Sector Report: Stablecoins

What is the current status of the stablecoin market in 2023? We explore with an eye on future regulations and investor sentiment. The post Sector Report: Stablecoins appeared first on Bitcoin Market Journal.

Executive Summary: The report starts with an in-depth look at the present state of the stablecoin market in 2023. We focus special attention on the proposed stablecoin regulations in the US and the EU, and their potential impact on the industry and investors. We also share our investing thesis for stablecoins, and an overview of the top 5 tokens.

Industry Overview

Stablecoins are the lifeblood of the modern cryptocurrency marketplace. Thanks to extreme volatility, traditional cryptos like bitcoin and Ethereum act more like tech stocks than stable stores of value.

As investor interest in cryptocurrencies has grown, so has the demand for digital assets with stable value. Stablecoins were created to fill this demand. They act as stores of value and reliable mediums of exchange for trading various tokens on the blockchain.

Rise and Fall Since 2017

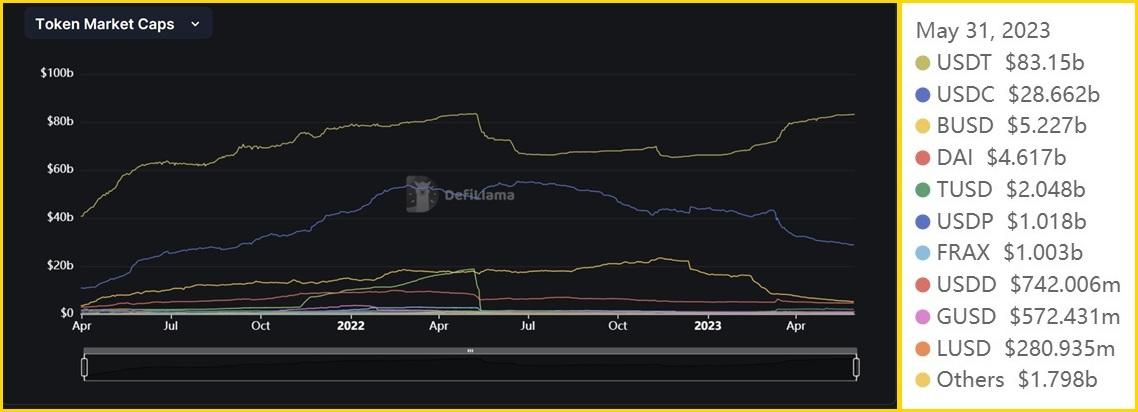

The first major stablecoins started gaining traction in 2017-18. From near-zero in 2017, the market capitalization of the top 10 stablecoins reached a staggering $186 billion in May 2022. This charge was led primarily by tokens like Tether, Binance USD, and USDC.

As an integral part of the broader cryptocurrency ecosystem, stablecoins have been significantly affected by the 2022-2023 bear market. The total market cap of the top 10 cryptos has fallen by nearly $50 billion in one year.

Almost $40 billion of the market crash can be attributed to just one project: the algorithmic stablecoin TerraUSD (UST) coupled with its twin LUNA. The collapse of Terra/LUNA shook the entire cryptocurrency market and wiped out a reported $60 billion in investor wealth.

Major Upheavals

Tether, the most popular stablecoin by market cap, was de-pegged twice in 2022, during the crash of Terra and later during the closure of FTX. Similarly, USD Coin was briefly de-pegged in March 2023 due to its exposure to the now-defunct Silicon Valley Bank.

The fallout from the FTX crash claimed another major victim from the stablecoin space in 2023. Binance ceased minting Binance USD (BUSD) after spooked investors withdrew their funds en masse from the Binance exchange.

The Major Players in 2023

As the crypto market recovers, we can see several big winners and losers in the stablecoin space. Arguably the biggest name in the business right now is Tether.

The token never relinquished its early bird advantage over all these years. And USDT also enjoys a more permissive regulatory climate in Hong Kong. Meanwhile, most of its US-based rivals face harsh scrutiny from multiple regulators.

