Technical Analysis & Forecast for July 20, 2023

GBP Continues a Wave of Decline. The overview also covers the dynamics of EUR, JPY, CHF, AUD, Brent, Gold, and the S&P 500 index. The post Technical Analysis & Forecast for July 20, 2023 appeared first at R Blog - RoboForex.

GBP Continues a Wave of Decline. The overview also covers the dynamics of EUR, JPY, CHF, AUD, Brent, Gold, and the S&P 500 index.

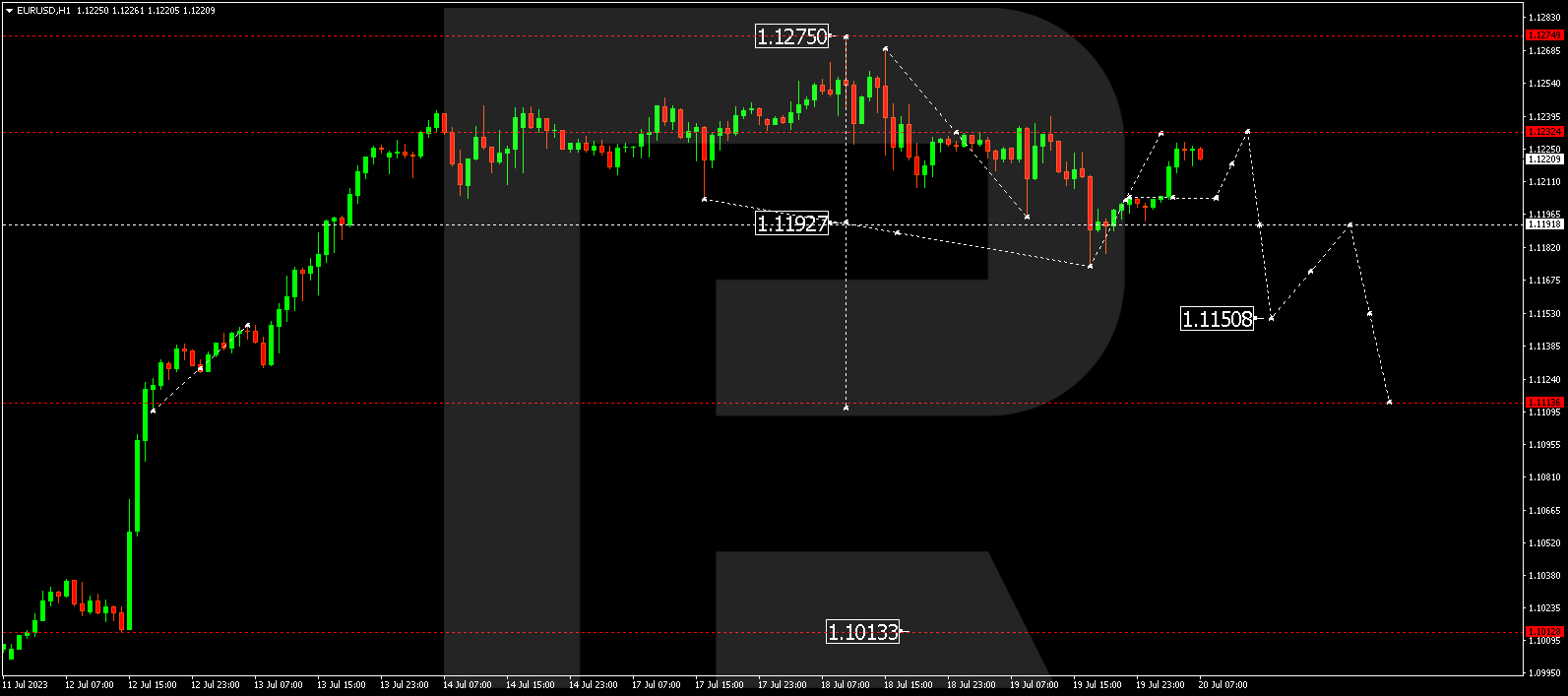

EUR/USD (Euro vs US Dollar)

EUR/USD has completed the first wave of decline, reaching 1.1174. Today, it might correct to 1.1232 with a test from below. After the correction, a new wave of decline to 1.1150 could start. This is a local target.

