seen a 230% increase in two months on the back of the Ethereum Merge. Imagine how the value of the OP token could increase if Base is successful.

If Ethereum becomes the de facto Layer-1 solution used globally for all Layer 2 activities, combined with massive user adoption, we could see the flippening sooner rather than later.

Oh, and if you like collecting NFTs, there’s a free NFT giveaway (you will need 0.000777 ETH for minting fees) promoting Base, Introduced. Click the link to go mint your free NFT.

The post How Coinbase Plans to Bring One Billion Users to Web3 appeared first on Bitcoin Market Journal.