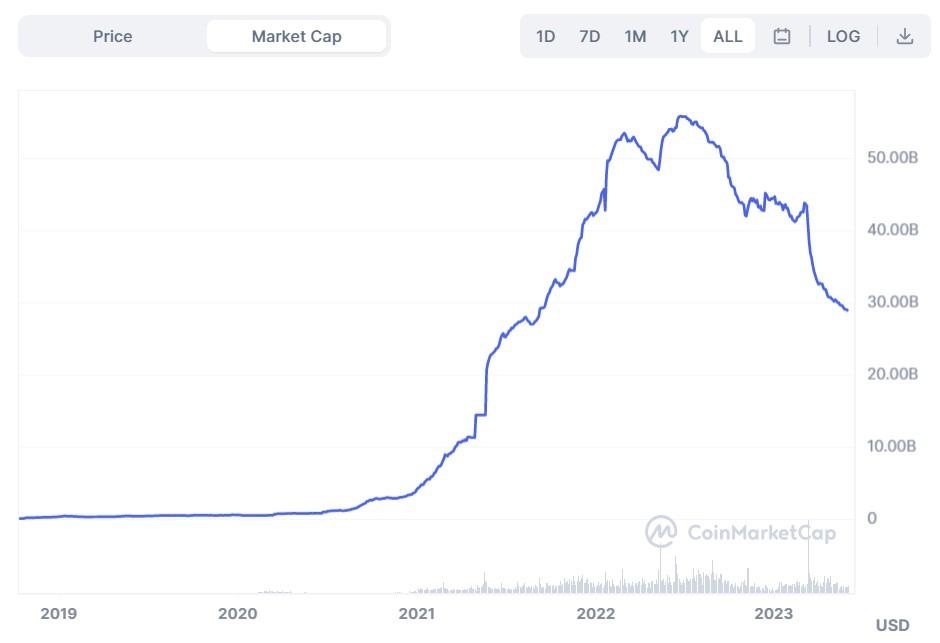

After threatening to overtake Tether at one point in 2022, USD Coin was forced to cede market share to Tether after the Silicon Valley Bank closure. But all that could change with the ongoing progress of stablecoin market regulations.

Stablecoin Regulations

Two major crypto regulations are on each side of the Atlantic in 2023. In the US, the House Financial Services Committee has published a draft bill on stablecoin regulations.

The highlight of the bill is the requirement for all issuers to hold reserves that back their digital assets on a minimum 1:1 ratio. The new bill also contains proposals for moratoriums on stablecoins backed by other digital assets. This could spell bad news for algorithmic tokens like DAI.

In the European Union, the Markets in Cryptoassets (MiCA) Regulation aims to bring transparency and accountability to crypto service providers. Stablecoins will be covered under rules related to Electronic Money Tokens or EMTs.

All stablecoin issuers will have to apply for an EMT license and a MiCA license to operate in the EU. In addition, there will be a usage cap of €1 million on any stablecoin that is not pegged to a European currency.

These regulations are a direct result of incidents like the collapse of Terra/LUNA and FTX. Lawmakers are keen to avoid such incidents and protect consumers from massive losses.

Investment Thesis

Since stablecoins are designed to hold their value, you can’t make money by buying, holding, and hoping that the price will go up.

Instead, investors can use stablecoins for staking and DeFi lending to earn interest (a.k.a. “yield” or “staking rewards”). At a current APY of 3% to 6% or more, staking rewards are comparable to US treasury bonds and better than municipal bonds. (See our up-to-date list of current interest rates here.)

The combination of extreme stability (relative to traditional cryptos), excellent liquidity, and good staking returns make stablecoins an attractive investment for those willing to hold them patiently over the long term (5 or more years).

Who’s Investing: Institutional Backing

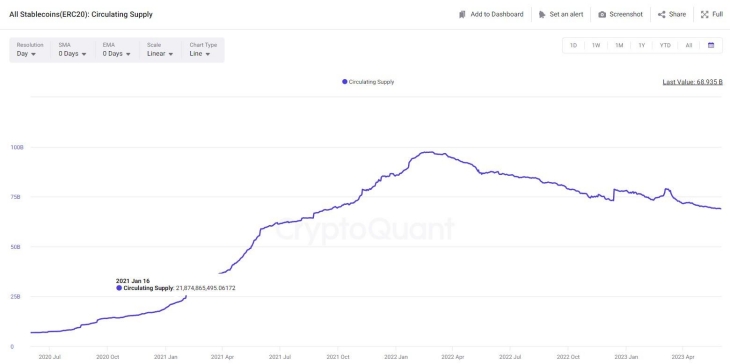

The chart below tracks stablecoin circulating supply, which we are using as a proxy for inflows into the ecosystem. Before the collapse of Terra/LUNA and the broader market chaos in 2022, investors were putting billions of dollars into major stablecoins.