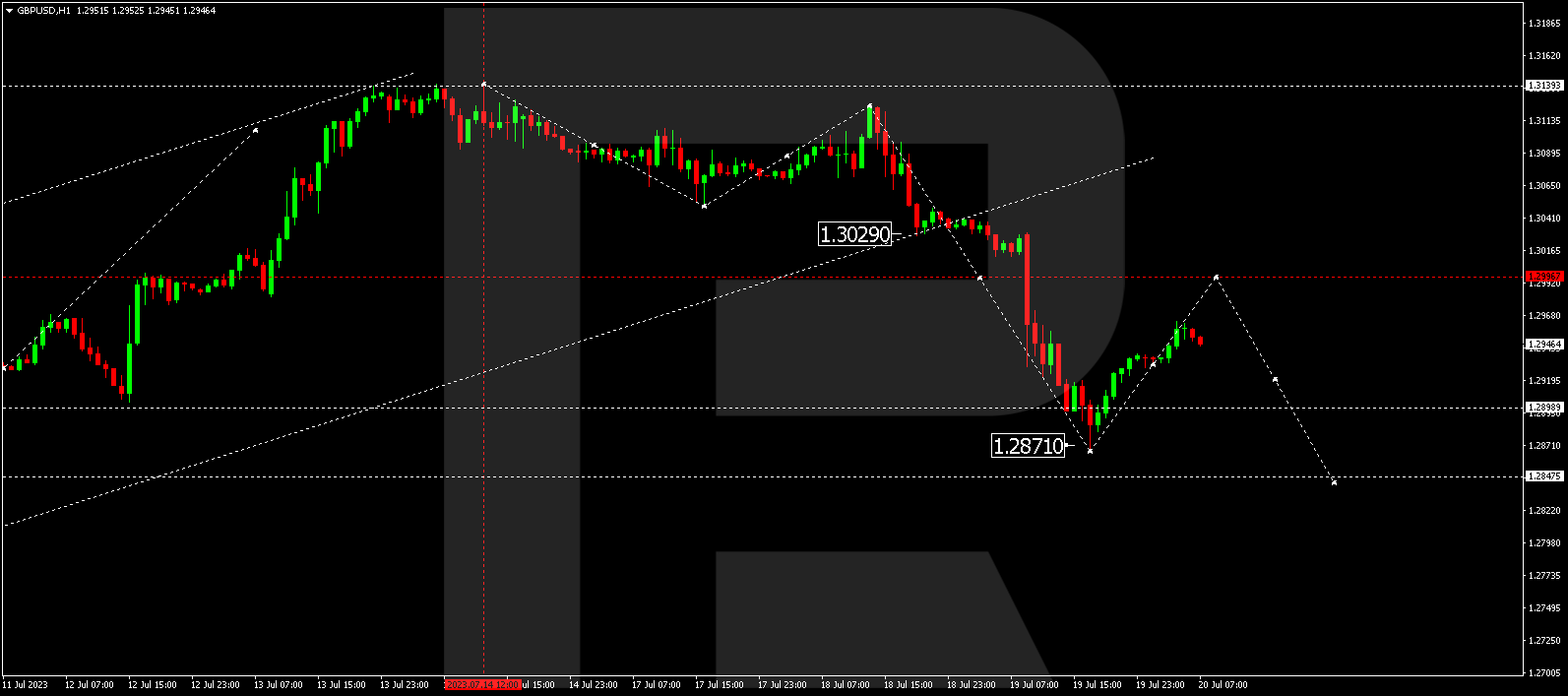

GBP/USD (Great Britain Pound vs US Dollar)

GBP/USD has completed a structure of a wave of decline to 1.2866. A correction to 1.2990 might form today. After the correction is over, a new wave of decline to 1.2848 could follow. This is the first target.

