Stocks get Jolted, Labor market is starting to loosen

10-year Treasury Yield tumbles from 10 bps to 3.34% after JOLTS data Stocks 4-day winning streak snapped Dollar looking vulnerable as Fed’s tightening work almost done US Stocks Stocks got jolted after labor market weakness suggested both disinflation trends will remain but also the economy is quickly weakening. Job vacancies were dropping pre-banking crisis, so […]

- 10-year Treasury Yield tumbles from 10 bps to 3.34% after JOLTS data

- Stocks 4-day winning streak snapped

- Dollar looking vulnerable as Fed’s tightening work almost done

US Stocks

Stocks got jolted after labor market weakness suggested both disinflation trends will remain but also the economy is quickly weakening. Job vacancies were dropping pre-banking crisis, so it is seems logical this will become more noticeable in the coming months.

The bears are feeling confident that the recent rally can’t keep going given valuations and how the rates markets is clearly signaling we are recession bound. The bulls see a weakening economy and end of the Fed’s tightening cycle. The bears most likely have a stronger argument as if we see rate cuts in the fall, that means something is really wrong with the economy. For the bulls to be right, somehow a soft landing has to emerge.

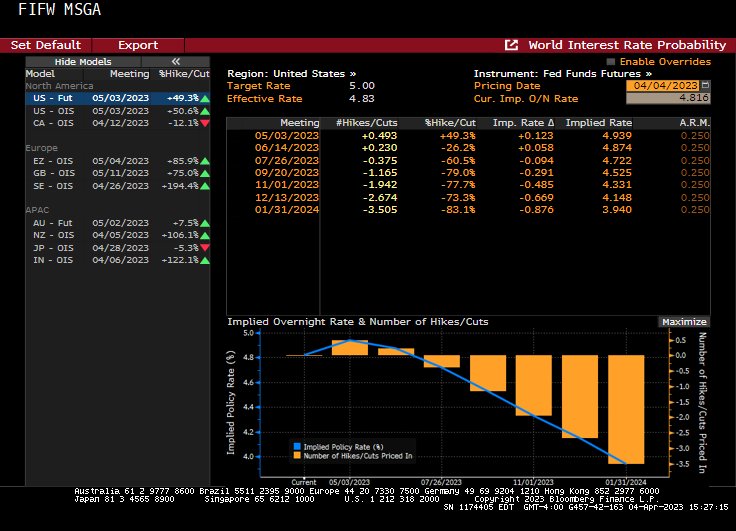

After the dust settled, Fed rate hike odds for the May meeting fell to a coin flip, while a rate cut is still getting priced in by the September meeting. If Wall Street becomes more convinced a recession will happen in the second half of this year, rate cut bets will grow.

JOLTS Job Openings

The labor market is starting to loosen. The headline JOLTS job openings reading fell 6% from a revised 10.563 million to 9.931 million, the lowest reading since May 2021 and a bigger decline than the consensus estimate of 10.5 million. The report was not all bad news for the labor market as the quits rate slightly rose to 2.6%, equaling to about 4 million Americans. The February ratio of jobs available for every unemployed worker was 1.7, a decrease from 1.9 in the prior month.

With a wrecking ball potentially about to hit small business due to lending difficulties, the labor market softness trend should steadily continue later in the year. The Fed’s tightening work should be done, but they could still justify one last hike before calling it quits if the remaining data before the May meeting warrants one more hike.