On-chain metrics sign upcoming BTC volatility

The open futures curiosity and the futures estimated leverage ratio metrics had reached their highest…

The open futures curiosity and the futures estimated leverage ratio metrics had reached their highest ranges for over a month, which signifies an upcoming Bitcoin (BTC) volatility, in accordance with Glassnode knowledge analyzed by CryptoSlate.

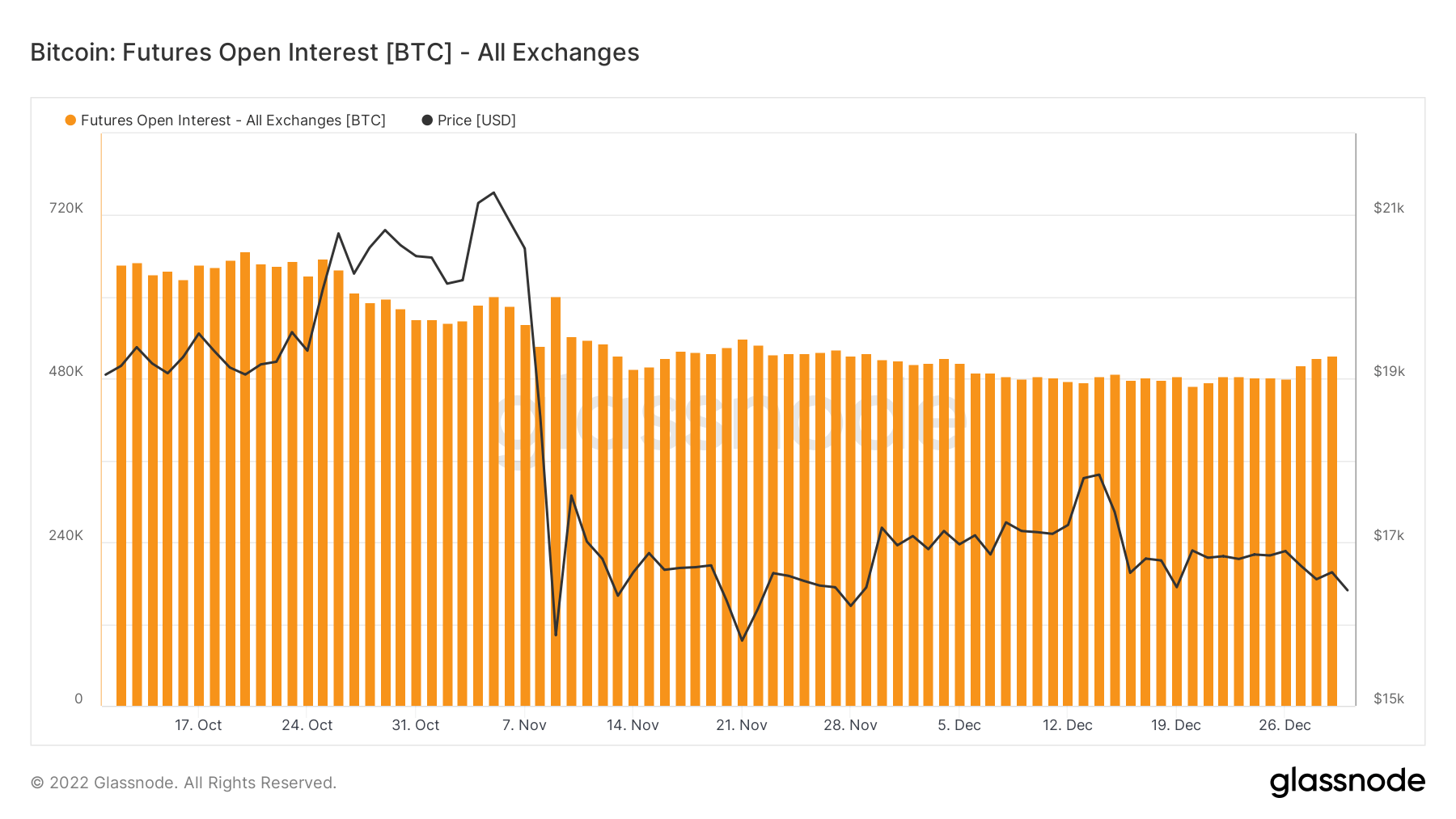

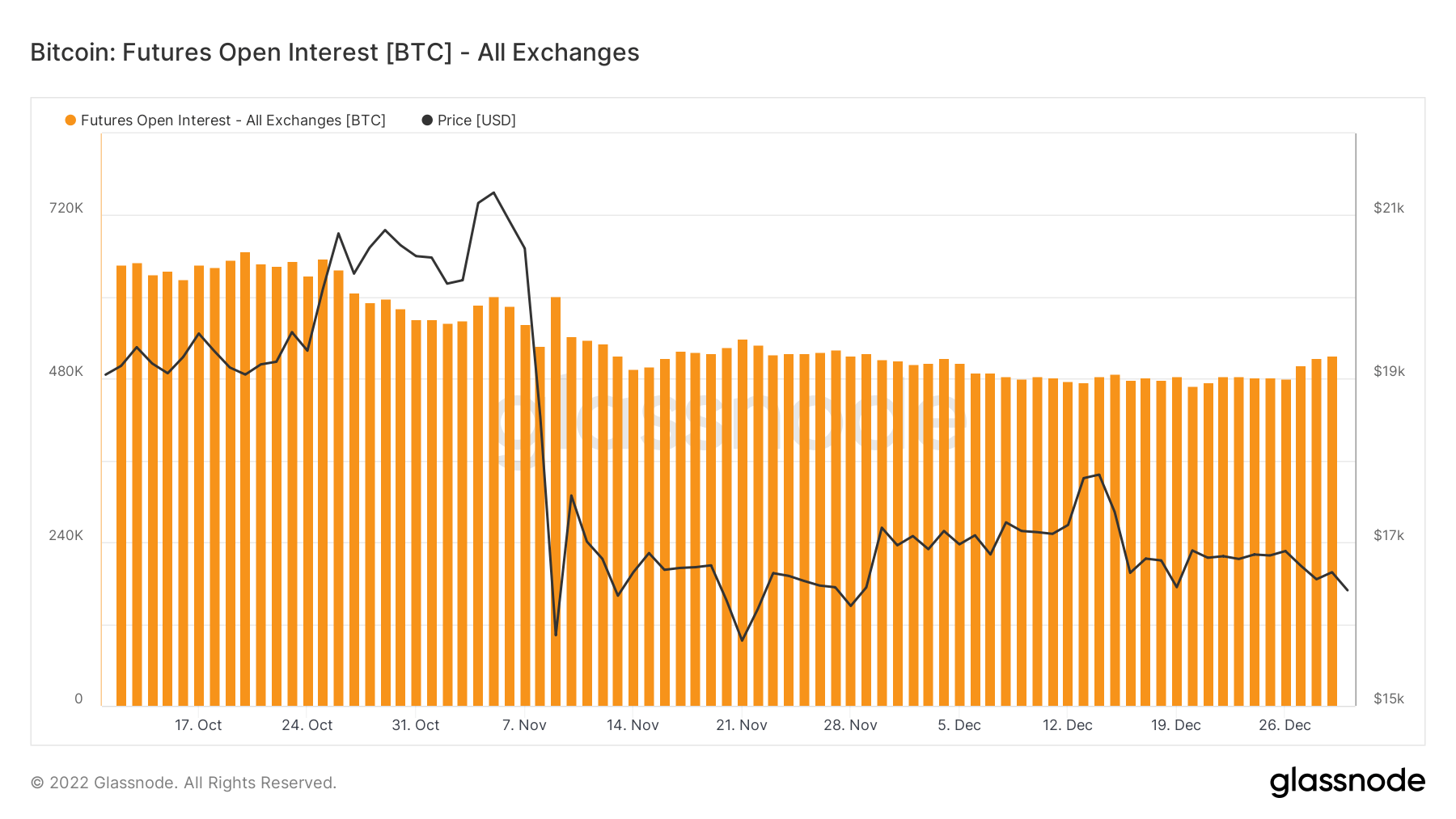

Futures open curiosity

The futures open curiosity metric displays the USD worth of the full quantity of funds allotted in open futures contracts.