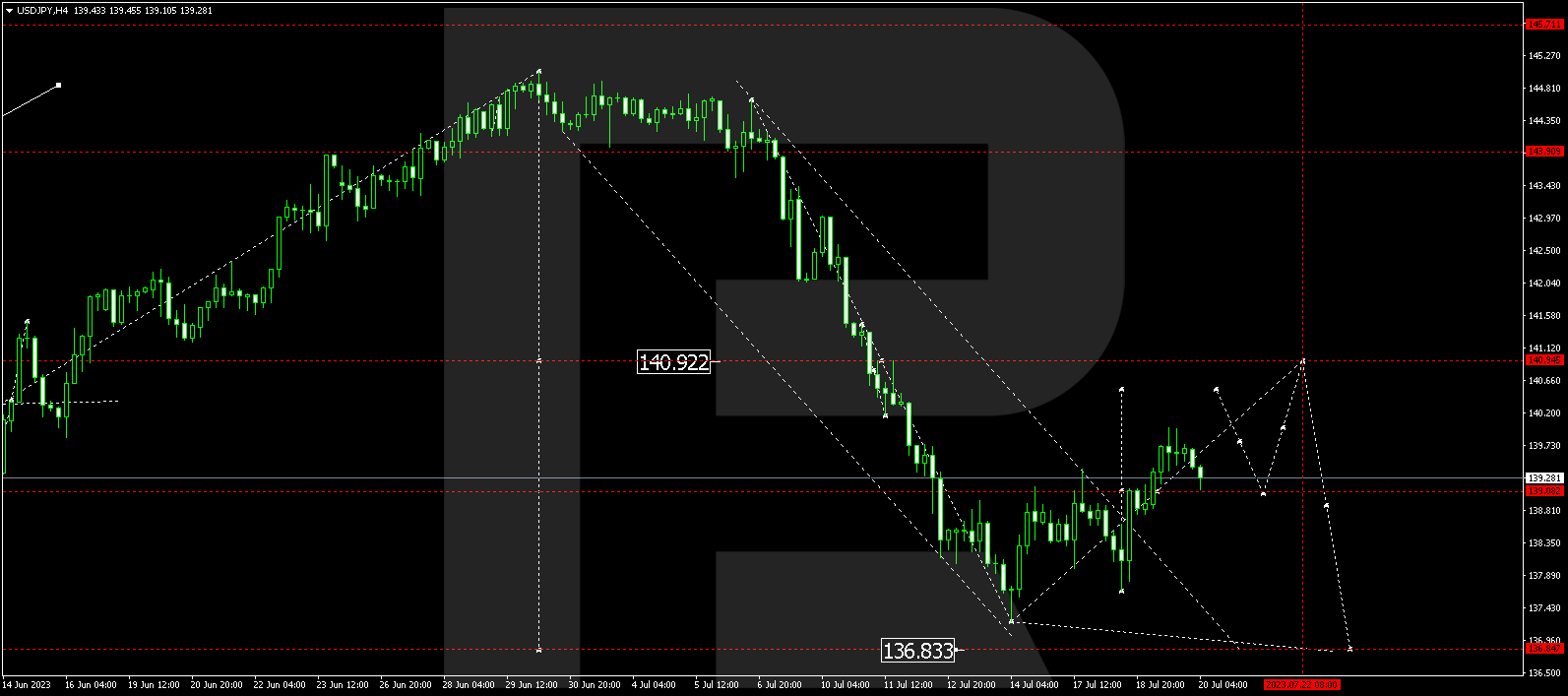

USD/JPY (US Dollar vs Japanese Yen)

USD/JPY continues forming a structure of growth to 140.50. Next, a decline to 139.09 and a rise to 140.95 are expected. After reaching this level, a link of decline to 136.83 is not excluded.