Since February 2022, these large inflows have declined. The question is whether this decreased interest is across the board, or confined to a certain subset of investors.

Tether accounts for more than 64% of the stablecoin market. A deeper look at the holding patterns of USDT owners should reveal some insights regarding the nature of investments in stablecoins.

For reference, the charts below divide token holders into three main categories:

- Retail: Addresses that own less than 0.1% of the token’s total supply

- Investors: addresses that own between 0.1% and 1.0% of the total supply

- Whales: addresses that hold more than 1% of the total supply (in many cases, these whale accounts are also institutions).

Investors in USDT

The charts below show some interesting metrics:

- Over $18 billion worth of USDT tokens were held by large or institutional investors in July 2022, accounting for 24% to 40% of the total supply.

- Roughly 25,000 addresses are holding more than $100k worth of USDT.

- Nearly 50% of the addresses hold the tokens for a minimum of 12 months.

These numbers indicate that the vast majority of active addresses with USDT belong to retail investors and traders who hold less than $1000. In general, the holdings of retail traders and investors remains relatively stable.

But the stablecoin space is also seeing interest from institutions and whales, with billions of dollars held across 25,000 addresses. That said, the 2023 figures for large institutional holdings indicate a significant decline to the tune of $4 billion.

The implications of the data are quite clear. While retail investor interest in stablecoins remains high, there has been a decline in fund inflows from larger institutional investors and whales since 2022.

| Project | Ticker | Market Cap | Number of Chains Supported |

| Tether | USDT | $83.03b | 63 |

| US Dollar Coin | USDC | $28.88b | 63 |

| Binance USD | BUSD | $5.29b | 34 |

| Dai | DAI | $4.26b | 41 |

| True USD | TUSD | $2.05b | 10 |

Top 5 Stablecoins in Circulation

Tether (USDT)

Tether (USDT)

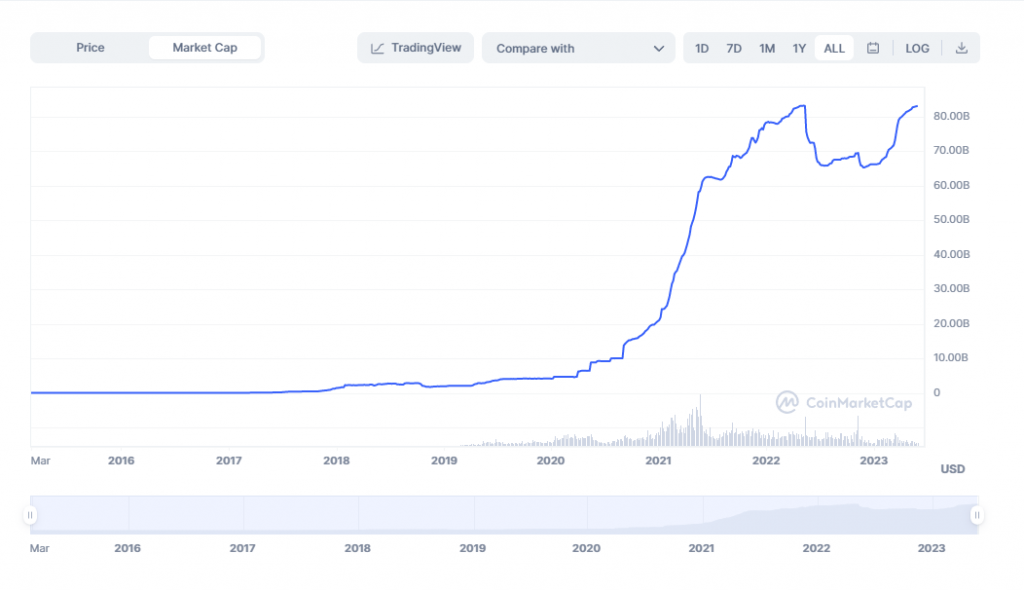

Tether is a stablecoin project owned by the Hong Kong-based iFinex. Launched in 2014, Tether is one of the oldest stablecoin projects in the market. And it is also the most popular stablecoin, with more than 4.4 million active addresses and a market capitalization of $83 billion. In April 2023, Tether’s market share stood at 63%.

