NAS100 Pip Calculator

The post NAS100 Pip Calculator appeared first on Get Know Trading.

The NAS100 pip calculator in Forex represents a Forex calculator that calculates the value of a NASDAQ pip in the currency you want by defining following values:

- number of pips

- lot size used

- currency pair

- deposit currency

Why do you need NASDAQ pip calculator?

You can calculate the value for a number of NASDAQ pips. And that means for example if you have 100 pips as a stop loss or take profit set, then you can calculate how much that will be in terms of a currency you select.

How to use the NAS100 pip calculator?

Inside the NAS100 calculator you have several fields you need to fill with the data. And those are the number of pips, NAS100 symbol, deposit currency and lot size. At the end you click the button Calculate and you get the value of NAS100 pip.

In this article I will show you all details you need to know about NAS100 pip calculator and what you can get with using it, why you should use it to speed up the process of calculating pip value and how to use it so you do not get confused when looking at pip calculator.

Read more: What is Pip Calculator

NAS100 Pip Calculator Example

The best way to explain how the NAS100 calculator works is to show an example. I will make a few examples so you can see the difference in calculations.

NOTE: Very Important

When trading NAS100 or Indice like S&P500 it is important to know what is the contract size on trading platform.

What contract size means?

In Forex when you check the contract size it says that one standard lot is 100,000 units of base currency. So, the contract size for 1.0 lot is 100,000.

In Indices like NAS100 the broker will define what the contract size will be on the trading platform. So, they can define a contract size of 1.0 in MT4 not to be 100,000 units, but for example:

- 1.0 = 100 units or

- 1.0 = 1.00 units

So, when you make calculation of a pip value on NAS100 or any other Indice where 1.0 is not equal to 100,000 units then you need to pay attention to this.

Let’s say a broker defines that the contract size is 1 unit. That would mean that 1 standard lot if you are trading in MT4 this would be

Volume = 1.0 = 1 unit

inside trading platform.

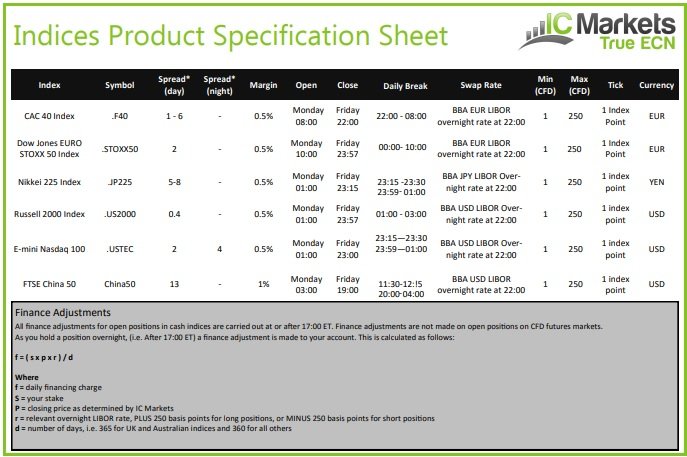

Take a look in the image above where you can see that IC markets broker has defined that a contract size in MT4 will be equal to 1.0 standard lot.

Second way how to define what is your broker contract size for the NASDAQ is to go into the trading platform, MT4 or MT5, and then find the symbol under the Market Watch window with symbols list.

Click the right mouse button on the NAS100 and select Specification. This will open new window where all details for NAS100 symbol will be.

Inside this window you can find details about the symbol from the broker you are using.

You can see what is the Contract size and what is minimal volume available for trading.

For the NAS100 the contract size is 1 which means 1 unit for a volume of 1.00.

This means 1 standard lot inside the MT4 will be 1 unit of a base currency and that is NAS100.

This will have influence on the NAS100 pip calculation. Let me show you that.

First example is when you have NAS100 currency pair with NAS100 as a deposit currency and contract size is 100,000 units:

- Number of pips: 1

- Instrument: NAS100

- Lot size: 1.00 (100,000 units)

- Deposit currency: NAS100

- NAS100 pip size: 0.01

Second example is when you have NAS100 currency pair with USD as a deposit currency and contract size is 100,000 units:

- Number of pips: 1

- Instrument: NAS100

- Lot size: 1.00 (100,000 units)

- Deposit currency: USD

- NAS100 pip size: 0.01

You can see that here you have examples where one contract is equal to 100,000 units, and not to 1 unit like IC markets broker has defined.

Here is an example how this would look with IC markets:

- Number of pips: 1

- Instrument: NAS100

- Lot size: 1.00 (1 unit)

- Deposit currency: USD

- NAS100 pip size: 0.01

How to Calculate Pips for NAS100

To calculate pips for NAS100 you need to use following formula which defines the pip value:

For deposit currency which is equal to base currency, NAS100 :

Pip value = (Pip / Current market price) x Lot size

For deposit currency which is equal to quote currency, USD:

Pip value = Pip x lot size

NAS100 Pip Value

Now with the formula you have you need to use the first formula where the deposit currency is NAS100 .

Pip Value for Base Currency

For deposit currency which is equal to base currency, NAS100 , pip value will be equal to:

Pip value = (Pip / Current market price) x Lot size

Here are other data you need:

- Number of pips: 1

- Instrument: NAS100 = 13,058.60

- Lot size: 1.00 (100,000 units)

- Deposit currency: NAS100

- NAS100 pip size: 0.01

Now, when you put all the data in the formula you get:

Pip value = (Pip / Current market price) x Lot size

Pip value = (0.01 / 13,058.60) x 100,000

Pip value = (7.65e-5) x 100,000

Pip value(NAS100) = 7.65

What you can see here is that the value of a pip in NAS100 is equal to 7.65. But, the problem here is that your account deposit currency cannot be in NAS100. That means you cannot open a trading account with NAS100 by investing NAS100 as a currency.

