Trade Sideways Markets (consolidations) Like Professional Forex Traders Do

Consolidation in Forex Trading Forex professionals look for all sorts of trading situations to describe price movements. One such scenario is sideways markets. In this guide, we’ll dig deeper into what trading sideways means, its strategies, and how you can benefit from it. What is a Sideways Market? A sideways market surfaces when the […] The post Trade Sideways Markets (consolidations) Like Professional Forex Traders Do appeared first on The5ers | Funding Traders & Growth Program.

Consolidation in Forex Trading

Forex professionals look for all sorts of trading situations to describe price movements. One such scenario is sideways markets.

In this guide, we’ll dig deeper into what trading sideways means, its strategies, and how you can benefit from it.

What is a Sideways Market?

A sideways market surfaces when the price oscillates in a tight range for a specific period without moving one way or the other.

Instead of going up and down, the price fluctuates in a horizontal channel in a sideways market. It shows neither the bulls nor the bears are in control.

A sideways market is represented by an area of support and resistance where the price moves. It is also called non-trending markets, range-bound markets, or choppy markets.

What Does a Sideways Market Tell You?

The sideways market appears when the price moves in a certain range. This means the price will continue to move in the direction it was before. Since the sideways market shows traders’ indecision, it is likely that there will be a change in the direction of the price after its appearance.

A sideways market can be described as a period of consolidation. The consolidation pattern presents market hesitancy and ends when the price moves above or below the support and resistance areas. Therefore, a sideways market tells traders about a shift in price pattern.

For instance, a sideways market can emerge before a strong bullish rally.

How to Identify a Sideways Market?

To locate a sideways market, first, you need to navigate support and resistance levels.

When the price goes up and then declines, the highest point before the falloff is resistance. The resistance level indicates an excess of sellers. Conversely, when the price goes up again, the lowest point reached before the rise is a support. A support level indicates an excess of buyers.

Trading sideways means you have to look for the price pattern within these levels. Price can go above the resistance level and below the support level, but it will never break a higher high or lower low.

If the price goes above the resistance level, breaking the higher high, this signifies that a sideways trend is about to end. On the other hand, if the price goes below the support level, breaking the lower low, it’s the end of the sideways market.

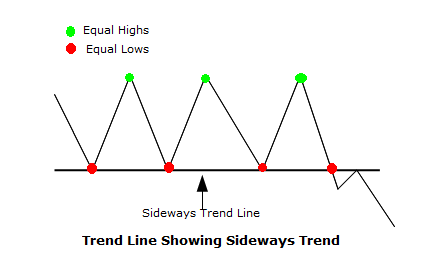

Example of a sideways market

The above graph shows a perfect trend line with equal highs and lows. As you can see, when the price breaks the lower low, it is an indication that the market will go downwards.

Common Sideways Markets Indicators

There are a lot of indicators that help in a sideway market. However, Stochastics, RSI, and ADX are considered best for trading sideways.

The RSI (Relative Strength Index) gives a reading between 0 and 100. It displays overbought and oversold conditions. When the RSI is below 30, it’s an oversold condition. Contrarily, when the RSI is above 70, it’s an overbought condition.

The Stochastics work similarly to the RSI, illustrating overbought and oversold conditions and oscillating between 0 and 100. Stochastics has two signal lines: %K and %D.

The ADX (Average Directional Indicator) oscillates between 0 and 100 and has two lines: +DMI and –DMI.

When the indicator is below 25, it is a weak trend, while when the indicator is above 75, it is a strong trend.

Other indicators like Bollinger Bands and CCI (Commodity Channel Index) also work fine with a sideways market.

How to Trade Sideways Markets?

Trading sideways requires patience. If you are hungry enough to take every trade, the sideways market is not for you. You can apply four main strategies in a sideways market: trade the edges, stalk the breakout, trade inside the price swings, and range breakout trading.

Here’s a quick glance at each of them.

Trade the edges

In a sideways market, the price behaves in three ways: normal, volatile, and quiet. You need to apply a lower timeframe, like 5 minutes or 15-minute and look to trade reversals off the edges in normal and volatile conditions. Here, edges exemplify support and resistance levels.

Stalk the breakout

The Forex market moves between periods of volatility and quietness. This means you can adjust your risk/reward ratio accordingly. Stalk the market signifies that the best breakouts appear after a quiet sideways market.

A keynote to add here is that sometimes breakouts don’t occur; therefore, it’s best to wait for the arrival of a breakout and then choose an entry point. In addition, breakouts can be dangerous, so it’s essential to go with proper risk/reward.

Trade inside the price swings

In this approach, you need to place your trades when the price moves back and forth inside a sideways market. You set your trade in the direction of the leap, and when the price moves opposite, you exit the trade.

This strategy looks simple but requires full attention. This is because a sideways market shows uncertainty, and the forex pair can move in any direction.

Range breakout trading

The concept of range breakout trading is to enter the market after the breakout. You enter the market in the direction of the breakout. For instance, if the direction is bearish, you go short.

We have prepared a video to help you understand how to trade Sideways Markets (consolidations):

How do you Know When a Sideways Market is Going to End?

At times, it is difficult to know when a sideways market is going to end, as the price can break higher highs or lower lows or continue moving like before.

One way to answer this question is to look for news. If there is major news coming up, like the Federal Reserve Policy announcement, there is a chance that a breakout will appear and a sideways market will disappear. Alternatively, you can use a volume indicator, MFI (Money Flow Index), to check the volume. If the volume is high, chances are the sideways market will end.

Benefits of Trading a Sideways Market

Here are the two main advantages:

- A sideways market presents clear exit and entry points due to the presence of support and resistance levels. Since these levels denote the highest and lowest price levels, you can pinpoint exit and entry points.

- Trading sideways isn’t open for too long in low time frames. It means a sideways market can continue for a few days or a week more. As a result, you can close your positions before a key news announcement or an unexpected event.

Limitations of Trading Sideways Market

Here are the two main limitations:

- In a sideways market, everything happens fast, and there is a significant increase in the number of trades. This means it requires more time than other markets. You have to monitor your positions all day long.

- Trading sideways presents more trading opportunities, and traders look to enter every time. This frequent buying and selling comes at a high cost.

Trading a Sideways Market Summary

A sideways market presents profitable trading opportunities if you can correctly recognize it. It’s important to define your risk/reward appetite before trading sideways. Besides this, it’s important to be patient and enter and exit at the right time.

If you want to receive an invitation to our live webinars, trading ideas, trading strategy, and high-quality forex articles, sign up for our Newsletter.

If you want to receive an invitation to our live webinars, trading ideas, trading strategy, and high-quality forex articles, sign up for our Newsletter.

Click here to check our funding programs.

Click here to check our funding programs.

Don’t miss our Forex Trading Ideas.

Don’t miss our Forex Trading Ideas.

Follow us:  YouTube

YouTube  Linkedin

Linkedin  Instagram

Instagram  Twitter

Twitter  TradingView

TradingView

The post Trade Sideways Markets (consolidations) Like Professional Forex Traders Do appeared first on The5ers | Funding Traders & Growth Program.