Tether is no stranger to controversies. It has been the focus of several investigations and lawsuits by US regulators. Tether was fined $41 million by the Commodity Futures Trading Commission in the US in 2021 for lying about its currency reserves.

Industry experts acknowledge that Tether tokens are not backed 100% by US dollar cash reserves. Instead, it is backed by what the company calls “Tether’s reserves” – a combination of cash, short-term deposits, corporate bonds, secured loans, corporate bonds, and more.

Despite all the controversies, Tether remains the overwhelming favorite for cryptocurrency investors and traders seeking stable digital dollars with high liquidity on the blockchain. It has strong growth potential and staying power due to its market dominance.

However, the road ahead may not be easy for this stablecoin. Lawmakers in the US have singled Tether out as an example of the risks posed by the lack of regulations in the stablecoin market. Stringent stablecoin regulations could have grave implications for USDT as they could very well rule out reserves other than cash or short-dated Treasuries. This already appears to be the case in the European Union, where the MiCA crypto framework outlines strict reserve requirements.

US Dollar Coin (USDC)

US Dollar Coin (USDC)

USD Coin is a stablecoin issued by Circle, a prominent blockchain-based payments company, through a collaboration with the Centre Consortium.

Since its launch in September 2018, USDC has emerged as a major player in the stablecoin market. It boasts a market cap of $29 billion and daily transaction volumes of $2.1 billion. USDC is the second most popular stablecoin after Tether, with around 1.6 million active addresses as of this writing.

Unlike Tether, the USD Coin is a US-based project. Due to the stricter restrictions regarding investor safety in the US, the USD Coin is 100% backed with cash reserves and short-term US treasury bonds as collateral.

But in 2023, the USDC faced some instability due to its close links to Silicon Valley Bank (SVB). When SVB collapsed in March 2023, Circle’s exposure to the bank led to investor panic and a brief de-pegging of USDC value from $1 to $0.88.

While it has lost market share to Tether since March 2023, USDC’s prospects look better than its rival. It is based in the US and has a more transparent approach to managing its reserves. Overall, USDC is better positioned to benefit from a regulated stablecoin market.

Binance USD (BUSD)

Binance USD (BUSD)

Binance USD is a stablecoin issued by Paxos, a New York-based blockchain infrastructure company. It was launched in 2019 under a partnership/licensing agreement with Binance, the largest crypto exchange in the world.

Like Circle’s USD Coin, BUSD is also a US-based stablecoin with its currency reserves held in US banks and financial institutions. Binance claims that BUSD is 100% backed by a combination of fiat cash and US treasury bills.

BUSD enjoyed a market cap of $23 billion at its peak in November 2022. But the collapse of the FTX exchange triggered a crisis of confidence among its rivals, including Binance. Investor pullout has decreased the BUSD market cap to just $5.3 billion in 2023.

The crisis even forced New York regulators to order Paxos to stop minting new BUSD tokens in February. This triggered a further exodus of investors from the stablecoin. Both USD Coin and Tether benefited from the fall of BUSD and experienced a surge in users.

With Paxos announcing an end to their relationship with Binance, prospects look bleak for BUSD. Although Binance and Paxos promised ongoing support, the prevailing expectation is that most users will switch to other stablecoins over time.

Dai (DAI)

Dai (DAI)

DAI is a popular algorithmic stablecoin on the Ethereum blockchain, issued by the Maker protocol. The decentralized autonomous organization (MakerDAO) behind DAI was founded by Rune Christensen in 2015. DAI was first issued in 2017 as a single-collateral token (SAI).

A modern version of DAI with support for multiple cryptocurrencies as collateral was launched in 2019. Although it was one of the pioneers of decentralized stablecoins, MakerDAO was eclipsed by the meteoric rise of Terra/LUNA.