The chart above exhibits the BTC futures open curiosity every day since Oct. 17. As of Dec. 30, the metric exceeded over 500,000 BTC, marking its highest stage for over a month.

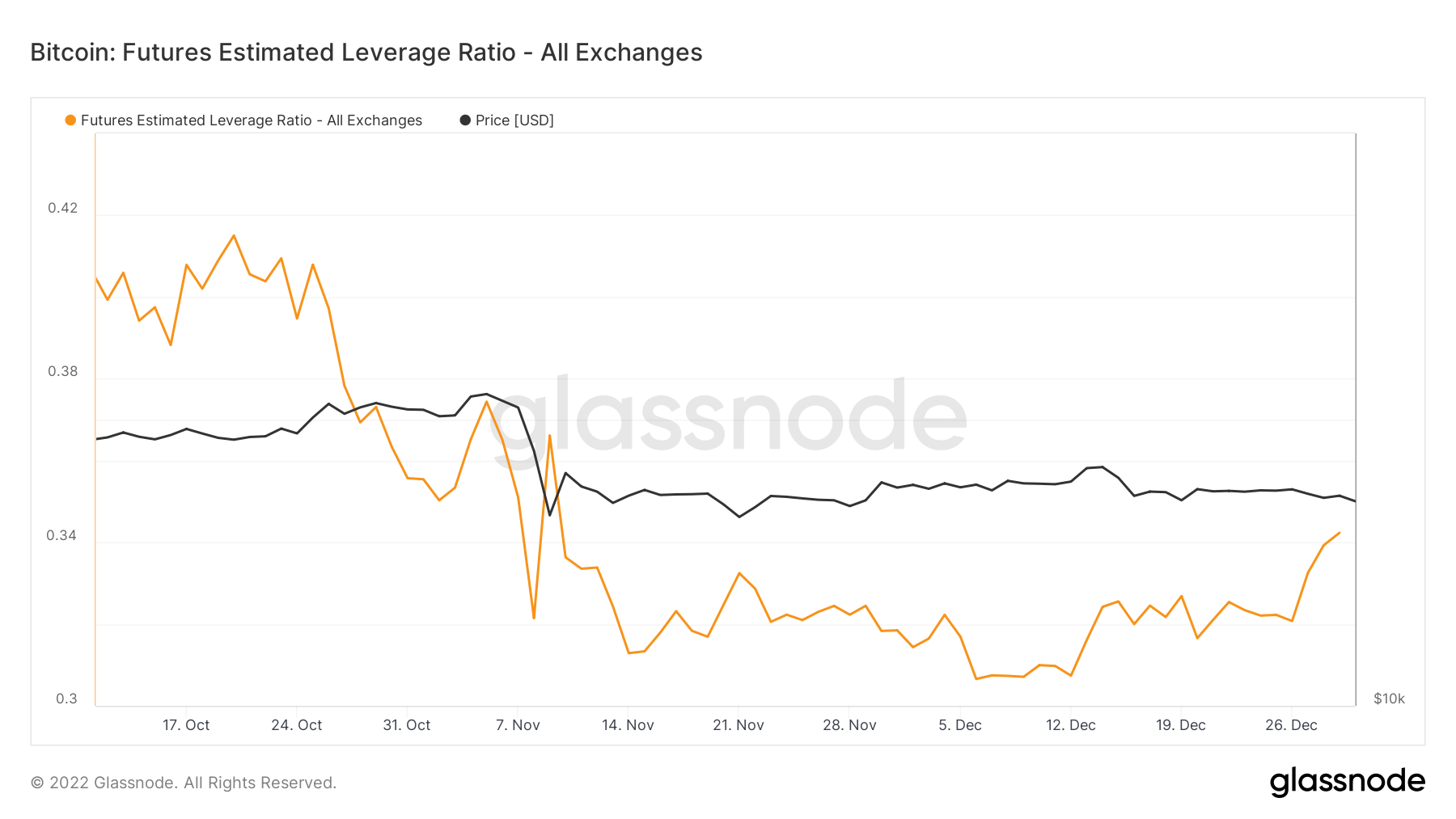

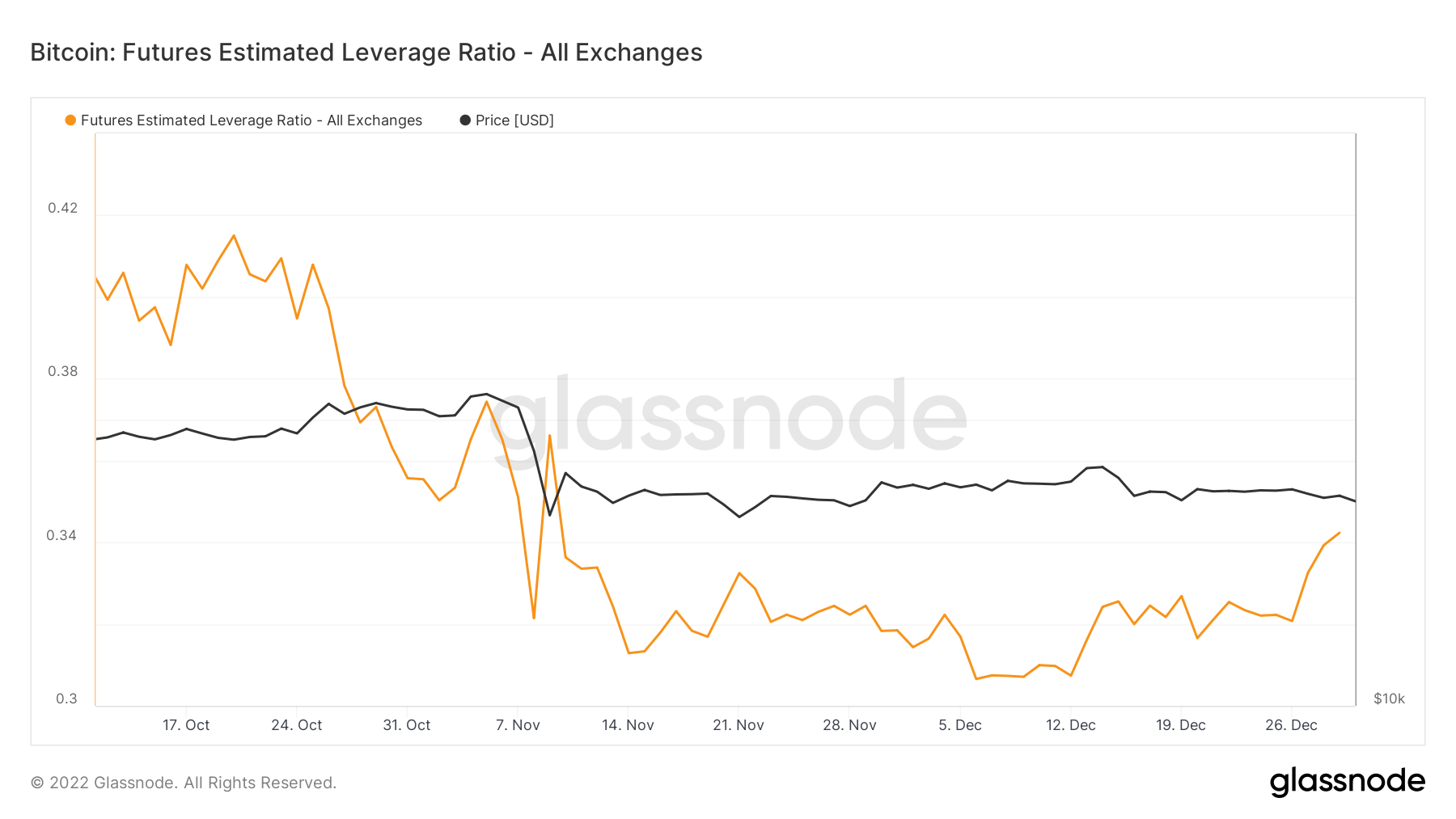

Futures estimated leverage ratio.

