US Dollar Dominates Market Sentiment with Unprecedented Strength

Amidst USD dominance, EUR/USD faces resistance at its 200-day moving average, while GBP/USD grapples with hurdles at its 50-day moving averag

Insights and Analysis: Navigating the Current Landscape of the US Dollar

The US Dollar (USD) stands tall, commanding the financial markets with unwavering strength. As investors and traders alike navigate through the ever-shifting currents of global finance, understanding the driving forces behind the USD’s bullish momentum becomes paramount. In this article, we delve deep into the core factors propelling the USD forward, analyze the impact of key economic indicators, and provide strategic insights for traders seeking to capitalize on this dominant trend.

Core PCE Data: Impact on US Dollar Strength

At the forefront of market attention is the release of core Personal Consumption Expenditures (PCE) data, hailed as the Federal Reserve’s preferred measure of inflation. The anticipated rise of 0.4% in January, coupled with an annual rate decrease to 2.7%, is poised to influence USD performance significantly. However, market participants must remain vigilant, as surprises in the data could trigger unexpected price swings and alter sentiment towards the greenback.

Interest Rate Expectations: Driving Forces Behind USD Momentum

Closely intertwined with USD dynamics are interest rate expectations, serving as a barometer for future Fed policy decisions. With sticky price pressures, robust job creation, and soaring wage growth, speculation mounts on the possibility of a delayed easing cycle. Should the Fed opt for a more hawkish stance, prolonging higher interest rates, the USD could experience sustained upward pressure, bolstering its bullish trajectory.

