US DJIA Technical: Major US banks’ Q1 earnings in the focus over adverse macro factors

Three major US banks; JPMorgan Chase, Citigroup, and Wells Fargo will report their Q1 2024 earnings results today. JPMorgan Chase is ranked 13th in terms of component weightage in the DJIA. Analysts’ Q1 earnings estimates for these three US banks have been lowered which increases the possibility of positive earnings surprises. Technical analysis suggests a […]

- Three major US banks; JPMorgan Chase, Citigroup, and Wells Fargo will report their Q1 2024 earnings results today. JPMorgan Chase is ranked 13th in terms of component weightage in the DJIA.

- Analysts’ Q1 earnings estimates for these three US banks have been lowered which increases the possibility of positive earnings surprises.

- Technical analysis suggests a potential short-term mean reversion rebound scenario on the DJIA after 10 days of decline.

- Watch DJIA’s key short-term support of 38,200/060.

This is a follow-up analysis of our prior report, “US DJIA Technical: Bullish breakout ahoy” published on 14 March 2024. Click here for a recap.

Since our last report, the price actions of the Dow Jones Industrial Average have shaped the expected rally, surpassed the highlighted 39,610 resistance, and printed a fresh all-time high of 40,031 on 1 April 2024 based on data obtained from the US Wall Street 30 Index (a proxy of the Dow Jones Industrial Average futures).

Thereafter, a minor corrective decline took form in the past 10 days and the Index tumbled by -4.5% amid a lingering fear of interest rates in the US staying higher for a longer period that pushed up the US 10-year Treasury yield above its 4.50% key medium-term resistance (it recorded a daily close of 4.59% in yesterday, 11 April US session).

A diminishing “Fed dovish pivot” narrative due to the recent backdrop of a resilient US jobs market and firmer US inflationary trends inferred from March’s CPI prints as well as commodities prices have triggered near-term headwinds on the major uptrend phases of the major US stock indices via a higher cost of funding conduit that can potentially put downside pressure on net profit margins, especially growth-related stocks.

DJIA’s performance has lagged S&P 500 & Nasdaq 100

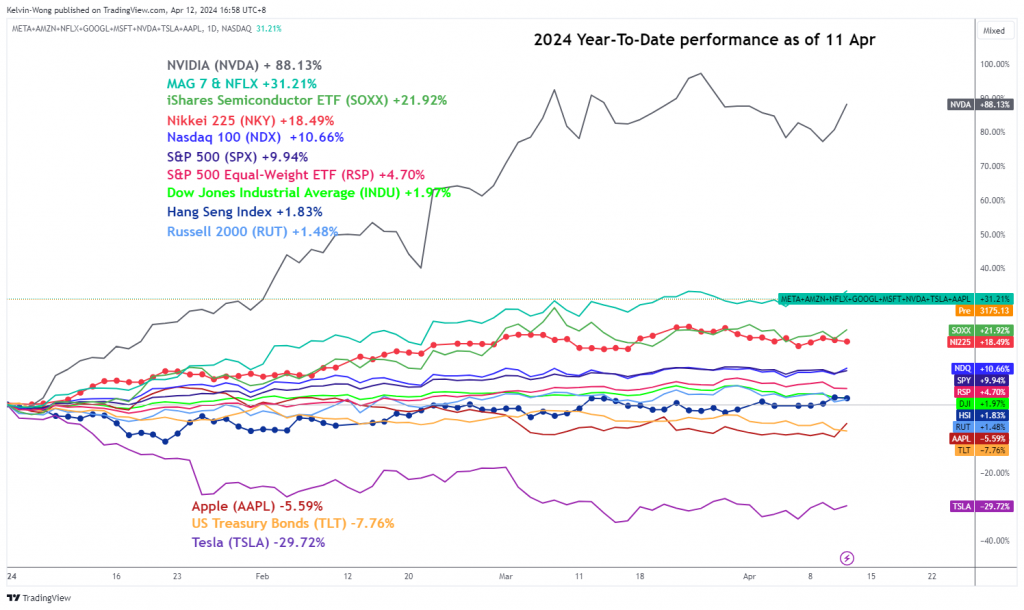

Fig 1: Year-to-date performances of major US stock indices with key US equities, sectors & global stock indices as of 11 Apr 2024 (Source: TradingView, click to enlarge chart)

So far, the Dow Jones Industrial Average has lagged behind the Artificial Intelligence (AI) technology-heavy weighted Nasdaq 100 (+11%) and S&P 500 (10%) with a year-to-date gain of just 2% as of yesterday, 11 April (see Fig 1)

Q1 earnings growth expectations for major US banks have been lowered significantly

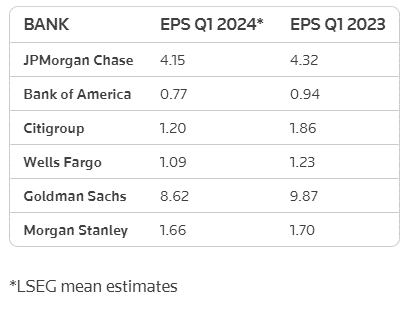

Fig 2: Analysts’ Q1 2024 EPS estimates for major US banks (Source: LSEG, Reuters News as of 11 Apr 2024, click to enlarge chart)

Three major US banks; JPMorgan Chase, Citigroup, and Wells Fargo will report their Q1 2024 earnings results today before the start of the US session. Given that these banks’ guidance on revenue outlook has been lowered in the past two months, equity analysts on average as surveyed by LSEG (see Fig 2) have pencilled in a weaker pace of earnings growth on US banks in Q1 2024; JP Morgan Chase is likely to post a 4% y/y drop in earnings per share (EPS) from the year-ago quarter, and further declines of 35% y/y and 11% y/y in EPS are forecasted for Citigroup and Wells Fargo.

Given that a “lower bar” has been set on the Q1 earnings projections for these three major US banks, a potential positive earnings surprise beat is likely to be easier to obtain which in turn may trigger a positive feedback loop at least in the short-term for the Dow Jones Industrial Average (JP Morgan Chase is ranked 13th in terms of component weightage in the DJIA while Goldman Sachs is ranked 3rd).

Watch the key short-term support of 38,200/060 on the DJIA

Fig 3: US Wall St 30 short-term trend as of 12 Apr 2024 (Source: TradingView, click to enlarge chart)

In the lens of technical analysis, trends do not move in a vertical direction but oscillate within trending phases.

The price actions of the US Wall Street 30 Index (a proxy of the Dow Jones Industrial Average futures) have started to transform into short to medium-term downtrend phases as it broke below the 20-day and 50-day moving averages.

Interestingly, recent observations seen in the hourly RSI momentum indicator have traced out a bullish divergence condition yesterday after it hit an oversold condition on Wednesday, 10 April which suggests that the short-term downside momentum in place since Wednesday has started to ease (see Fig 3).

The easing of downside momentum has increased the odds of a potential short-term mean reversion rebound for the Index as long as 38,200/060 key short-term pivotal support holds. A clearance above 38,660 near-term resistance sees the next intermediate resistances coming in at 38,930, and 39,100 (also confluences with the 20-day & 50-day moving averages).

On the flip side, a break below 38,060 invalidates the mean reversion rebound scenario for a continuation of the bearish impulsive down move sequence to expose the next intermediate supports at 37,770 and 37,390.