Short on time for full-fledged trading? Register in the CopyFX copy trading system and start copying the trading strategies of top-ranking traders right now!

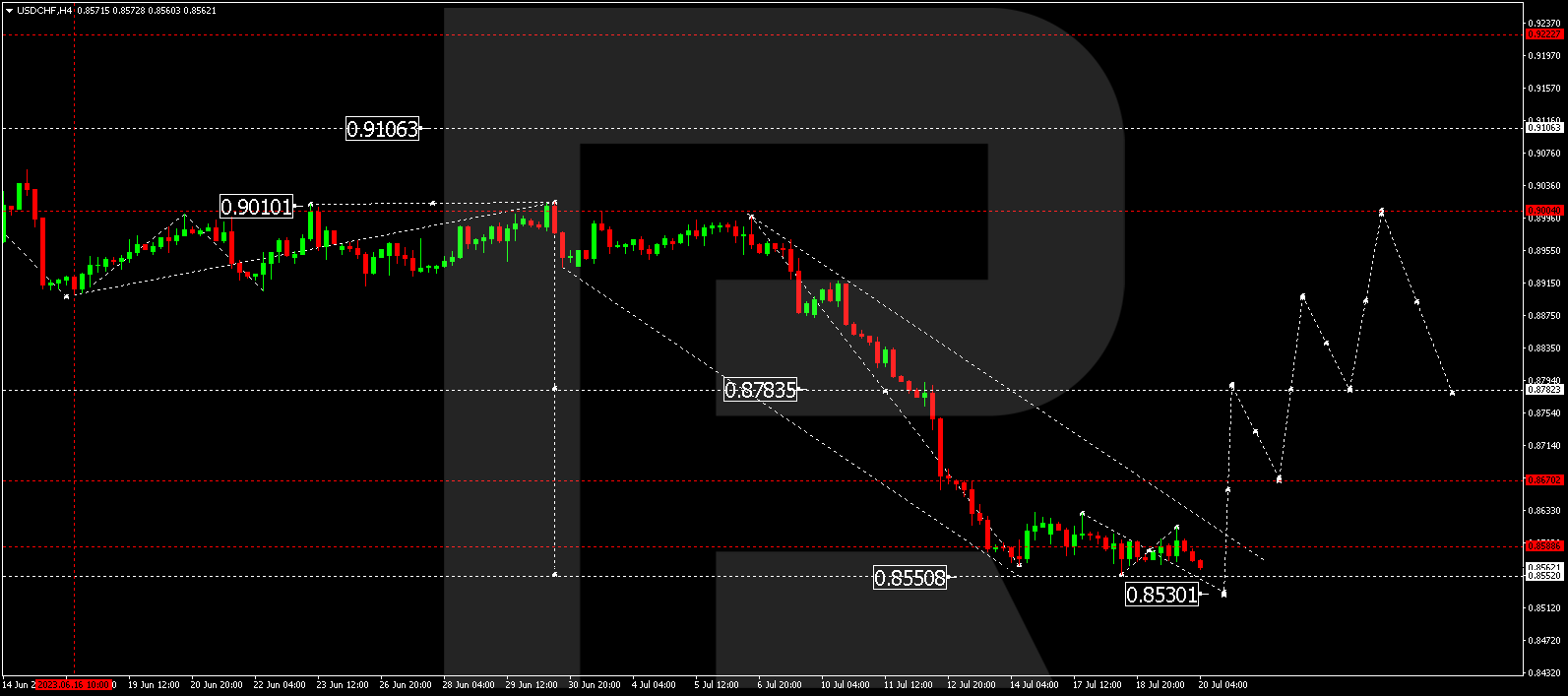

USD/CHF (US Dollar vs Swiss Franc)

USD/CHF continues forming a consolidation range around 0.8590 without any expressed trend. Today, the range could expand to 0.8530. Next, a wave of growth to 0.8782 is expected to begin. This is the first target.