To avoid this you would open a trading account with USD as a deposit currency. In that case you would use following calculation.

Pip Value for Quote Currency

For deposit currency which is equal to quote currency, USD, pip value will be equal to:

Pip value = Pip x Lot size

Here are other data you need:

- Number of pips: 1

- Instrument: NAS100 = 13,058.60

- Lot size: 1.00 (100,000 units)

- Deposit currency: USD

- NAS100 pip size: 0.01

Now, when you put all the data in the formula you get:

Pip value = Pip x Lot size

Pip value = 0.01 x 100,000

Pip value = $1,000

No matter what is current market price, if your quote currency (NAS100/USD), in this case is USD is equal to account deposit currency and that is USD, the value of a NAS100 pip will be equal to $1000.

And the condition is to use standard lot size, 100,000 units of base currency or 1.00 Lot.

Pip Value for Third Currency

Third case is when you have a NAS100 symbol, but the deposit currency is EUR. Which is not NAS100 or USD.

This case requires that you make more calculations. If you use the NAS100 calculator then the whole calculation is done by the pip calculator.

But, if you want to do it manually, then you need to use the following process.

First:

- decide in which currency you will calculate the pip value. Will that be NAS100 or USD

Let’s use USD. The reason why to use USD is because we will ned EUR/USD pair price from the market to calculate NAS100 pip value in EUR.

If we would use NAS100 then we would need to find the NAS100 in EUR price which is not available online easily. Or we would need to make more calculation to get NAS100 pip value in EUR. And to do that it would make a lot of confusion for you.

The formula for the pip value will be:

- Number of pips: 1

- Instrument: NAS100 = 13058.60

- Lot size: 1.00 (100,000 units)

- Deposit currency: USD

- NAS100 pip size: 0.01

Now, when you put all the data in the formula you get:

Pip value = Pip x Lot size

Pip value = 0.01 x 100,000

Pip value = $1,000

Second:

Now, you need to use the EUR/USD currency pair so you can extract EUR pip value from it.

Current market price for the EUR/USD = 1.09112. Which gives us EUR = 1.09112 USD.

This is the same as 1 EUR = 1.09112 USD.

So, the formula would be:

Pip value (EUR) = Pip value (USD) x (1/ EURUSD)

Pip value (EUR) = 1000 x (1 / 1.09112)

Pip value (EUR) = 1000 x 0.91649

Pip value (EUR) = 916.49

Pip Value for IC Markets Case

For deposit currency which is equal to quote currency, USD, pip value will be equal to:

Pip value = Pip x Lot size

Here are other data you need:

- Number of pips: 1

- Instrument: NAS100 = 13058.60

- Lot size: 1.00 (1 unit)

- Deposit currency: USD

- NAS100 pip size: 0.01

Now, when you put all the data in the formula you get:

Pip value = Pip x Lot size

Pip value = 0.01 x 1

Pip value = $0.01

No matter what is current market price, if your quote currency (NAS100/USD), in this case is USD is equal to account deposit currency and that is USD, the value of a NAS100 pip will be equal to $0.01.

And the condition is to use standard lot size, 1 unit of base currency or 1.00 Lot.

Here you can see an example from MT4 platform where I have open Sell order in MT4 with 1.0 standard lot.

Here are all details about the open order:

- Currency pair: NAS100

- Deposit currency: USD

- Lot size or Volume: 1.0

- Entry price: 13,057.10

- Current market price: 15,054.60

- Pip difference between entry and current price: 250 pips

So, I have open sell order where the current profit is 250 pips.

In the image you can see that the current loss is equal to $2.50.

Let’s calculate NAS100 pip value for this example.

Here are other data you need:

- Number of pips: 1

- Instrument: NAS100 = 13,057.10

- Lot size: 1.00 (1 unit)

- Deposit currency: USD

- NAS100 pip size: 0.01

Now, when you put all the data in the formula you get:

Pip value = Pip x Lot size

Pip value = 0.01 x 1

Pip value = $0.01

Pip profit or loss is equal to:

Pip profit/loss = $0.01 x 250 pips

Pip profit/loss = $2.50

Because my trade has profit 250 pips this would be $2.50 of profit.

This is the way how you calculate NAS100 pip profit in case of IC markets with 1 unit of standard lot where contract size is 1 unit.

How Do You Calculate NAS100 Pip Profits?

With the above calculated you can calculate NAS100/USD, pip profit.

Let’s say you have an open SELL order on the market with the NAS100 = 13,057.10.

And you want to close the trade at NAS100 = 13,050.10.

The price difference in pips is:

Pips = |Entry price – Exit price|

Pips = |13,057.10 – 13,050.10|

Pips = 7.00 = 700 pips

You can see the difference is 700 pips between open and close price.

Pay attention to this when you make manual calculation.

Now, the profit for 700 pips is:

Profit = Pip value x Pips

Profit = $0.01 x 700

Profit = $7.00

If you want to use EUR as a deposit currency then the pip value is 0.0091649 EUR:

Profit = Pip value x Pips

Profit = 0.0091649 x 700

Profit = 6.41 EUR

The post NAS100 Pip Calculator appeared first on Get Know Trading.