The Futures Estimated Leverage Ratio is a metric that represents the ratio between the open curiosity in futures contracts and the steadiness of the corresponding change.

The estimated leverage ratio fell as little as 0.3 on Dec. 5 after the FTX collapse. Nevertheless, it rapidly began to get well after Dec. 12. The ratio almost elevated by round 10% in 20 days to see 0.34 on Dec. 30.

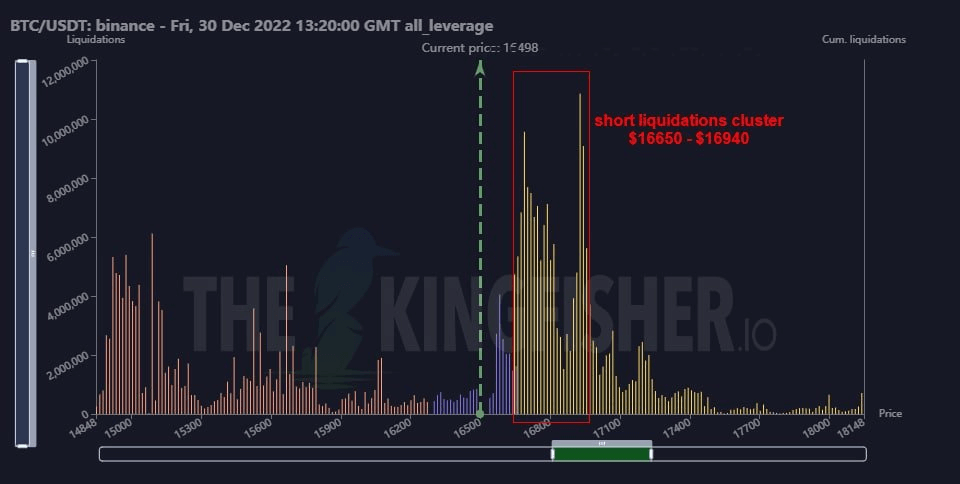

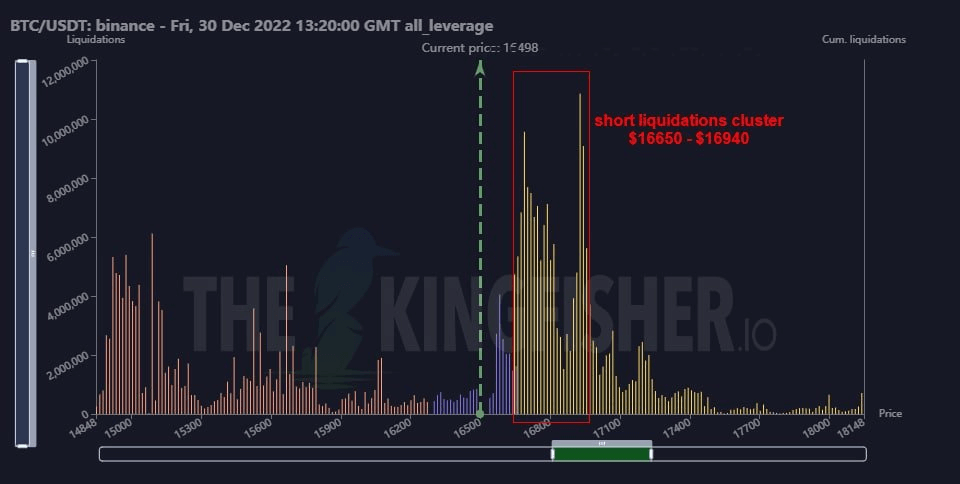

Binance liquidations

Along with metrics signaling potential volatility, knowledge from Binance signifies that Binance will contribute to the worth swings.

A brief liquidations cluster has fashioned in Binance between the costs of $16,650 and $16,940. The present BTC worth lingers round $16,547 on the time of writing, solely $100 away from coming into the cluster zone.