Sector Report: Decentralized Exchanges in 2023

The DEX ecosystem has been dormant during the crypto winter, but the collapse of FTX has sparked an interest in DEXs, which may support a quick recovery of the sector. The post Sector Report: Decentralized Exchanges in 2023 appeared first on Bitcoin Market Journal.

Centralized crypto exchanges like Coinbase and Binance have contributed to the rapid adoption of digital currencies, but decentralized exchanges (DEXs) have introduced a new approach to trading: users buy, sell, and trade digital assets from each other.

This article will explore the emerging DEX industry, to see whether this new model can continue its growth in the coming years.

Industry Overview

After lending, DEXs are the second major use case to emerge in decentralized finance (DeFi). They’re a proven model that’s here to stay, enabling users to trade cryptocurrencies with each other in a decentralized environment.

One of the most important features of a DEX is the Automated Market Maker (AMM) model, which replaces centralized order books and market makers. An AMM relies on smart contract-powered pools for each trading pair, where liquidity providers lock their tokens in exchange for rewards from trading fees.

The price of a pair is dictated by an algorithm based on the supply/demand dynamics of the related pool. This model is far more efficient that the traditional order book and market maker approach. (Read more on the old model here.)

Unlike centralized exchanges (CEXs) such as Coinbase, DEXs are non-custodial, i.e., they don’t hold user funds. This enables them to provide trading services without KYC (know your customer) verification. This makes them easier for new users: just connect your crypto wallet, and start trading.

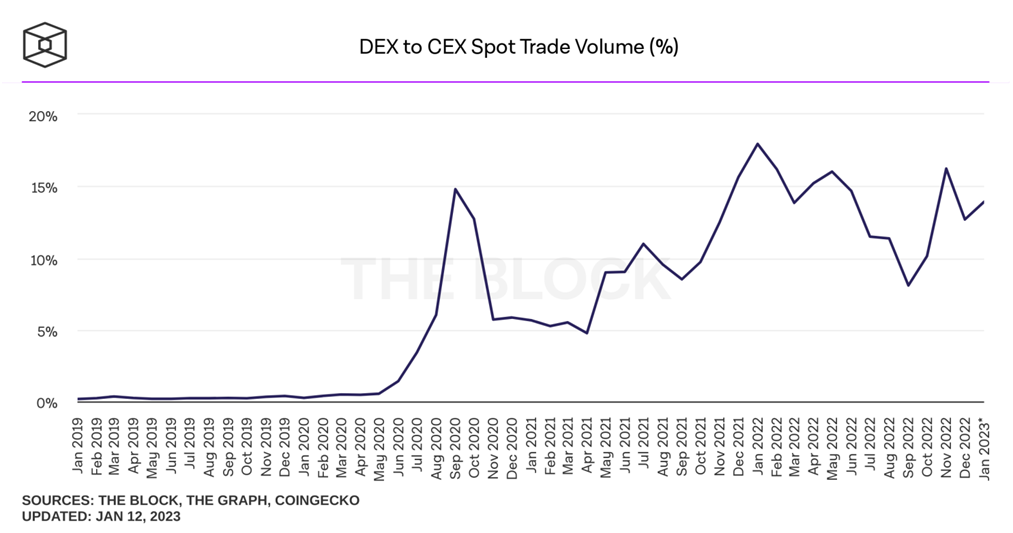

While trading volumes on DEXs remain considerably smaller compared to CEXs, they have gained traction during the DeFi boom that started in 2020. As of this writing, DEX trading accounts for about 15% of all trading volume.

However, all DEXs have seen declining volumes since the beginning of 2022 amid the “crypto winter.” SushiSwap has been among the worst performers, with its native token, SUSHI, losing about 87% (light blue line on the bottom):

Nevertheless, the 2-year performance tells a different story. The DEX industry has had several ups and downs since the beginning of 2021, but some DEXs, such as Curve (red) and Uniswap (light purple), saw their tokens gain over 60% during this period:

DEXs are still an emerging market, as they only began gaining wider adoption in 2020. The DEX sector has great potential to expand in the future thanks to its promise of non-custodial trading at low costs.

Investment Thesis

There are two ways for an investor to gain exposure to DEXs:

- Buying the token: DEXs are fueled by their native tokens. Although the tokens may have other use cases, such as governance, staking, and rewards, the token performance is generally impacted by the exchange trading volume. We view it like buying “stock” in the DEXs with high trading volumes and great potential for future growth.

- Liquidity mining: Another approach for investors is participating in its ecosystem by providing liquidity to one or more pools. In a classic model, a pool requires a 50/50 balance for each pair, and users have to lock both tokens of a pair (say, ETH and UNI). Liquidity miners are rewarded with a percentage of DEX trading fees.

DEX tokens have been negatively impacted over the past year, but user activity has been increasing, suggesting healthy fundamentals that should support a rebound in the coming months.