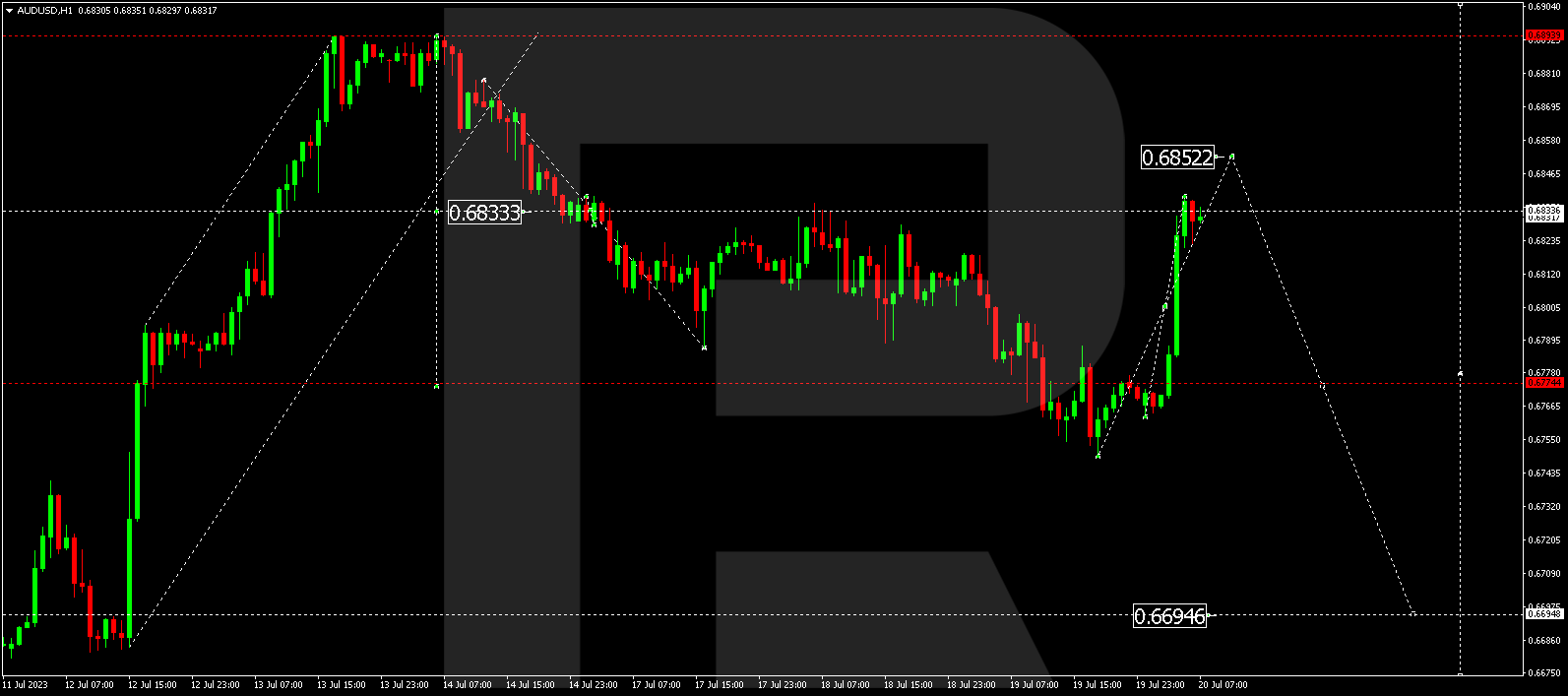

AUD/USD (Australian Dollar vs US Dollar)

AUD/USD has completed the target of a declining wave at 0.6750. Today, the market is forming a corrective structure to 0.6833. The correction might expand to 0.6852. After the correction, a new wave of decline to 0.6695 is expected to begin. This is a local target.

