Pip Calculator

The post Pip Calculator appeared first on Get Know Trading.

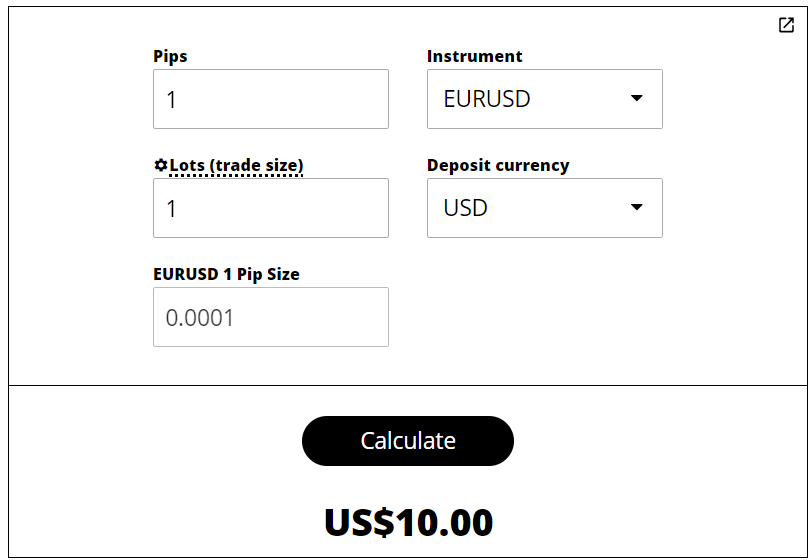

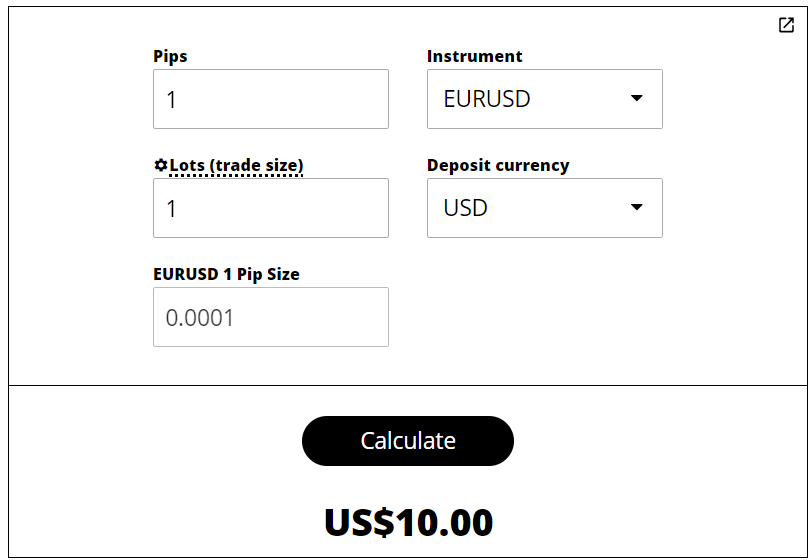

The pip calculator in Forex represents a Forex calculator that calculates the value of a pip in the currency you want by defining following values:

- number of pips

- lot size used

- currency pair

- deposit currency

Why do you need a pip calculator?

You can calculate the value for a number of pips. And that means for example if you have 100 pips as a stop loss or take profit set, then you can calculate how much that will be in terms of a currency you select.

How to use the pip calculator?

Inside the calculator you have several fields you need to fill with the data. And those are the number of pips, currency pair, deposit currency and lot size. At the end you click the button Calculate and you get the value of a pip.

In this article I will show you all details you need to know about what is pip calculator and what you can get with using it, why you should use it to speed up the process of calculating pip value and how to use it so you do not get confused when looking at pip calculator.

About the Pip Value Calculator

The pip calculator is a Forex calculator, a tool you can and should use to calculate the value of a pip in the currency you want. Currency you want is usually a deposit currency.

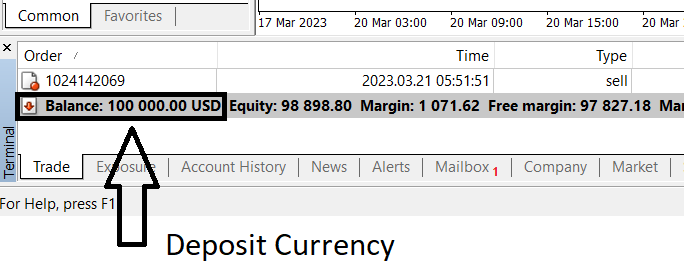

Deposit currency represents the currency you have your trading account in.

Inside MT4 trading platform you can see, in the bottom left corner under Terminal window, which deposit currency you have. In my example here I have USD as a deposit currency.

Read more: How to use Metatrader 4

When you enter all details in the pip calculator and click “Calculate” you get the value of pip. In the example above in the first image you can see that I have calculated 1 pip value on EURUSD currency pair. And the value of 1 pip is $10.

1 pip = $10

If you enter any other number of pips, or you change currency pair, or you change deposit currency, or you change the lot size, you will get another value of 1 pip.

How does the pip calculator calculate those values?

How Does the Forex Pip Calculator Work?

Before moving forward please pay attention!

You can switch between Units and Lots so have in mind not to make mistakes and use Units instead lots thinking that you are using Lots.

First image shows you a field which can be changed. Common is set to “Lots (trade size)“, but you can switch that to Units.

Switch from Lots to Units by clicking on the settings and then click on the blue “Switch to units” in blue written.

This will change from Lots to Units so you can enter the number of units. Have in mind that 1 lot is 100,000 units.

When you switch from Lots to Units you will see a field with the “Units (trade size)“. If you make a mistake and put 1 in the field where the units are, you will have an error in the calculation.

