Japanese Yen Succumbs to Pressure as US Dollar Surges Amidst Fed-BoJ Policy Disparity

Learn why the Japanese Yen succumbs as the US Dollar strengthens, examining the Fed-BoJ policy disparity and its implications.

The Japanese Yen succumbs as the US Dollar regains strength in the currency markets. This recent slide comes as both the Federal Reserve (Fed) and the Bank of Japan (BoJ) reiterate their respective monetary policy stances. The market eagerly awaits the response from the BoJ as Treasury yields continue to trend higher, potentially pushing the USD/JPY exchange rate even higher.

In the aftermath of the leaders from the Federal Reserve (Fed) and the Bank of Japan (BoJ) reaffirming their policy disparities earlier in the week, the Japanese Yen faced significant downward pressure, reaching its weakest level since November of last year. Fed Chair Jerome Powell has consistently expressed a hawkish stance, emphasizing the potential for tightening monetary policy in the near future. In contrast, Bank of Japan Governor Kazuo Ueda has made it clear that the BoJ intends to maintain its ultra-loose monetary settings for the foreseeable future, aiming to support economic recovery and combat deflationary pressures.

Japanese Yen Succumbs, BoJ Response Awaited

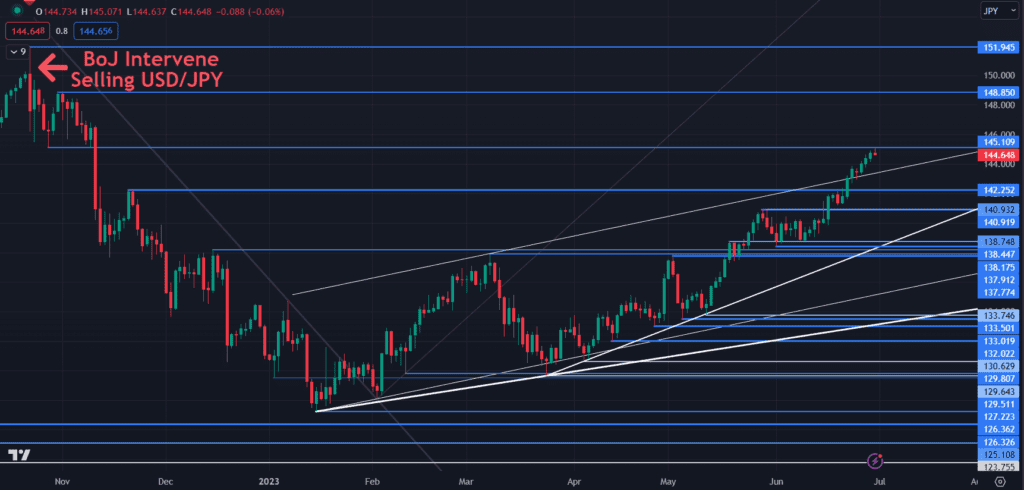

The divergence in monetary policy between the two central banks has intensified, leading to increased jawboning efforts from Japanese authorities. Finance Minister Shunichi Suzuki issued a warning, stating that the government will respond to excessive moves in currency markets. Such statements have prompted a retreat in the USD/JPY pair, pushing it back below the 145 level.

Click here to check the Live USD/JPY Chart

Simultaneously, Treasury yields have continued their upward climb following strong jobs data, contributing to the strengthening of the US Dollar. The policy-sensitive 2-year note has nudged 4.89%, approaching levels seen prior to the collapse of SVB (Société Générale de Banque au Luxembourg). The back end of the yield curve has also shown resilience, indicating investor confidence in the US economic recovery.

The impact of these developments has been observed in global government bond markets, albeit to varying degrees. Investors have been adjusting their positions in response to the changing interest rate environment, leading to subdued performance in the Asia-Pacific (APAC) equity markets. However, China’s CSI 300 index experienced some gains following the release of the National Bureau of Statistics (NBS) Purchasing Managers’ Index (PMI) data, which met expectations with a reading of 49. This suggests a stabilization in China’s manufacturing sector.

Adding to the market dynamics, the People’s Bank of China (PBOC) surprised market participants by setting the Yuan stronger than anticipated. This unexpected move indicates that Beijing may adopt a closer focus on the exchange rate, aiming to maintain stability amidst recent market fluctuations. The PBOC’s actions reflect its intention to balance economic growth, trade competitiveness, and financial stability.

Turning to the commodities market, crude oil prices have remained steady as Friday’s session approaches. The West Texas Intermediate (WTI) futures contract is approaching the US$70 per barrel mark, while the Brent contract oscillates around US$74.50 per barrel. Stable oil prices indicate a delicate balance between global supply and demand factors, with market participants closely monitoring geopolitical developments and production decisions by major oil-producing nations.

Click here to check the Live Crude Oil Prices

Gold, often considered a safe-haven asset, experienced a temporary dip after reaching US$1,900 overnight. However, the precious metal has since recovered and is currently trading near US$1,915. The volatility in gold prices reflects market sentiment, which is influenced by factors such as inflation expectations, geopolitical tensions, and the performance of other financial assets.

Click here to check the Live Gold Price Chart

Looking ahead, there are several key economic events and indicators that investors will closely monitor. Following the release of UK Gross Domestic Product (GDP) and European Consumer Price Index (CPI) data, Canada will publish its GDP figures. These data points will provide insights into the health of these respective economies and could impact currency exchange rates and investor sentiment. In the United States, the focus will be on the Personal Consumption Expenditures (PCE) inflation gauges as the calendar transitions into a new month, quarter, and half-year. The PCE inflation gauges are closely watched by the Fed as they provide an indication of consumer price inflation and can influence the central bank’s monetary policy decisions.

From a technical perspective, USD/JPY has recently encountered resistance just below the breakpoint of 145.10. This level is expected to continue offering resistance, with additional potential hurdles at the prior peaks of 148.85 and 151.95.

Source: dailyFX

On the downside, there is potential support at the breakpoints of 142.25 and 140.90. Further down, a cluster of breakpoints and previous lows in the 137.75 – 138.85 area may provide a significant support zone for the USD/JPY pair.

As the USD/JPY exchange rate continues to fluctuate in response to the monetary policy stance of the Fed and BoJ, market participants will closely monitor Treasury yields and any potential actions from the Bank of Japan. The outcome of these factors will likely influence the direction of the Japanese Yen in the coming weeks.

Conclusion

In summary, the Japanese Yen has faced downward pressure as the US Dollar strengthens, driven by the Fed’s hawkish stance and the BoJ’s commitment to maintaining ultra-loose monetary settings. The USD/JPY exchange rate remains in focus as Treasury yields continue their upward trajectory. Investors await the BoJ’s response to determine the future direction of the Japanese Yen.

Click here to read our latest article on Jerome Powell’s Latest Speech Revealing Multiple Rate Hikes by EOY