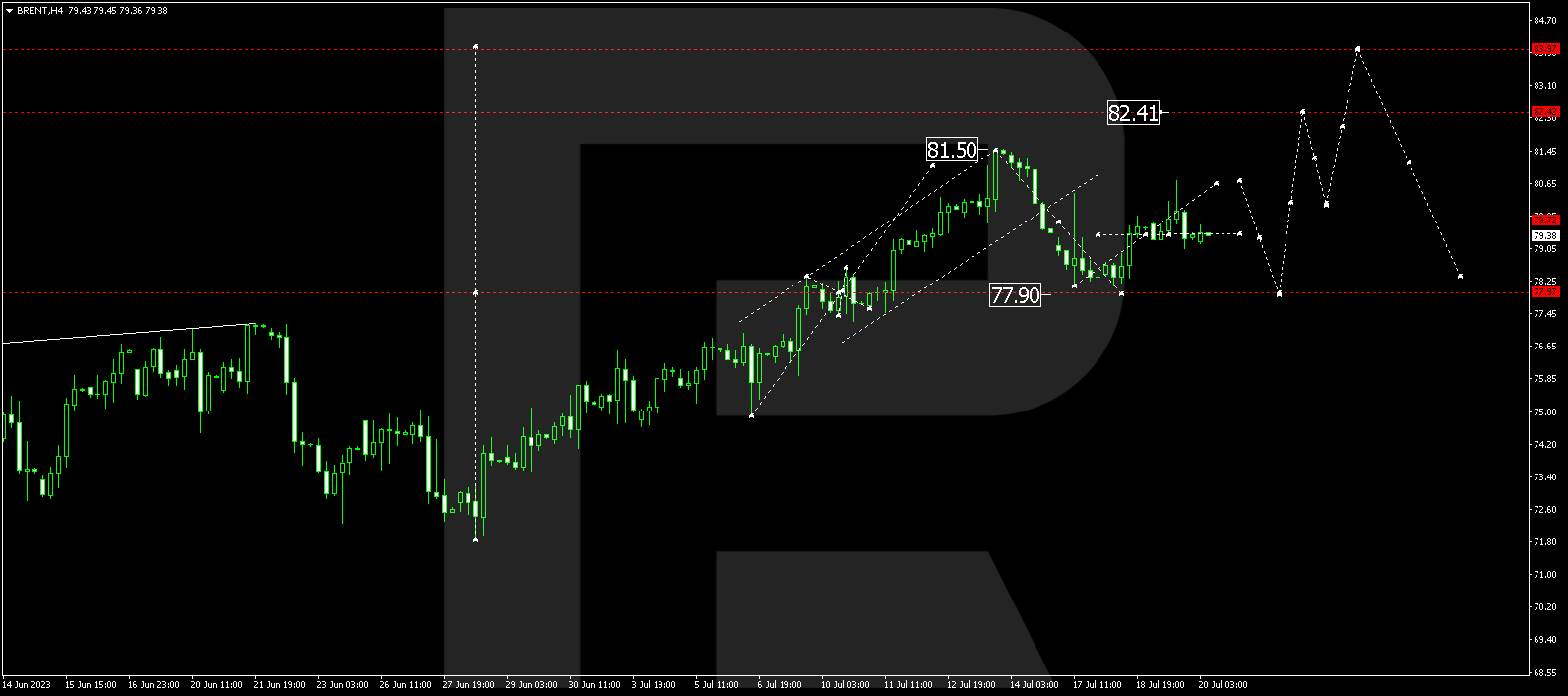

BRENT

Brent continues forming a consolidation range around 79.71 without any expressed trend. A corrective link of decline to 77.90 is not excluded (with a test from above). After reaching this level, a new wave of growth to 82.42 could begin, and the trend might continue to 84.00. This is a local target.