If you want to return back from Units to Lots simply repeat the process of changing. Click on the settings next to “Units (trade size)” and then click again on the “Switch to lots” written in blue.

The Forex pip calculator works in a way that takes the entry values, number of pips you want to get the value of, currency pair, deposit currency and the lot size.

Then he calculates the pip value. But the details about the calculation are as follows.

First, let me show you the connection between the Pip and the Lot Size.

The lot size in the Forex is defined like this:

| Lot size | Units of base currency |

Volume | Pip value in USD |

|---|---|---|---|

| 1 standard lot | 100,000 | 1.00 | 1 pip=$10 |

| 1 mini lot | 10,000 | 0.10 | 1 pip=$1.00 |

| 1 micro lot | 1,000 | 0.01 | 1 pip=$0.10 |

| 1 nano lot | 100 | 0.001 | 1 pip=$0.01 |

Read more: What is Lot Size in Forex

You can see that one standard lot, 100,000 units of base currency, or simply written lot = 1.00, is equal to $10 where deposit currency must be in USD $.

Have in mind that this is valid only if the quote currency is USD (EURUSD) and deposit currency is USD. If you change currency pair to EURNZD and deposit currency stays USD, the Lot = 1.00 will not be equal to $10. In that case you would need to make calculation to get the value of a pip.

Now, let’s use the EURUSD currency pair for example. The price of the EUR USD is $1.12345.

Have in mind that there are two different calculations. First one is for base currency. In EURUSD the base currency is Euro(EUR).

Second calculation is for the quoted currency. The quote currency in EURUSD currency pair is the U.S. dollar(USD).

In this example let’s first calculate the pip value for base currency.

How to Use the Forex Pip Calculator?

So, in that case we have these values:

Pips (number of pips) = 1

Instrument = EURUSD

Lots (lot size) = 1 (100,000 units of base currency)

Deposit Currency = USD $

Now, to calculate the value of a pip you need to use the formula:

Pip value = (Pip / Current market price) x Lot size

What are Pips in Forex?

Here is a short recap about the pip. The pip is the price change of a currency pair. So, if the price of EURUSD = 1.1234 changes to EURUSD = 1.1235 that will be change of:

EURUSD = 1.1235 – 1.1234 = 0.0001

EURUSD change = 0.0001 = 1 pip

Read more: What are Pips in Forex

How Do You Convert Price to Pips?

Pip is written as 0.0001. And this is in case you have a 4 digit broker. That means the broker shows you the price of EURUSD = 1.1234.

If the broker shows you EURUSD = 1.12345 that means you have 5 digit broker and then the pip will be written as:

1 pip = 0.00010

You can see that there is a small difference between 4 digit and 5 digit brokers.

4 digit broker -> 1 Pip = 0.0001

5 digit broker -> 1 Pip = 0.00010

What is Pip Value?

Now, with all these informations the Pip value will be equal to:

Pip value = (Pip / Current market price) x Lot size

Pip value = (0.0001 / 1.1234) x 1

Pip value = (0.0000890154) x 100,000

Pip value = 8.90154 Euro

How Do You Calculate Profit Per Pip?

So, how to calculate the pip value in the deposit currency?

You should use simplest formula and that one is:

Pip value = Pip x lot size

So, if you have used one standard lot, which is 100,000 units, that would make one pip equal to:

Pip value = 0.0001 x 100,000 = 10

In my case I have USD as a deposit currency so this would give me one pip equal to $10.

Pip Calculator Profit

When you calculate the pip value you can easily calculate profit with pips.

Pip profit would be equal to:

Pip profit = Number of pips x Pip value

Let’s define first what we need for pip calculation.

Currency pair = EURUSD

Deposit currency = USD

Lot size: 1 standard lot (1.00 or 100,000 units)

If you have open a BUY order with one standard lot, 1.00, at the price EURUSD = 1.1234 and you have closed that trade at the price EURUSD = 1.1238 then the pip profit would be:

Number of pips won = 1.1238 – 1.1234 = 0.0004 = 4 pips

The pip value for USD as a deposit currency and for one lot size used we would get:

Pip value = Pip x Lot size

Pip value = 0.0001 x 100,000

Pip value = $10

Now, we can calculate the pip profit:

Pip profit = Number of pips x Pip value

Pip profit = 4 x Pip value

Pip profit = 4 x $10

Pip profit = $40

Pip Calculator With Leverage

When you use leverage in trading the value of a pip will not change. And that is because you have formula for pip value equal to:

Pip value = (Pip / Current market price) x Lot size

So, the leverage is not in the calculation and it will not affect the pip value.

Read more: What is Leverage in Forex

But, leverage has an impact on the margin you will need to open a position and that means to open a trade.

Margin — This is how much capital (margin) is needed in order to open and maintain your position

Read more: What is Margin in Forex

If you have leverage 1:100 the margin will be equal to:

Margin = Position size / leverage

Margin = 1 lot / 100

Margin = 100,000 / 100

Margin = $100

This means if you have leverage 1:100 then you would need to have $100 on your trading account set aside to open a trade. This amount a broker set aside and it is not available for trading. So, have in mind to have more money on the trading account if you want to open a trade with one standard lot.

As you can see the pip value will not change based on the leverage, but the lot size will be needed to adjust to open a position.

If you do not have too much money you should open a lower lot size, like a mini lot size which is 10,000 units. That would affect the pip value because the pip value would be 10 times lower with lot size equal to 10,000 units.

Disclaimer

Calculation`s made in the trading calculator are for informational purposes only. Whilst every effort is made to ensure the accuracy of this information, you should not rely upon it as being complete or up to date. Furthermore this information may be subject to change at any time.

The post Pip Calculator appeared first on Get Know Trading.