SEC vs. Ripple: Investor Takeaway

The glass is half-empty, and it’s half-full. The post SEC vs. Ripple: Investor Takeaway appeared first on Bitcoin Market Journal.

Investor Takeaway: The recent ruling in the SEC’s lawsuit against Ripple is a mixed blessing (read more here). Even though XRP is soaring, don’t invest unless you feel it’s a great long-term investment (5+ years), because Ripple’s not out of the woods yet.

It’s been interesting to read the response to yesterday’s ruling in the SEC’s lawsuit against Ripple. If you follow the crypto news sites, you would think this was the second coming of Satoshi.

The truth: for crypto investors, it’s a mixed bag.

The question hinges around whether Ripple’s XRP token is a security (e.g., a company stock).

If it is a stock, Ripple should have registered it with the SEC (along with every other crypto company out there). If it’s not a stock, then that would broadly benefit the entire crypto industry, because we’d all be free to create new tokens.

The judge ruled that XRP is not a stock when sold on exchanges, but is a stock when sold to big investors at launch.

If we were all hoping for regulatory clarity, this isn’t it.

My hot take is that we’re pretty much where we started. So why are investors going bananas, driving up the price of XRP?

Probably because investors just realized that just because their favorite crypto companies are getting sued by the SEC, it doesn’t necessarily mean the SEC is going to win.

Should You Invest in Ripple Now?

Three years ago I explained the SEC case against Ripple, so click that link if you need a refresher. I also explained our reasoning for dropping XRP from our Blockchain Believers Portfolio.

We believe in Ripple. It promised to be the first global remittance platform that would use blockchain technology to make cross-border payments instant and free (or nearly so). Our first analyst report, in fact, was on Ripple’s token, XRP.

But when the SEC launched its lawsuit against Ripple in 2020, we could no longer say in good conscience, “Hey, new investors, we’re investing in XRP.”

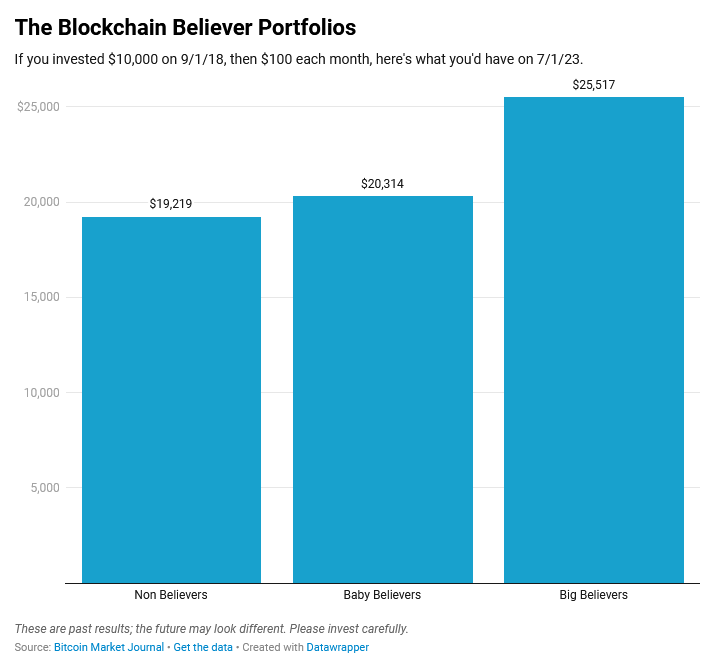

Turns out, our Blockchain Believers Portfolio performed even better without XRP:

The question everyone’s asking is, “With XRP rocketing to the moon, should I buy?”

Here’s our take.

There are Still Ripples to Come

The recent ruling will have ripple effects for some time.

First, the SEC can appeal the ruling, which can still be overturned. (Of course, Ripple could appeal parts of the ruling they don’t like, as well.) So this will likely drag on for the foreseeable future.

Second, the judge ruled that Ripple is guilty of selling an unregistered security to institutional investors. This point is getting lost in the euphoria.

Third, the key question in crypto investing is not whether the price is going up. That’s the worst way to invest.

Instead, we use judgment and analysis to see whether Ripple is a good company, well-run by competent managers, with a large and growing customer base.

(Premium members can download our XRP Investor Scorecard here to get our rating on Ripple’s growth prospects.)

I get it: after months of bad news from the SEC, this small and partial victory feels like a reprieve, so everyone is going nuts. But it’s just another loop-de-loop on the crypto roller coaster.

Avoid investing on FOMO, which is going around like a mofo. Instead, invest in quality crypto projects, as a small part of a balanced portfolio. Most of all, think long-term: 5 or more years.

We’ve still got a long way to go. But for today, I admit it does feel good to get even a small win … even if it’s just a drop in the pond.

The post SEC vs. Ripple: Investor Takeaway appeared first on Bitcoin Market Journal.