The collapse of FTX exchange has also worked in favor of DEXs. Shortly after FTX went bankrupt, one family moved over $1 million worth of crypto to DEXs, choosing not to trust centralized exchanges with their assets.

Even though DEXs have no risk of hacking attacks as they don’t hold user funds, loopholes in the smart contracts may persist. The most notable attack points are bridges that are used to connect different blockchains.

Who’s Investing: Institutional Backing

The DeFi boom has attracted institutional investors, who have poured hundreds of millions of dollars into DEXs. Many DEXs implement the Decentralized Autonomous Organization (DAO) governance model, but some are still backed by centralized entities that maintain the protocol.

For example, Uniswap is backed by Uniswap Labs, which raised $165 million in a Series B funding round held in October 2022. The round was led by Polychain Capital and was joined by other institutional and venture capital investors, including a16z crypto, Paradigm, SV Angel, and Variant. Uniswap Labs is currently valued at $1.66 billion.

In August of the same year, 0x raised $70 million in a Series B round led by private equity firm Greylock Partners. Other participants were Pantera, Sound Ventures, OpenSea, Coinbase, and A.Capital, among others.

At the end of 2021, 1inch secured $175 million in a Series B round from Amber Group, which was joined by about 50 investors, including VanEck, Fenbushi Capital, and Jane Street.

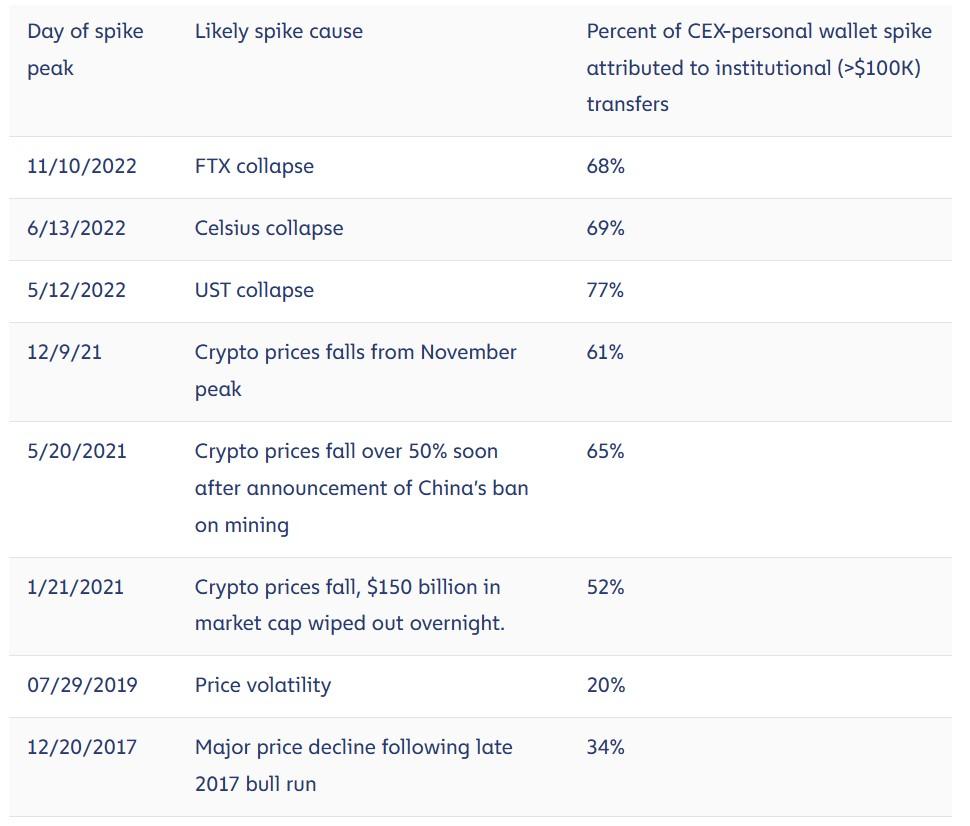

A recent report from blockchain intelligence firm Chainalysis shows that institutional investors also increased transfers from CEXs to DEXs during times of market volatility, like after the fall of FTX.

Top DEX Projects

As of this writing, here are the Big 5 DEXs to watch:

| Project | Ticker | Market Cap | Daily Active Users |

| Uniswap | UNI | $4.9B | 46,100 |

| Synthetix Network | SNX | $566M | 2000 |

| 1Inch | 1INCH | $404M | N/A |

| SushiSwap | SUSHI | $276M | 3700 |

| 0x | ZRX | $180M | N/A |

Uniswap (UNI)

Uniswap is a DEX founded in 2018. It focuses on Ethereum-based tokens and enables users to swap ERC-20 tokens almost instantly. It is currently the largest DEX by trading volume. Uniswap is also one of the oldest DEXs, and it thrived well before the boom of DeFi in mid-2020.

