Surge in Crude Oil Prices as US Dollar Weakens, Prompting Speculation on WTI’s Future

Learn about the recent surge in crude oil prices, driven by a weakened US Dollar and softer inflation figures.

The recent surge in crude oil prices has been fueled by a weakened US Dollar and a decrease in inflationary pressures, generating excitement and speculation among market participants. This surge has propelled crude oil to a 10-week peak, particularly in the WTI contract, which reached US$76.15 per barrel, and the Brent futures contract, soaring to US$80.55 per barrel. As a result, questions have emerged about the potential for further price increases in the WTI crude oil market.

Weaker USD and Eased Inflation Cause Surge Crude Oil Prices

A key driver behind this surge has been the release of softer-than-expected US inflation figures for June. The headline Consumer Price Index (CPI) rose by a modest 0.2%, falling short of the anticipated 0.3% increase. Similarly, the core CPI, which excludes volatile food and energy prices, also came in lower than estimates.

These inflation figures have alleviated concerns of rapidly rising prices and signaled a more moderate inflationary environment. The year-on-year reading of 3.0% for the headline CPI was slightly below both the forecasted 3.1% and the previous figure of 4.0%. Likewise, the core CPI’s month-on-month increase of 0.2% fell short of the projected 0.3% rise, while the year-on-year figure of 4.8% was softer than the anticipated 5.0% and the previous figure of 5.3%.

Click here to view the Live Crude Oil Price Chart

The release of these inflation figures has broader implications beyond the oil market. It has led to a sharp decline in Treasury yields across various maturities, notably in the 2 to 10-year range. Market participants interpret this data as a potential signal that the Federal Reserve might adopt a less restrictive monetary policy in 2024.

The prospect of a more accommodative monetary stance eases concerns about tightening financial conditions and has contributed to the decline in the US Dollar. As a result, the US Dollar has retreated to levels last witnessed prior to the Federal Reserve’s interest rate hikes in May 2022. This depreciation of the US Dollar plays a significant role in fueling the rally across the entire commodity complex, with crude oil benefiting notably.

However, amidst the positive sentiment surrounding the surge in crude oil prices, challenges have emerged from inventory data. The Energy Information Administration (EIA) reported a substantial increase in US stockpiles, rising by 5.946 million barrels during the week ending July 7th, surpassing the expected increase of 0.483 million barrels. The American Petroleum Institute (API) data from the previous day also indicated a build-up of 3.026 million barrels during the same week. It is important to note that this build-up represents a reversal of the significant decline of 4.382 million barrels witnessed in the previous week.

The inventory build-up raises concerns about the supply-demand balance in the crude oil market. Increased stockpiles suggest an abundance of supply, which can potentially weigh on prices if not met with robust demand. Market observers will closely monitor future inventory reports to assess whether the build-up was a temporary deviation or a sign of sustained oversupply. Such data will play a crucial role in determining the trajectory of crude oil prices in the coming weeks.

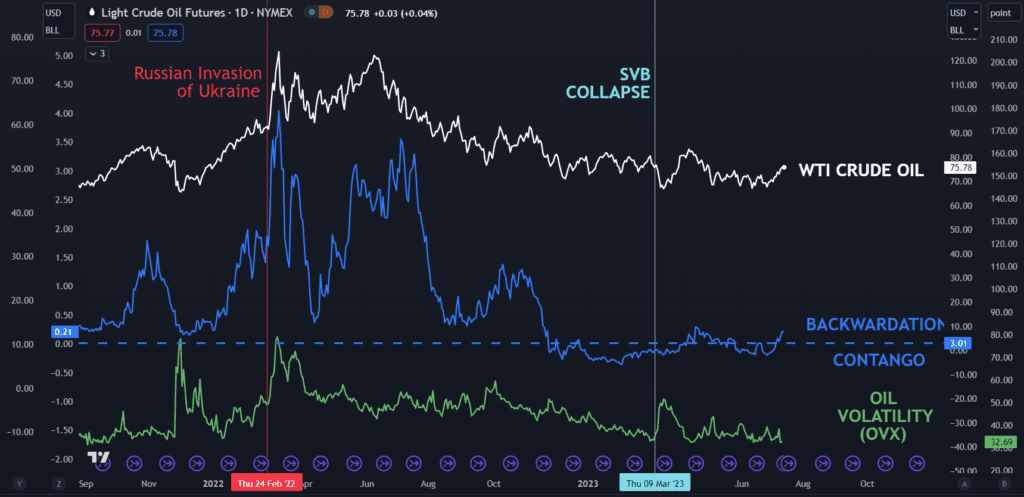

Despite these inventory challenges, factors supporting the upward momentum in crude oil prices persist. Notably, the price difference between the front two WTI futures contracts has shifted toward backwardation. Backwardation occurs when the first contract trades at a premium to the subsequent contract, indicating a preference for immediate delivery and suggesting positive market sentiment.

Source: dailyFX

Moreover, the stability of oil volatility, as measured by the OVX index, has been notable throughout the recent price fluctuations. The subdued volatility reflects the market’s resilience and lack of significant perturbation despite the rapid price movements. This stability in oil volatility further bolsters the confidence of market participants in the ongoing recovery and sustainability of higher crude oil prices.

Looking ahead, market attention turns to Beijing, where authorities are considering measures to stimulate China’s economy. The announcement of significant stimulatory policies could have a substantial impact on the oil market, as increased economic activity in China would likely lead to higher demand for crude oil. As China remains a key driver of global oil demand, any positive developments in the country’s economic policies will be closely monitored by market participants for their potential impact on crude oil prices.

Conclusion

In conclusion, the recent surge in crude oil prices, driven by a weakened US Dollar and eased inflationary pressures, has generated optimism and speculation among market participants. While inventory challenges persist, the backwardation of WTI futures contracts and the stability of oil volatility signal positive sentiment in the market. Attention now turns to potential stimulatory policies in Beijing, which could provide additional support to the oil market. Overall, the path of crude oil prices will continue to be influenced by various factors, and market participants will closely monitor developments to assess the future direction of the market.

Click here to read our latest article on the RBI Facilitating Digital Rupee Pilot Program