The Bootcamp Increased My Confidence and Discipline in Trading

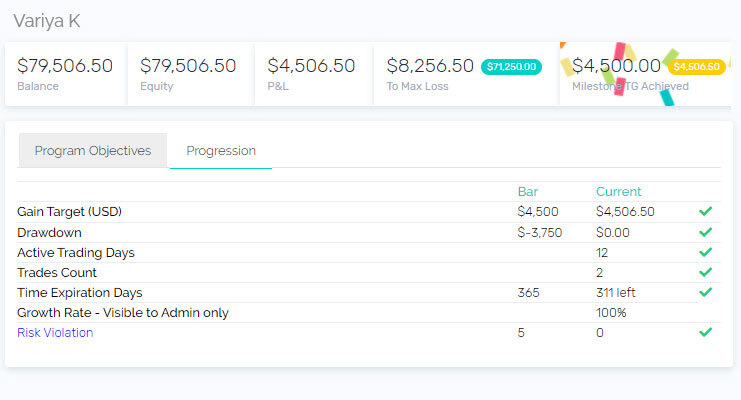

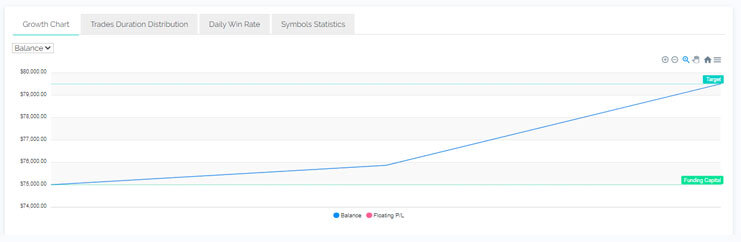

“I found that trading with less RRR and mainly focusing on Risk management is a suitable strategy to pass the Bootcamp challenge”. That’s Variya’s Advice. Variya K, 35 years old, From Thailand. Variya has just successfully passed the Bootcamp challenge. She is now one of The5ers funded traders and is trading a $100K funded account. Her […] The post The Bootcamp Increased My Confidence and Discipline in Trading appeared first on The5%ers | Funding Traders & Growth Program.

We spoke with Variya about her trading plan, insights, and lessons gained while trading in the Forex market and our platform as a funded trader.

Click here for more Inspirations lessons and interviews from our professionally funded traders.

- Tell us a little bit about you.

My name is Variya Katewongsa. I am from Thailand but living now in France for my professional career. I love trading and started Forex trading around two years ago. I have my personal Facebook page, www.facebook.com/catslavefx (just because I am a cat lover!) I usually share my trading plan, technical analysis, and trading strategy there.Two years ago, I started on it with gold trading as major pair. Then learn to know that there are some proprietary firms in the market, funding qualifying traders with a significant amount of funds. So I stop my personal portfolio trading and focused only on passing the firm’s evaluation.It was difficult during the first year. All things that I have learned and understood were improper for sustainable and risk management trading. It is more like a bet. I spent the year after learning and overcoming all my trading knowledge and behavior, including start growing my technical analysis knowledge. I was just passing Chartered Market Technician Program level I (CMT level I) beginning of this year. It is a program to learn about technical analysis organized by the CMT association. Anyhow, it is just to improve my own technical analysis knowledge. My main career is nothing linked to this trading or finance activity. Trading is my part-time hobby which I will do for the whole of my life.

- How long have you been trading?

I began my FX trading in January 2020. However, I personally invest in other markets as a value investor and am interested in the investment. So, for trading in FX and the oversea market, let’s say that it is now 2 years exactly since I started trading.

- Briefly describe your Trading Plan and how it contributes to your success.

There will be several factors for my trading plan.1. Start Analysis with a Macroeconomics view and Money flow.

It is important that we understand how the world and economic policy circumstance is. For example, FED Interest rate decisions and inflation, how it will impact to USD index, overall indexes, FX currency, and other commodities. Then play along with that policy. As said, don’t fight the FED! It is always the first hint to take a look at the analysis.2. Technical Analysis

I have developed my quantitative analysis method into a trading view. Despite it, is several indicators. But I use them all! I have more confidence in judging the situation by using numbers and quantitative analysis conditions with a multi-timeframe. Here are the following key factors.- Trend Analysis

– Momentum Analysis

– Price Range Analysis

– ConfirmationAll the above, I usually confirm with several numbers and create my trading scenarios according to the situation. Most of the time, it will be trend following strategy as the trend is a friend. But sometimes, I also decide to be a contrarian or momentum trader If I see that there should be some available opportunity for that trade. But let’s assume that 70-80% of my trading is likely to trend in the following strategy.Another important thing is we need to plan,

– how many pairs are we going to trade or focus on?

– How many lot sizes we can place per pair.

– What if we have 1 trade? What is going to be the lot size versus we have 4 trades?

– What is the risk per trade we are going to use?