The annualized trading volume on the exchange is nearly $400 billion. Also, during the last 12 months, traders paid over $430 million in fees. Uniswap attracts over 45,000 daily active users on average.

Uniswap is backed by its proprietary token UNI. The total market cap is nearly $5 billion as of this writing, which makes it the 18th largest cryptocurrency.

The total value locked (TVL) in Uniswap’s pools is about $4 billion. Uniswap is the sixth-largest DeFi protocol by TVL and the second-largest DEX by TVL after Curve.

Uniswap’s status as a market leader will likely support its further growth. When the crypto market is recovering, UNI will likely be among the first tokens to benefit.

Uniswap raised over $160 million at the end of 2022, suggesting that large institutional investors have high expectations of this DEX and the DeFi market in general. (Read more in our Uniswap Revenue Report.)

Synthetix Network (SNX)

Synthetix Network (SNX)

Synthetix Network is not a classic DEX, although it also enables users to swap different tokens. The Ethereum-based protocol acts as a decentralized synthetic asset platform that enables traders to get on-chain exposure to real-world assets, such as fiat currencies, commodities, stocks, and indices.

For those unfamiliar, synths are tokens that track the value of real-world assets and act as derivatives. On Synthetix, anyone can create synths by locking the native token, SNX, as collateral. For example, sUSD tracks the US dollar, while sBTC mimics the price of bitcoin. Synths rely on decentralized price oracles to track the performance of underlying assets. Therefore, Synthetix users can trade various synths in a trustless environment.

The annualized trading volume of Synthetix is over $4.4 billion, and the annual revenue from fees exceeds $13 million. As of today, over $400 million worth of cryptocurrency is locked on Synthetix, which helps it maintain in the top 30 DeFi protocols by TVL. The protocol hosts over 2,000 daily active users.

Synthetix used to be one of the largest DeFi projects by TVL and trading volume. Despite the dramatic decline from its 2021 peak, the project still has much to offer thanks to its unique business model.

SushiSwap (SUSHI)

SushiSwap (SUSHI)

SushiSwap is an Ethereum-based DEX launched in 2020. The DEX was created by copying the open-source code of Uniswap. Thus, it works the same way as Uniswap. The promise of Sushi was to give users more decision-making power. Thus, the native token, SUSHI, acts as a governance token.

While Sushi made waves shortly after the launch, it has lost ground and is much smaller than Uniswap. Sushi’s annualized trading volume is $6.5 billion. The annualized trading fees reach $20 million. Sushi hosts less than 4,000 daily active users on average.

SUSHI has been the worst performer across DEXs during the crypto winter, and it remains to be seen if it manages to recover.

1Inch (1INCH)

1Inch (1INCH)

1Inch is a bit different from other DEXs because it is an aggregator. Rather than acting as an exchange itself, it scrapes other DEXs looking for the lowest or highest prices. It then reroutes its customers’ trades between these various exchanges to ensure that traders get the best possible price when buying and selling crypto.

Trading volumes at 1Inch routinely exceed $1 billion monthly, giving it an annualized trading volume in excess of $14 billion. All that trading volume only adds up to $3.36 million in annual fees however, as 1Inch charges very little for the service it provides.

The 1Inch token suffered along with its peers during the crypto winter, hitting a low of $0.3738 in December 2022, however it seems to be on the mend as of this writing.

0x (ZRX)

0x (ZRX)

0x is another DEX aggregator that works with ERC-20 tokens. Its engine searches prices across multiple exchanges, finding the lowest price for buyers and the highest price for sellers. Where it differs is that it allows anyone to create their own exchange. 0x also keeps fees low for traders by conducting trades offline, thus avoiding Ethereum’s network fees.

0x is quite popular, with an annualized trading volume of $30.36 billion and over 14,000 average daily users as of this writing. It is also popular with institutional investors, having raised $70 million in April 2022 from the likes of Coinbase, Greylock Partners, Pantera Capital, and OpenSea.

It has its own native crypto token, ZRX, which is used for trading fees and is also a governance token for the network. The token had its problems in 2022 however, falling from $0.80 at the start of the year to close at just $0.15, for a loss of nearly 80%. Things are looking better as of this writing, with the token advancing by 60% at the start of 2023.

Investor Takeaway

The DEX ecosystem has been struggling since the beginning of 2022, but the need for secure, decentralized trading infrastructure is likely to recover and grow.

The collapse of FTX, preceded by the fall of other centralized crypto projects, is helping support the case of DEXs. Decentralized exchanges have a unique business model that we believe will stay relevant in the years to come.

Some DEXs that were popular in the early days of the DeFi boom, such as Sushi, may not recover. Still, there are exchanges with billions of TVL that may continue to dominate, such as Uniswap, Balancer, Curve, and PancakeSwap.

Be sure to check out our Future Winners portfolio, which has UNI as one of our four crypto picks.

The post Sector Report: Decentralized Exchanges in 2023 appeared first on Bitcoin Market Journal.