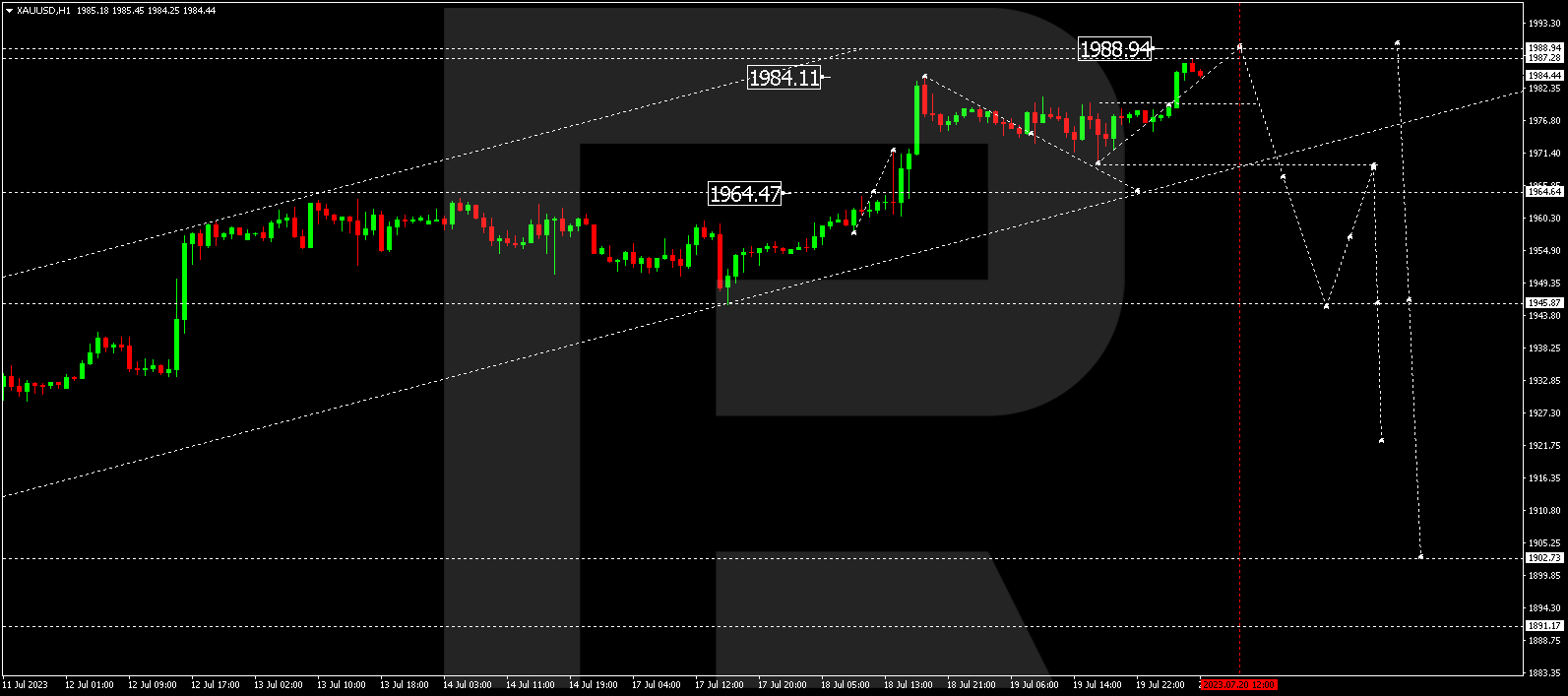

XAU/USD (Gold vs US Dollar)

Gold has completed a structure of growth to 1987.00. Today, the quotes might drop to 1979.50. Next, a link of growth to 1988.99 is not excluded. Subsequently, a wave of decline to 1964.64 might start. A breakout of this level could open the potential for a wave of decline to 1902.00.