The de-pegging and collapse of Terra/LUNA had a mixed impact on the fortunes of DAI in 2022. After an initial collapse in market cap, DAI stabilized and even found new takers among people who wanted a more reliable decentralized stablecoin.

But in the long run, DAI has fallen from a peak market cap of $10.23 billion in February 2022 to $4.8 billion in April 2023. The prospects don’t look too rosy, since algorithmic stablecoins may get hit by moratoriums under proposed US and EU regulations.

That is not to say that the market has caved in for DAI. Wallet holdings have remained remarkably steady for this token. From 436K active addresses in June 2022, it has inched to 464.3K addresses in May 2023.

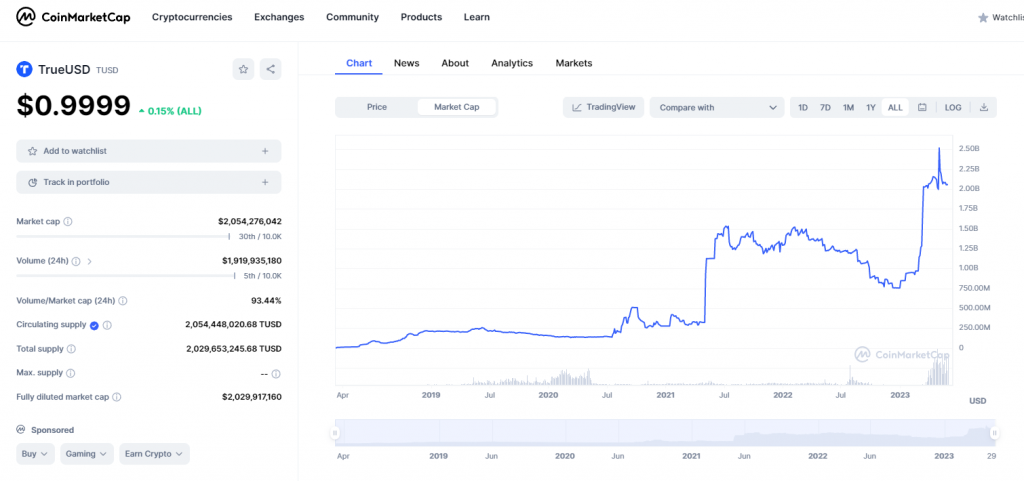

TrueUSD (TUSD)

TrueUSD (TUSD)

TrueUSD is a smaller stablecoin launched by TrustToken in 2018. The California-based company later sold the project to an Asian conglomerate called Techteryx. Like USDC and Tether, TUSD is backed by collateral to keep its value pegged to the dollar.

TUSD has remained relatively dormant in the last five years, with one major growth spurt in 2021. The token received a boost in popularity in March 2023, when Binance announced that it will replace BUSD with TrueUSD and Tether for all its stablecoin-related investments.

Overall, TrueUSD is a bit of a strange fish in the world of stablecoins. Its market cap has increased by nearly $2 billion in a matter of months. Not much is known about its current Asian owners, and 75% of its token holdings are in whale accounts. In contrast, USDC whale holdings are just 21%.

During its launch, TrueUSD came with a promise of live on-chain attestations by independent institutions, making it the first such stablecoin to offer this feature. While there have been occasional hiccups in the process, TrueUSD remains committed to providing these attestations.

Investor Takeaway

Stablecoins lost $50 billion in market cap through capital outflows or losses in 2022. But investor interest remains quite high, with $130 billion in locked value and daily transaction volumes above $23 billion.

The entire market has been upended by recent events like the collapse of Terra/Luna and FTX. Increased regulatory control is on the way, with possible moratoriums spelling doom for algorithmic stablecoins.

Question marks loom large, even over industry leaders like Tether, due to increased focus on mandatory requirements like minimum 1:1 fiat/asset collateralization.

There is no doubting the long-term value potential of stablecoins. But given the high degree of uncertainty in the market, investment decisions should probably take a backseat until we get more concrete updates on the progress of the proposed regulations, particularly in the US.

Don’t miss out. Subscribe to Bitcoin Market Journal and get all the blockchain knowledge you need to make informed investing decisions.

The post Sector Report: Stablecoins appeared first on Bitcoin Market Journal.