– Is that trade a good quality or just normal quality trade?This is the basic thing that I need to calculate and plan before placing any order aside from technical analysis.Using the Daily Average True Range for risk management is key for my trading plan. Every trade needs to calculate carefully to ensure that we won’t have too much risk of violating our balance. This is a key contribute to success on top of the other analysis.

Always think about risk management first before thinking about profit.

- Share with us a challenge you faced in your trading career and how you overcame it?

As I am working as other professional fulltime job. To do it together with trading, I really need to manage my time properly then I can focus and do my best at both things. Previously I was so addicted to trading and traded almost all of the time. This can lead to the wrong decision when you are trading in the condition that you are not ready. I spent one year changing my trading behavior to have better focus.I trade just only when the price reaches the zone that I did the trading plan, which is usually in H1 – H4 timeframe. In case I am busy at work or not available, I won’t do any trading or watch the chart. What I have to do is just control myself to trade based on the plan. Just plan the trade and trade the plan. And work-life balance is also necessary.I was also wondering about the real basic of technical analysis. Did I really understand all the technical correctly? Then I put myself enrolled CMT program and spent 6 months of basic technical analysis study last year to enhance my technical analysis knowledge. At least I have learned basic technical analysis, not just only one trading system. I also attend several webinars to strengthen my knowledge. Using the one that I learn from the class to apply in my trading strategy is the key to success.Do not stop yourself from learning new things. Be always the empty glass to fill new knowledge.

- How did you adjust risk management to your trading personality?

I am always using Average True Range in a Daily timeframe to calculate the stop loss point. Sometimes it is 100% of the ATR Daily range, and sometimes it is 75% or 50%. My stop loss is always based on this system, and I use daily timeframe and master timeframe to manage the risk. I am not a fan of the high Risk to Reward Ratio. According to ATR Strategy, I will calculate lot size and risk per trade accordingly to avoid losing more than what we can accept. It is from 0.5% – 1.5% of the account initial balance per total trade.

- Describe a key moment in your trading career.

When I realized that the current behavior and situation that I was facing were not good for sustainability in long-term trading, I lost a lot of money, and I applied for several proprietary fund programs but failed. I stopped trading for a while and stepped back. Studying with the right knowledge and approach, adapting good trading manners, and eliminating bad behavior like overtrading, trading with emotion, or trade when the situation is complicated. Try not to focus on the money but on risk management. It was a hard time because several times I fell into the same trap. But I try to reinforce my change that if I really need to survive in trading, I MUST change. So, I believe this is the key moment of my trading career.

- How long it took for you to become a consistent trader, and what aspects did you change that helped you to become consistent?

2 years until I can stabilize my trading style. As explained above, I force myself that if I want to become a sustainable trader, I need to change myself.

- What is your mental/psychological strength, and how did you develop it?

Stop trading addiction, keep calm, accept the loss, and move on.I think the key to developing psychology is to learn from your mistake. Understand what the root cause is and why it happens. Then reinforce yourself to avoid making the same mistake. It is hard, but you really need time to overcome it.Forgive yourself if you just do something wrong and believe that tomorrow you will be a much better version.

- What was your strategy to successfully pass The5ers’ First Level?

This round, I trade only gold and approximately 15 trades in total for 3 challenges.Think first about the risk, but not the profit. Bear in mind that there will always be the opportunity to trade. If I miss it, I just wait for the next setup. Sometimes I am so eager to maximize RRR, but it won’t always work. I found that trading with less RRR and mainly focusing on Risk management (Using ATR as explained before) is a suitable strategy to pass the Bootcamp challenge.

- How is trading for The5ers different from trading by yourself?

You need to understand several things and plan the trade in a very consistent way. While trading by myself might have more flexibility than The5ers. In addition, The5ers also provides the opportunity of growing the portfolio according to the trader’s performance rapidly.

- What would you recommend to someone who is just starting with us?

Think about the risk before profit. Take your time on the evaluation. And be very careful with each trading plan. Think before you place an order.

- Share online resources that were/are significant in your trading development. Names and links are appreciated.

CMT: Chartered Market Technician ProgramYou can find program detail and other interesting webinars. There is some technical journal available so.Below will be most from Thai traders as it is in the Thai language

Youtube: ICMARKETS Webinar onlineThe speaker is from this FB page. I learned a lot from him and give 100% of my success to his creditability.Last, you can visit my FB and have a greeting.

- Would you like to share anything else with us?

Thank you so much for having such a great program like Bootcamp! It is really a “Behavior Changing” Program, which brings me to have more confidence and discipline in trading.

If you want to receive an invitation to our live webinars, trading ideas, trading strategy, and high-quality forex articles, sign up for our Newsletter.

If you want to receive an invitation to our live webinars, trading ideas, trading strategy, and high-quality forex articles, sign up for our Newsletter.

Click here to check our funding programs.

Click here to check our funding programs.

Follow us:  YouTube

YouTube  Linkedin

Linkedin  Instagram

Instagram  Twitter

Twitter  TradingView

TradingView

The post The Bootcamp Increased My Confidence and Discipline in Trading appeared first on The5%ers | Funding Traders & Growth Program.