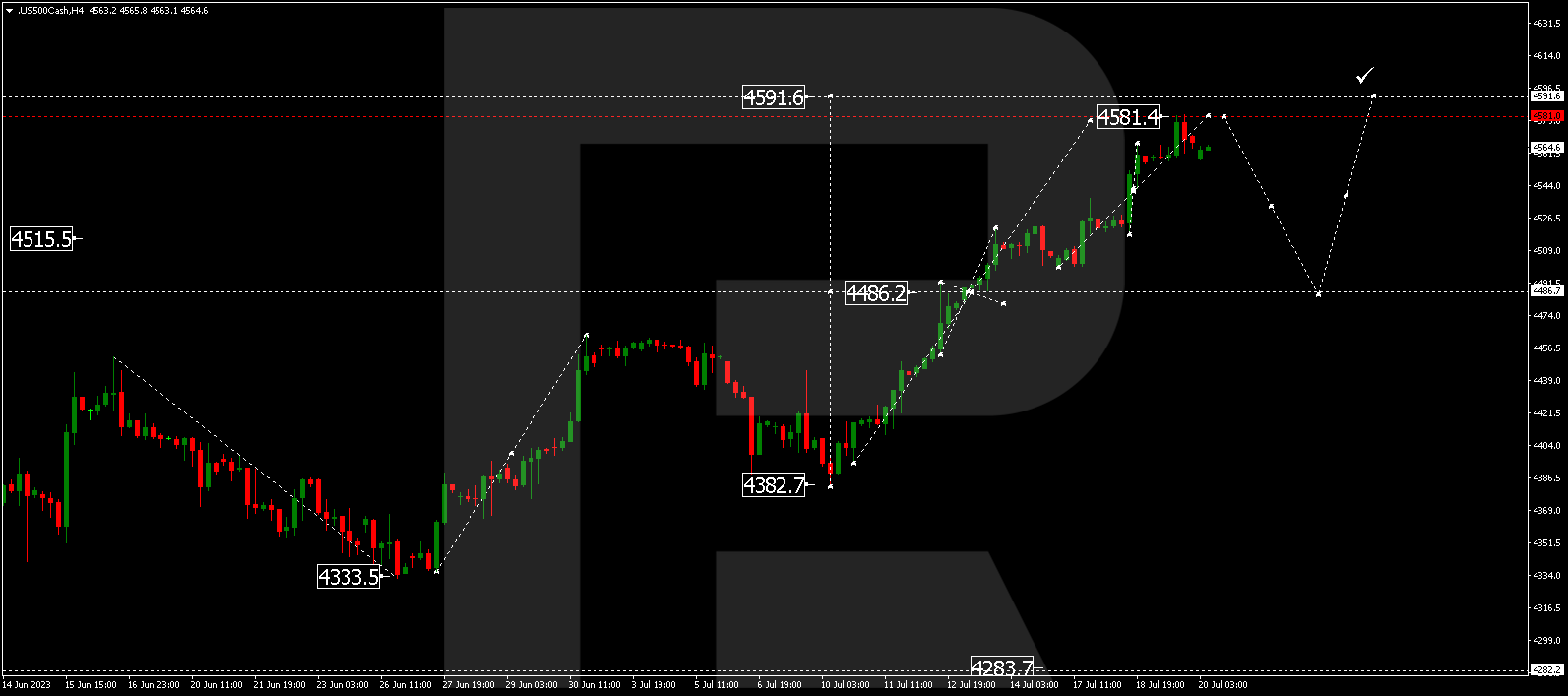

S&P 500

The stock index has formed a link of growth to 4581.4. Today, it might correct to 4486.0. Next, a new structure of growth to 4591.0 is not excluded, followed by a decline to 4485.0. If a breakout of this level occurs, it could open the potential for a wave of decline to 4282.0.

The post Technical Analysis & Forecast for July 20, 2023 appeared first at R Blog - RoboForex.