Technical Analysis of EUR/USD, GBP/USD, and Gold Prices

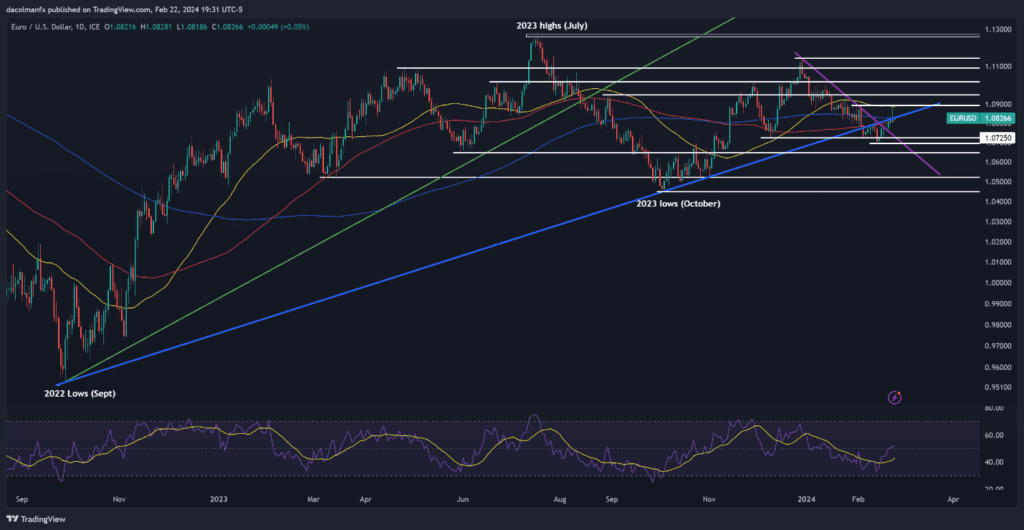

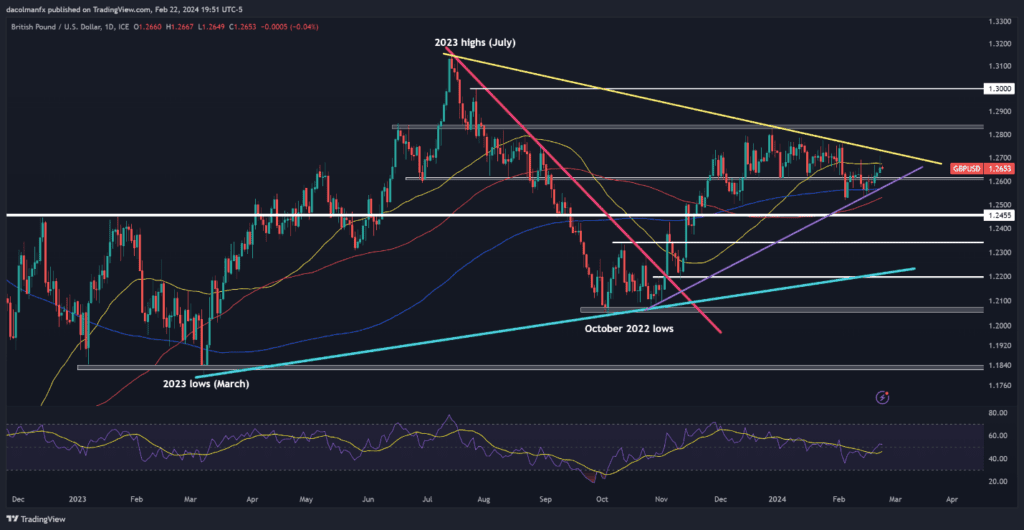

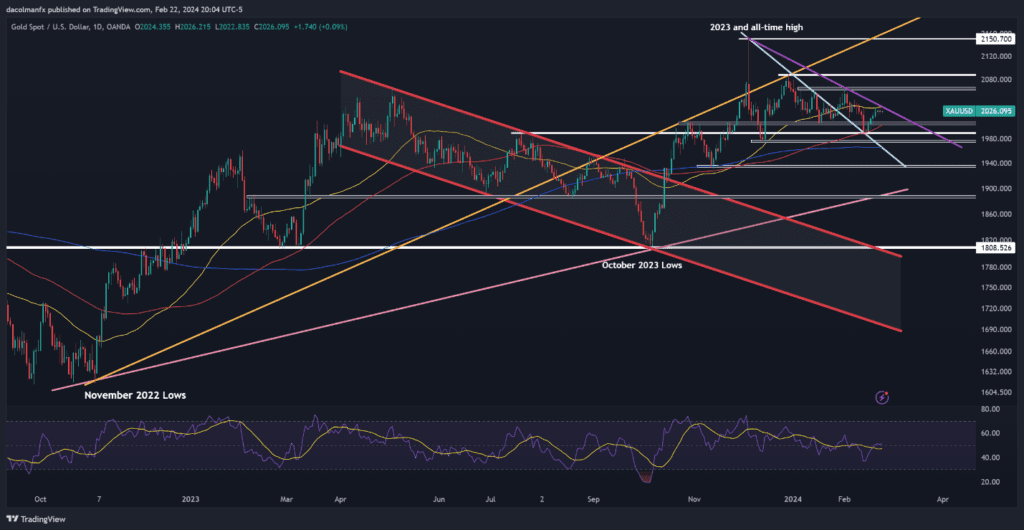

In the realm of technical analysis, a meticulous examination of major currency pairs and gold prices reveals intriguing insights into their performance amid the prevailing dominance of the US Dollar (USD). Let’s dissect the intricacies of EUR/USD, GBP/USD, and gold prices to discern potential trading opportunities amidst USD-centric market dynamics.

Starting with EUR/USD, the currency pair exhibits a gradual resurgence after recent fluctuations. However, its ascent is met with formidable resistance at the 200-day simple moving average, a critical juncture that could determine its trajectory in the coming sessions. Should EUR/USD manage to breach this significant barrier, bullish momentum could propel prices towards key rally points, notably at 1.0890 and beyond. Traders eyeing long positions might find opportunities to capitalize on potential breakouts above this pivotal level, anticipating further upside potential fueled by improving sentiment or fundamental developments.

source:dfx

Analysis of GBP/USD

Conversely, GBP/USD faces its own set of challenges as it navigates through USD-dominated waters. The currency pair grapples with hurdles entrenched around its 50-day moving average, presenting a formidable barrier for bullish advances. Amidst this resistance, GBP/USD finds support levels delineated at 1.2600, reinforced by trendline support. Traders must monitor price action closely around these critical levels, as a breach could signal a shift in market sentiment and potentially pave the way for further upside or downside movements. Moreover, developments in geopolitical events or economic data releases could act as catalysts, influencing GBP/USD’s trajectory in the near term.

source:dfx

Analysis of Gold Prices

Meanwhile, gold prices find themselves in a precarious position amidst the prevailing strength of the USD. As a traditional safe-haven asset, gold typically exhibits an inverse relationship with the USD; however, recent market dynamics have seen the precious metal struggling to maintain its footing. With USD dominance exerting downward pressure, gold prices face significant challenges in sustaining upward momentum. Pivotal price thresholds emerge as key determinants of future movements, with traders closely monitoring support and resistance levels for potential trading opportunities. A break below crucial support levels could signal further downside for gold, while unexpected developments in macroeconomic factors or geopolitical tensions may offer temporary reprieves or catalysts for price movements.

source:dfx

In essence, the technical analysis of EUR/USD, GBP/USD, and gold prices provides valuable insights for traders navigating the USD-dominated market landscape. By leveraging technical indicators, identifying critical levels, and staying abreast of market developments, traders can position themselves strategically to capitalize on potential trading opportunities while mitigating risks associated with market volatility and uncertainty. As the USD continues to exert its influence on global markets, adept navigation of technical factors remains paramount for successful trading endeavors in the dynamic world of currency and commodity markets.

Strategies for Traders in the USD Dominated Market

For traders navigating the tumultuous waters of the USD-dominated market, strategic foresight is essential. Embracing volatility, leveraging fundamental insights, and utilizing technical analysis tools are integral components of a robust trading strategy. Whether seizing opportunities for short-term gains or adopting a long-term perspective, staying informed and adaptable is key to thriving in the ever-evolving landscape of global finance.

Conclusion

As the US Dollar maintains its bullish bias, fueled by core economic data and interest rate expectations, traders must remain vigilant in their pursuit of profits. By dissecting market trends, analyzing key indicators, and devising informed strategies, traders can harness the power of the USD to their advantage. In an era defined by uncertainty and rapid change, adaptability and knowledge are the cornerstones of success in the dynamic world of currency trading.

In conclusion, as the US Dollar continues to assert its dominance in the financial markets, understanding the intricacies of its strength is paramount for traders seeking to navigate this landscape effectively. By remaining informed, adaptable, and strategic, traders can capitalize on the opportunities presented by the USD’s bullish momentum, ultimately steering their portfolios towards success in the ever-changing world of global finance.